Gold Bullion Recovers vs. Weak Post-Fed Dollar as Bitcoin and Blockchain Grab Headlines’

Bullion.Directory precious metals analysis 23 November, 2017

Bullion.Directory precious metals analysis 23 November, 2017

By Adrian Ash

Head of Research at Bullion Vault

Holding rates unchanged on 1 November, but signalling a rate-hike will come in December, minutes from the Fed meeting showed policy-makers split over the strength of inflation and thus the need to raise further in 2018.

Stock markets in China today fell over 3%, the worst 1-day pace in 2 years according to Reuters data.

The Dollar meantime sank at its fastest pace in 5 months, helping gold bullion recover last Friday’s finish at $1292 per ounce, but gold priced in all other major currencies held lower for the week so far.

Crypto-currency Bitcoin meantime traded 1.7% below Tuesday’s fresh all-time high at $8347, some 11-fold higher for 2017 to date.

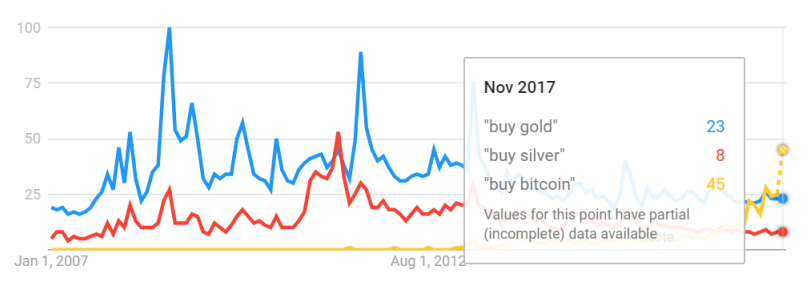

With Google searches for the phrase ‘buy bitcoin’ overtaking ‘buy gold’ last month, UK asset manager Old Mutual “is jumping on the Bitcoin wagon” reports Bloomberg, by enabling a 5% allocation to the crypto currency in its Gold & Silver Fund.

“The idea is to take profits from Bitcoin as it advances to reinvest in gold and silver assets,” Bloomberg quotes fund manager Ned Naylor-Leyland.

Data site FE Trustnet says the price of Naylor-Leyland’s fund ended Wednesday 6.0% below its level of 1 year ago.

The UK gold price in Pounds per ounce was 0.6% down over that time.

Old Mutual’s own factsheet for end-October reports the fund losing 16.0% in Pound Sterling terms from 12 months before.

That was almost twice the drop in Sterling gold prices.

Shares in Riot Blockchain (Nasdaq:RIOT) – a biotech company since 2000 until switching to distributed record-keeping technology this October – meantime rose 42% on Wednesday, nearly doubling the stock’s price from this time last week.

Trading as Bioptix, the company made multi-million dollar losses every year since at least 2012, according to data from MarketWatch.

Its stock-price doubled in the week prior to 4 October, when it announced the change.

“The company has exploded into popularity on investing social media forums,” says stock-tip research site Zacks.com, “[but] for many, Riot’s [new] business model is still relatively unclear.”

“We want to use blockchain to optimize the antiquated arena of commodity trade finance,” writes French investment bank Natixis’ head of global energy and commodities-trade & structured finance in the Americas, Arnaud Stevens, today.

“Distributed ledger technology brings some much-needed innovation into our industry.”

With US investment banks Goldman Sachs and J.P.Morgan meantime “remaking financial services” with a successful 6-month trial of a centralized ledger for equity swaps, “The most impressive trick that blockchain-in-banking advocates have performed,” writes Bloomberg columnist Matt Levine, “is getting the world to pay attention to back-office technology upgrades, and to think that they might be revolutionary.”

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply