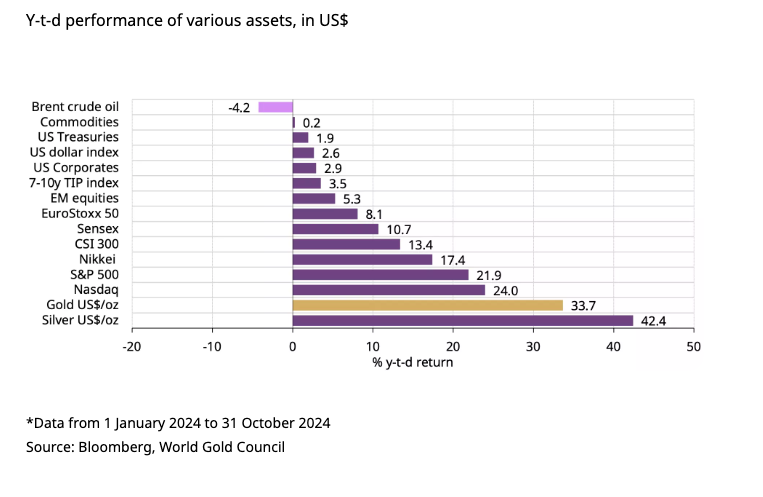

Gold and silver have been on a tremendous run in 2024 – in fact, they are the two best-performing assets this year.

Bullion.Directory precious metals analysis 05 November, 2024

Bullion.Directory precious metals analysis 05 November, 2024

By Mike Maharrey

Journalist, analyst and author at Money Metals Exchange

As of the end of October, silver was up by 42.4 percent, and gold was up by 33.7 percent. This compares to a 24 percent gain in the NASDAQ, the best-performing stock index.

Gold Shining Bright

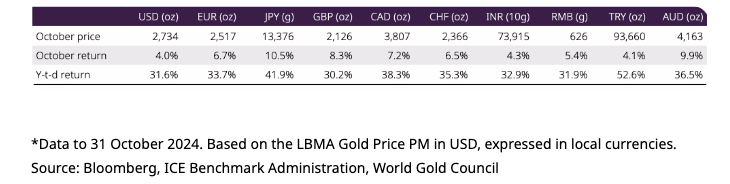

Gold was up another 4 percent in dollar terms in October. It also charted gains in other major currencies.

Looking more closely at gold’s performance this year, the yellow metal has posted 39 all-time highs so far in 2024. The only year gold set more records was 1979 when it broke its own record 57 times.

Gold hit 38 record highs in both 1972 and 2011.

The World Gold Council noted some differences between then and now.

“Previous record-setting years have been accompanied by strong investment demand. Gold ETF inflows in Western markets are very late to the party this year, and retail investment demand has not picked up much either.”

In 1980, gold established its all-time inflation-adjusted high. That record also fell this year.

Gold has continued its upward trajectory despite the positive performance of risk assets, a relatively strong dollar, and increasing Treasury yields, all of which typically create headwinds for the yellow metal.

The World Gold Council noted the lack of media hype despite gold’s stellar performance.

“Media fervor is not as visible today as it was during 2020 when gold made its first new all-time-highs for nigh-on a decade, suggesting perhaps that this time, sentiment has not gotten carried away.”

Trading in the East has provided the biggest catalyst during the gold bull run. World Gold Council analysis reveals that gold’s price action generally took place during late Asian/early European trading hours.

“This at least partly explains the increasingly frequent disconnect between gold’s return and its usually reliable – yet U.S.-centric – short-term drivers of rates and the U.S. dollar.”

Conversely, U.S. and European trading hours tended toward more price volatility. The World Gold Council noted that this is “consistent with the narrative of emerging market investors and central bank buying helping to drive prices higher even as trading in Western markets, as it tends to do, creates the most short-term noise.”

Despite the ever-increasing price, gold demand set a third-quarter record. Including over-the-counter (OTC) sales, gold demand came in at 1,313 tons in Q3, a 5 percent year-on-year increase.

The World Gold Council cites several factors that should propel the gold bull run forward.

“The conditions remain for demand to continue to impress including elevated geopolitical risk, overvalued equity markets, low Western investor gold ownership and central bank buying.”

Silver Lost In Gold’s Spotlight

Although silver has outperformed gold, it is widely viewed as a laggard and has remained in the shadow of gold’s spotlight. While gold has set multiple records this year, silver remains far below its all-time high.

Meanwhile, the gold-silver ratio remains mired above 80-1, signaling that silver is historically underpriced compared to gold this year.

This would seem to indicate that silver is poised to run higher.

Many long-term investors still view silver more as an industrial commodity. Industrial demand accounts for more than half of silver offtake. With this in mind, it is important to note that industrial demand is booming. Industrial offtake of 654.4 million ounces set a record in 2023. Analysts expect industrial demand in record territory again in 2024.

Meanwhile, robust demand and lagging silver mine output have resulted in market deficits for three straight years, with demand expected to outstrip supply again this year.

The technical picture also appears to be bullish silver.

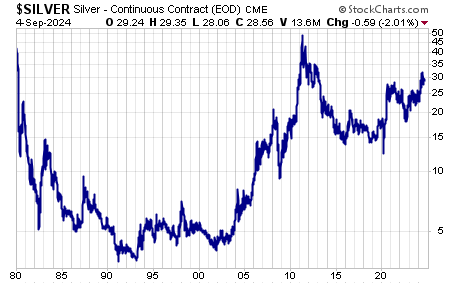

If we look at a 50-year price chart for silver, we see a very distinctive pattern known as a “secular cup and handle.”

This is a long-term bullish pattern. You can see the “cup” with the twin highs of around $50 per ounce in 1980 and 2011. Following the 2011 peak, we see a sharp decline in the price followed by a consolidation “handle.”

A handle pattern on the chart of a stock or commodity often precedes a breakout.

This cup-and-handle pattern has played out over an extremely long timeframe. Historically, longer patterns portend bigger breakouts with a broader base signaling a bigger upside case.

Gold followed a similar long-term pattern, resolving with a breakout to new all-time highs last year.

If you’re still bullish on gold, you should also be bullish on silver.

While silver’s industrial applications make it much more volatile than gold, it tends to track with the yellow metal over time.

In fact, silver has historically outperformed gold in a gold bull run.

The backdrop for gold investment looks solid moving into 2025.

Mike Maharrey

Mike Maharrey is a well-known author, journalist, financial analyst and writer at Money Metals Exchange, one of our top-rated US dealers and two-times winner of Bullion Dealer of the Year

He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida. Mike also serves as the national communications director for the Tenth Amendment Center and the managing editor of the SchiffGold website.

This article was originally published here

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply