Gold Makes Biggest Weekly Gain Since 2008 as Stock Market’s Virus-Relief Rebound Fades

Bullion.Directory precious metals analysis 27 March, 2020

Bullion.Directory precious metals analysis 27 March, 2020

By Adrian Ash

Head of Research at Bullion Vault

Government bond prices rose, pushing interest rates sharply lower again, while industrial commodities fell back with equities, taking crude oil back below $25 per barrel.

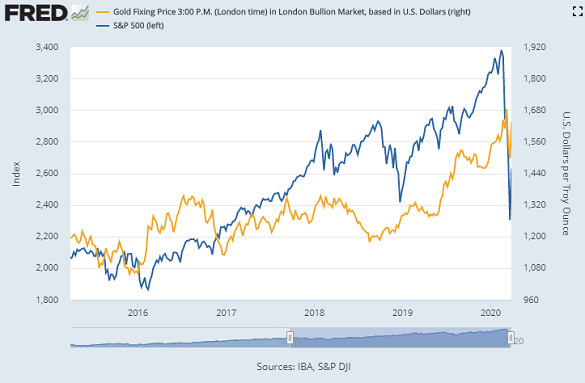

Having made its largest 1-day jump in Dollar terms since January 1980 on Monday, the gold price headed for a $125 weekly gain ahead of the Friday PM benchmarking in London.

The S&P500 share index in New York meantime lost a third of the week’s earlier 14.1% rebound, and thus failing to erase last week’s plunge.

“The US has just passed an era-defining stimulus package that dwarves the 2008 measures, and the Fed has committed to do ‘whatever it takes’ to protect the economy,” says Jonathan Butler, strategist at precious metals trader and global conglomerate Mitsubishi.

“The impact is largely positive for gold [but] coronavirus-related market stress” also spurred Tuesday’s breakdown between Comex gold futures prices and London’s over-the-counter spot price “in what is normally a very efficient market with tight spreads.”

Comex April contracts today retreated below London spot prices after surging to a premium of $100 per ounce earlier this week.

“The causes were multiple,” Butler says, pointing to cash liquidity issues “amid the recent scramble for the Dollar, [plus] a good deal of speculative activity in gold and, perhaps most importantly, a lack of physical gold bars with which to fulfil deliveries into the exchange amid the closedown of international air travel and three of Switzerland’s four gold refineries, plus the impact of the South African mining closure.”

Sold out of many retail products, Australia’s Perth Mint “is adding additional shifts to its refining output to meet some of that increased demand,” according to Kitco News.

While South Africa’s Rand Refinery has been exempted from the No.7 gold-mining nation’s lockdown, its operations will be “significantly scaled-down” and it is struggling anyway to book air-freight space to fly out gold bars.

“While a few refiners have suspended production,” said trade body the London Bullion Market Association to members late Thursday, the large-bar market “has 72 accredited Good Delivery gold refiners located in 31 countries…[so other] refiners are ready and able to accommodate the industry’s needs.

“Refiners and other market participants are [also] actively engaged with logistics companies to overcome travel constraints and ensure the physical movement of metal via, for example, chartered or cargo flights,” the LBMA added.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply