The federal government ran yet another massive budget deficit in February, pushing the total budget shortfall to over $1 trillion just five months into the fiscal year.

Bullion.Directory precious metals analysis 13 March, 2025

Bullion.Directory precious metals analysis 13 March, 2025

By Mike Maharrey

Journalist, analyst and author at Money Metals Exchange

The federal government spent $307.01 billion more than it took in last month. That drove the cumulative deficit for fiscal 2025 to $1.15 trillion with seven months left. It is the biggest deficit ever through five months.

The Treasury collected $296.42 billion in February. That was a 9.3 percent increase in revenue over February 2024.

So far, in fiscal 2025, government tax receipts total $1.89 trillion. That’s about $3 billion more than the same period last year, but according to a Treasury Department official, the 2024 revenue figure was inflated by deferred tax payments from 2023 related to natural disasters.

The real problem is on the spending side of the ledger.

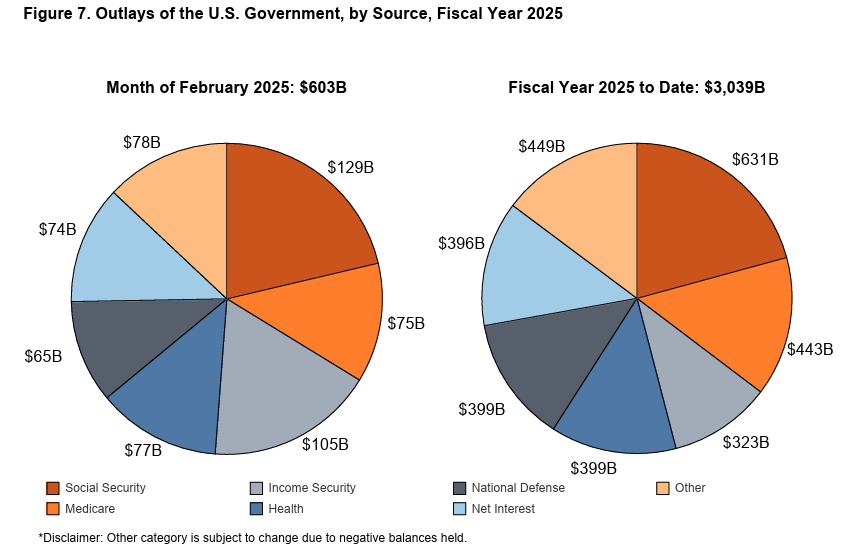

The Trump administration blew through $603.44 billion last month, a 6.3 percent increase over February 2024. That drove total spending in fiscal 2025 to $3.04 trillion, a 13.4 percent increase compared to the first five months of fiscal 2024.

You might recall that President Biden promised that the [pretend] spending cuts would save “hundreds of billions” with the debt ceiling deal (aka the [misnamed] Fiscal Responsibility Act).

That never happened.

And appears the Republicans aren’t going to do any better. The spending plan being kicked around by Congress would increase the deficit by some $6 trillion over the next decade.

The truth is the federal government always manages to find new reasons to spend money, whether for natural disasters at home or wars overseas. The Biden administration blew through a staggering $6.75 trillion in fiscal 2024, a 10 percent increase over 2023 outlays.

Interest on the national debt cost $85.87 billion in February. That brought the total interest expense for the fiscal year to $478.05 billion, up 10.3 percent over the same period in 2024.

So far, in fiscal 2025, the federal government has spent more on interest on the debt than it has on national defense ($399 billion) or Medicare ($443 billion). The only higher spending category is Social Security.

Uncle Sam paid $1.13 trillion in interest expenses in fiscal 2023. It was the first time interest expense has ever eclipsed $1 trillion. Projections are for interest expense to break that record in fiscal 2025.

Much of the debt currently on the books was financed at very low rates before the Federal Reserve started its hiking cycle. Every month, some of that super-low-yielding paper matures and has to be replaced by bonds yielding much higher rates. And even with the recent Federal Reserve rate cuts, Treasury yields have pushed upward as demand for U.S. debt sags.

This is one of the reasons everybody is clamoring for interest rate cuts despite stubborn price inflation.

Ramifications

These big deficits pile onto a national debt that officially topped $36 trillion in November. Currently, the debt level is steady because the federal government is up against the debt ceiling.

However, you can expect the huge surge in debt once Congress raises the ceiling. (And it will raise the ceiling.)

Some people claim that borrowing, spending, and big national debts don’t matter.

They do.

According to the national debt clock, the current debt level represents 122.48 percent of GDP. Studies have shown a debt-to-GDP ratio of over 90 percent retards economic growth by about 30 percent.

And as the Bipartisan Policy Center points out, the growing national debt and the mounting fiscal irresponsibility undermine the dollar.

“Confidence in U.S. creditworthiness may be undermined by a rapidly deteriorating fiscal situation, an increasing concern with federal debt set to grow substantially in the coming years.”

This could lead to lower economic growth, higher unemployment, and less investment wealth.

Lack of confidence in the U.S. fiscal situation could also lower demand for U.S. debt. This would force interest rates on U.S. Treasuries even higher to attract investors, exacerbating the interest payment problem. As already mentioned, we saw a big spike in Treasury yields despite Fed rate cuts.

Biden ran the debt higher at a dizzying pace, but to be fair, this isn’t just a Biden problem. Every president since Calvin Coolidge has left the U.S. with a bigger national debt than when he took office.

DOGE has done a great job of pointing out government waste, but it’s going to take more to get the borrowing and spending under control. Even if the Trump administration manages to slash discretionary spending as promised, that only accounts for 27 percent of total spending. The vast majority is for entitlements, and there is little political will to take the scissors to Social Security or Medicare.

And the sad fact is that most people in positions of power are content to kick the debt can down the road. They reason, ‘Nothing has happened yet, so why worry?’

But the problem with playing kick the can down the road is that you eventually run out of road.

Mike Maharrey

Mike Maharrey is a well-known author, journalist, financial analyst and writer at Money Metals Exchange, one of our top-rated US dealers and two-times winner of Bullion Dealer of the Year

He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida. Mike also serves as the national communications director for the Tenth Amendment Center and the managing editor of the SchiffGold website.

This article was originally published here

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply