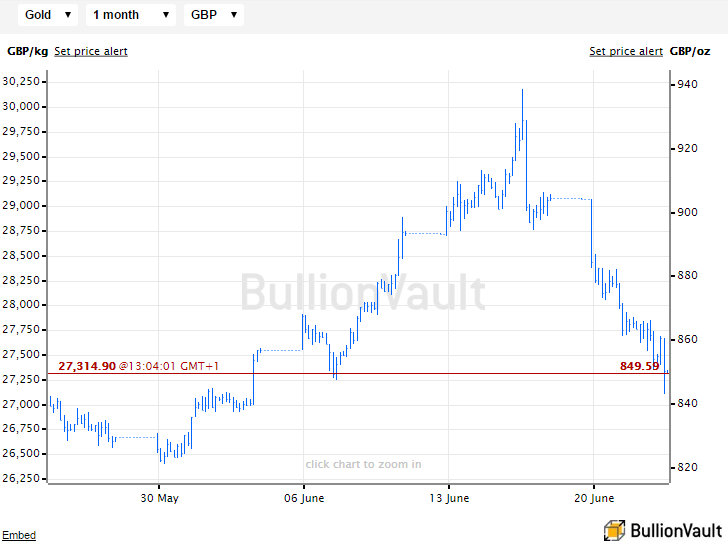

Gold Prices Drop 10% in GBP from Brexit Peak as ‘Remain’ Vote Expected

Bullion.Directory precious metals analysis 23 June, 2016

Bullion.Directory precious metals analysis 23 June, 2016

By Adrian Ash

Head of Research at Bullion Vault

Eurozone stock markets jumped over 2% as gold prices dipped below $1260 per ounce – down over 4% in US Dollar terms from last Thursday’s 2-year high.

London’s FTSE100 index lagged Frankfurt and Paris, but rose 1.5% for its fifth daily gain in succession off last Thursday’s 4-month lows.

Gold priced in Sterling fell yet again as the Pound rose on the FX market, dropping over 10% from last Thursday’s sudden 3-year high at £938 to dip below £845 per ounce.

The last opinion poll taken before today’s voting began put the Leave vote at 48% with Remain at 52%.

Some 17% of voters, however, remain undecided according to a separate telephone poll published Wednesday.

Results are due to start around midnight London time, 2 hours after polls close, with a clear verdict by 5am Friday.

Today’s rise in Sterling was widely read as a growing bet on a strong Remain vote, with some commentators citing ‘exit polls’ privately run for London hedge funds.

“Whilst the referendum has had an influence on gold prices in the last two weeks,” reckons UK fund manager George Cheveley at investment bank Investec, “the effect has been small compared to the impact of US interest rate and US Dollar moves over the past few months.

“Negative real rates, the US election and Chinese debt levels are also worrying investors.”

Shanghai gold prices steadied overnight, edging higher from 2-week lows even as the Chinese Yuan rose on the FX market.

That reversed yesterday’s $3 per ounce discount on Chinese gold versus international prices to a $5 premium at the benchmark Shanghai Gold Price auction.

“[Bullish gold bets] have started to correct,” said a note from Canada-based bullion bank Scotia Mocatta, “but the net long fund position is still large, so further profit-taking may follow.

“ETF investors continue to buy and there have not been many redemptions – this suggests sentiment remains bullish.”

Investor demand for shares in gold ETF market-leader the SPDR Gold Trust (NYSEArca:GLD) expanded yet again on Wednesday, extending its growth 1.7% since prices hit 2-year Dollar highs a week ago to need 915 tonnes of bullion backing – the largest quantity since September 2013.

The leading silver ETF in contrast – the iShares Silver Trust (NYSEArca:SLV) – has shrunk by more than 200 tonnes since mid-June to 10,360 tonnes, its smallest size since start-April’s then 16-month high.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply