Gold Price -$30 as UN Korea Sanctions See Stocks Hit Fresh Records, UK Inflation Jumps, Opec Oil Output Falls

Bullion.Directory precious metals analysis 12 September, 2017

Bullion.Directory precious metals analysis 12 September, 2017

By Adrian Ash

Head of Research at Bullion Vault

Dollar gold prices traded $30 per ounce below Friday’s 12-month high of $1356 and major government bond prices also fell, pushing 10-year US yields up towards 3-week highs at 2.17%.

World stock markets had already pushed higher after setting a fresh record high on Monday, while the Euro fell again, losing over 1.5 cents from last week’s new 32-month highs just shy of $1.21.

That supported the gold price for Eurozone investors just 1.5% below last week’s 2-month highs.

The Chinese Yuan meantime fell 1.6% from its jump to 2-year highs, helping buoy the premium offered for new bullion imports into the world’s No.1 gold consumer nation at $6 per ounce.

Twice the Shanghai premium offered last week, that was still one third smaller than the average.

“[Stock markets are being] buoyed by a tempering of tensions on the Korean peninsula and a downgraded Hurricane Irma,” says a trading note from Swiss refining and finance group MKS Pamp.

“The new UN sanctions against North Korea are not as wide-ranging as the US had originally demanded,” adds German bank Commerzbank in a gold price note.

“This is clearly a relief for market participants and is generating higher risk appetite.”

“If I’m more confident about the outlook,” says fund giant Fidelity’s UK multi-asset manager Nick Peters, “especially over the next 3 months, it makes sense to reduce the more defensive positions [such as] fixed-income and gold.”

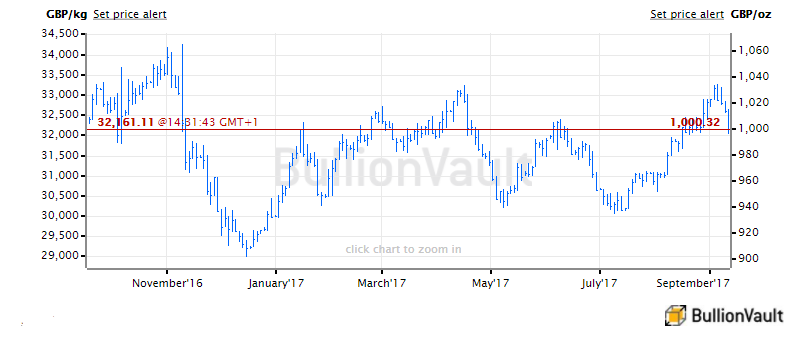

The UK gold price in Pounds per ounce today sank to dip below £1,000 per ounce – a 1-month low almost 4% below last week’s 10-month peak – as the British Pound rose to its strongest so far in 2017 on the FX markets following new inflation data.

Consumer prices in the European Union’s 2nd largest economy rose to 2.9% annually in August, matching this spring’s 5-year high.

The Bank of England next decides this Thursday on UK interest rates, cut last year to a fresh record low of 0.25% after the Brexit referendum shock, when new QE money creation also took the central bank’s holdings of government debt to £435 billion ($575bn) – equal to more than one-fifth of the UK’s annual GDP.

Separately the UK Government of former Home Secretary, now prime minister Theresa May, said Tuesday it is removing the 1% per year public-sector pay cap, but only for police and prison staff.

Trade union Unite’s leader Len McCluskey says he’s willing to “go outside the law” to call for mass action by other public-sector workers without getting 50% turn-out in a strike ballot.

Brent crude oil meantime pushed up towards last week’s 5-month highs above $54 per barrel Tuesday amid news of falling output from Opec cartel member states.

Top producer Saudi Arabia today said it foiled an ISIS terror attack on a military base, arresting 7 including Yemeni nationals.

US-based campaign group Human Rights Watch today said the Saudi-led coalition supporting the Yemen government against Houthi rebels has carried out 5 unlawful airstrikes killing 39 civilians, including 26 children, over the last 2 months.

Last weekend saw 31-year-old Crown Prince Mohammed bin Salman – now first in line to the throne after what analysts are widely calling a palace coup at the end of Eid in June – suspend talks with Qatar, isolated by its Arab neighbors since start-June over funding terrorism.

Those accusations are seen by some observers as a smokescreen for trying to silence Al Jazeera‘s news network and enforce Saudi control across the region.

This article was originally published hereBullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply