Silver is down but not out

By Chris Lemieux

Marco Strategist at TrendFlex™ & MacroView.co – Twitter @Lemieux_26

Silver is down over seven percent from 2018’s high, but speculative positioning is suggesting a rally could be near.

Both gold and silver have hit the skids recently. Whether we chalk it up to an overly hawkish Fed, cherry-picked macro data, etc., precious metals have been trending lower with the U.S. dollar.

However, if we look at a unique view of the CFTC commitment of trader positioning, we find that silver could be ready to rally.

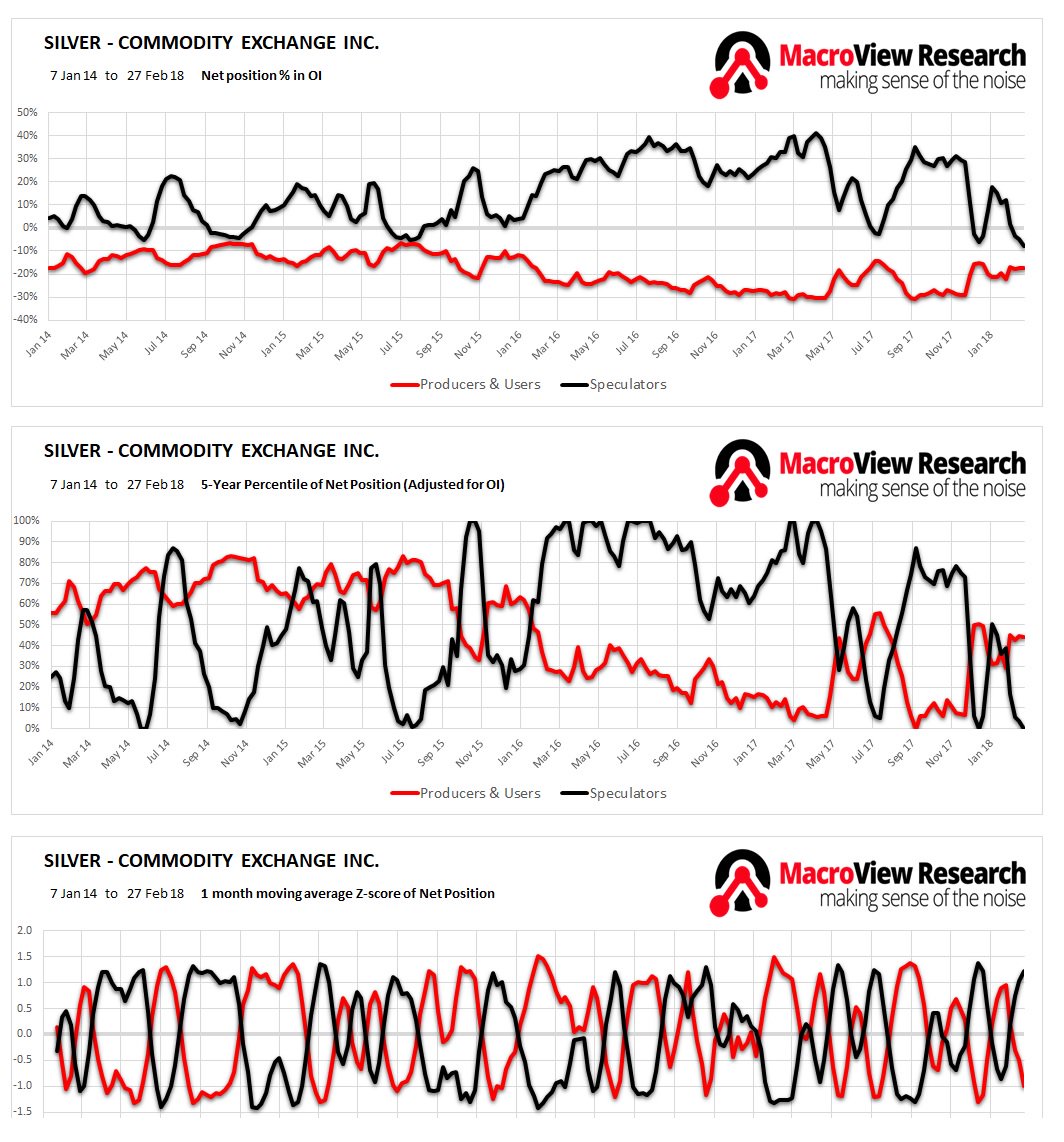

At MacroView Research, we strive to put market dynamics into context. By using a five-year percentile view of open-interest and net-positioning, we get a clearer picture. Speculators have greatly reduced their net-long position in silver with distribution occurring the last few months.

Two key factors come to the forefront:

1. Net-positioning for speculators have dropped below 10 percent within our given metric.

2. Net-positioning for speculators is quite extended, nearing 1.5 sigma.

MacroView Research, 5-Year Percentile of Silver Open-Interest, Net-Positioning and 1-Month Moving Average of Positioning.

The precious metal clouds could have a silver lining.

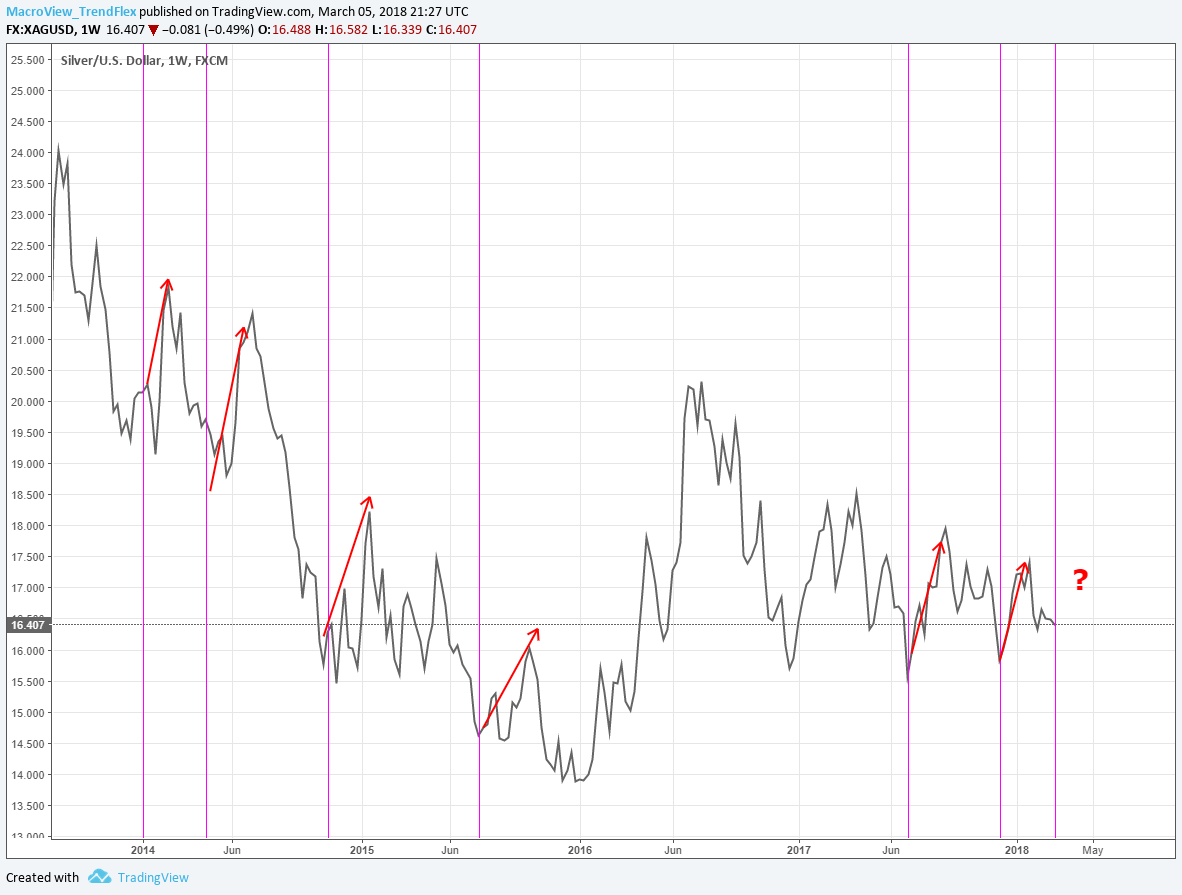

If we go back to when silver’s 5-year percentile dipped below 10 percent over the last 3.5 years, results have followed!

When 5-Year Percentile of Net-Positioning Dips Below 10% A Sizable Rally Follows

If we put into context the net-positioning for speculators in silver in relation to historical occurrences, silver could post serious gains. Keep in mind, it is not a guarantee but something to keep on your radar.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply