Kherson fell, but Ukrainians are still fighting fiercely. In the face of war, gold also shows courage – to move steadily up.

Bullion.Directory precious metals analysis 03 March, 2022

Bullion.Directory precious metals analysis 03 March, 2022

By Arkadiusz Sieroń, PhD

Lead Economist and Overview Editor at Sunshine Profits

There is a large Russian column advancing on Kyiv, but its progress has been very slow over the last few days due to the staunch Ukrainian resistance and Russian forces’ problems with equipment, tactics, and supplies, including fuel and food.

There is a large Russian column advancing on Kyiv, but its progress has been very slow over the last few days due to the staunch Ukrainian resistance and Russian forces’ problems with equipment, tactics, and supplies, including fuel and food.

David is still bravely fighting Goliath!

Of course, Russian forces still have an advantage and are progressing. However, the pace of the invasion is much slower than Vladimir Putin and his generals expected. The Ukrainians’ defense is much fiercer, while Russia’s losses are more severe. The Russian defense ministry admitted that 498 Russian soldiers have already been killed and 1,597 wounded, but the real number is probably much higher. Even if Russia takes control of other cities, it’s unclear whether it will be able to hold them.

What’s more, although the West didn’t engage directly in the war, the response of the West was much stronger than Putin could probably have expected. The US and its allies supplied Ukraine with weapons and imposed severe sanctions against Putin and the Russian governing elite, as well as on Russia’s economy and financial system.

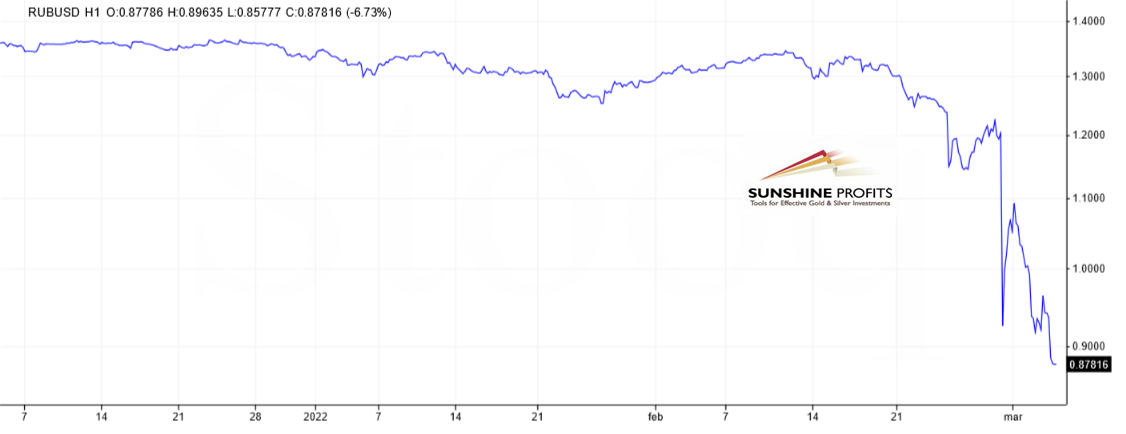

For instance, the West decided to exclude several Russian banks from SWIFT and also to freeze most of Russian central bank’s foreign currency reserve assets. Additionally, many international companies are moving out of Russia or exporting their products to this country, adding to the economic pressure. The ruble plummeted, as the chart below shows.

Implications for Gold

What does the ongoing war in Ukraine mean for the precious metals market? Well, the continuous heroic stance of President Volodymyr Zelenskyy and Ukrainian defenders is not only heating up the hearts of all freedom-lovers, but also gold prices.

As the chart below shows, the price of the yellow metal has soared to about $1,930, the highest level since January 2021.

As a reminder, until recently, gold was unable to surpass $1,800. Thus, the recent rally is noteworthy. The war is clearly boosting the safe-haven demand for gold. Another bullish driver is rising inflation.

According to early estimates, euro area annual inflation soared from 5.1% in January to 5.8%, and the war is likely to add to the inflationary pressure due to rising energy prices. Both Brent and WTI oil prices have surged above $110 per barrel.

Last but not least, I have to mention Powell’s appearance before Congress. In the prepared testimony, he said that the Fed would hike the federal funds rate this month, despite the war in Ukraine:

Our monetary policy has been adapting to the evolving economic environment, and it will continue to do so. We have phased out our net asset purchases. With inflation well above 2 percent and a strong labor market, we expect it will be appropriate to raise the target range for the federal funds rate at our meeting later this month.

This sounds rather hawkish and, thus, bearish for gold. However, Powell acknowledged that the implications of Russia’s invasion of Ukraine for the U.S. economy are highly uncertain.

The near-term effects on the U.S. economy of the invasion of Ukraine, the ongoing war, the sanctions, and of events to come, remain highly uncertain. Making appropriate monetary policy in this environment requires a recognition that the economy evolves in unexpected ways. We will need to be nimble in responding to incoming data and the evolving outlook.

Hence, the war in Eastern Europe could make the Fed more dovish than expected at a time when inflation could be higher than forecasted before the war outbreak. Such an environment should be bullish for the gold market.

However, there is one important caveat. The detailed analysis of gold prices shows that they declined around the first and second rounds of negotiations between Russian and Ukrainian diplomats in anticipation of the end of the conflict. However, when it became apparent that the talks ended in a stalemate, gold resumed its upward move. The implication should be clear: as long as the war continues, the yellow metal may shine, but when the ceasefire or truce is agreed, we could see a correction in the gold market. It doesn’t have to be a great plunge, but a large part of the geopolitical premium will disappear.

Having said that, the war may take a while. I pray that I’m wrong, but the slow progress of the Russian invasion could prompt Vladimir Putin to adopt a “whatever it takes” stance. According to some experts, he is already more emotional than usual, and when faced with the prospects of failure, he could become even more brutal or irrational.

We already see that Russian troops, unable to break the Ukrainian defense in open combat, siege the cities and bomb civilians.

Hence, the continuation or escalation of Russia’s military actions could provide support for gold prices.

Arkadiusz Sieroń

Arkadiusz Sieroń – is a certified Investment Adviser, long-time precious metals market enthusiast, Ph.D. candidate and a free market advocate who believes in the power of peaceful and voluntary cooperation of people.

He is an economist and board member at the Polish Mises Institute think tank, a Laureate of the 6th International Vernon Smith Prize and the author of Sunshine Profits’ bi-weekly Fundamental Gold Report and monthly Gold Market Overview.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply