Gold Bullion Nears 4-Week Friday Low as ‘No Way Currency’ Bitcoin Rallies, Turkey-US Tensions Worsen

Bullion.Directory precious metals analysis 1 December, 2017

Bullion.Directory precious metals analysis 1 December, 2017

By Adrian Ash

Head of Research at Bullion Vault

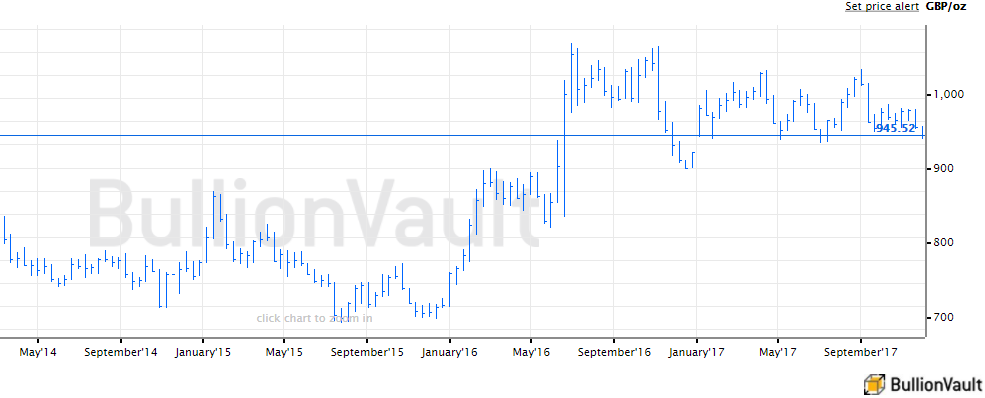

Falling back to $1273 per ounce at lunchtime in London, wholesale gold bullion bars began December 10% higher for 2017 to date against the Dollar, but was lower from New Year for Eurozone investors and flat in terms of the British Pound.

Rising over 10-fold for 2017 to date in contrast, crypto-currency Bitcoin — widely called “digital gold” by pundits and headline writers — rose to $10,500 as derivatives exchange the CME Group said it has received regulatory approval for Bitcoin futures contracts to launch on 18 December.

Sales of gold and silver bullion coins by the US Mint have in contrast totalled the lowest in 10 years, before the financial crisis exploded, so far in 2017 according to data compiled by Reuters.

“We need to be clear,” said French central bank chief François Villeroy de Galhau today, speaking in Beijing.

“Bitcoin is in no way a currency, or even a cryptocurrency. It is a speculative asset. Its value and extreme volatility have no economic basis, and they are nobody’s responsibility.”

Adding that the Banque of France itself is “experimenting with [the] innovative technology” of blockchain and distributed ledger record-keeping, “We have also noted with interest the measures taken by the Chinese authorities regarding ICOs,” said villeroy de Galhau, referring to Beijing’s September ban on what it called “illegal and disruptive” initial coin offerings of other digital tokens.

After new data yesterday put US economic growth at its strongest pace in 3 years, manufacturing surveys today said business at European factories is expanding the fastest since 2000.

Gold prices for Eurozone investors fell to new 3-month lows beneath EUR 1070 per ounce.

The gold price in Pounds per ounce meantime headed for its lowest Friday finish since mid-July at £945, as the Markit data agency’s UK PMI survey put manufacturing activity at a 4-year high.

Hong Kong’s stock market fell for the fifth session running, trading over 3% below last week’s new 10-year high.

Commodities meantime ticked higher as crude oil rallied towards last month’s 2-year highs following confirmation of a 2018 output cap by producer-nation cartel Opec together with Russia.

Over in New York, Iranian-Turkish gold trader Zarrab yesterday implicated Turkey’s president, Recep Tayyip Erdoğan, in evidence against bank executive Mehmet Hakan Atilla over sanction-busting cash transfers to Iran.

Avoiding prosecution himself by pleading guilty and co-operating with the US authorities, Zarrab said Turkey’s former economic minister Zafer Caglayan — whom he claims to have bribed — told him that Erdogan had approved payments to Iran by two Turkish banks in 2013.

Cut off by Western sanctions over its nuclear program, Iran allegedly used money paid into Atilla’s Halkbank to buy gold bullion, smuggle it to Dubai, and then sell it for cash.

Erdogan’s team last week said Zarrab was being held “hostage” by the US in a politically-motivated case.

Today the Public Prosecutor in Istanbul today issued an arrest warrant for former CIA vice-chairman Graham Fuller, claiming he was involved in July 2016’s failed coup attempt in Turkey.

Accused along with US academic Henri Barkey of “attempting to overthrow the government” of Turkey, Fuller supported the 2006 immigration to America of Turkish cleric Fethullah Gülen — blamed by Ankara as the mastermind of last year’s coup attempt — and last month named as part of the plot by Russian political strategist and philosopher Alexander Dugin.

Nicknamed “Putin’s brain” for his reported sway over the Russian president, Dugin said Moscow has “concrete evidence that CIA agents commanded the failed coup attempt.”

Tensions between the US and fellow Nato military treaty member Turkey – the world’s No.5 gold bullion consumer – have risen sharply in recent months over policy towards the Assad regime in Syria and also Ankara’s purchase of a new missile system from Russia.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply