Long weekends are often a chance for the markets to cool off recent emotionality and focus on the main trend. And the trend in gold is back!

Bullion.Directory precious metals analysis 21 February, 2023

Bullion.Directory precious metals analysis 21 February, 2023

By Przemysław K. Radomski

Founder of GoldPriceForecast.com

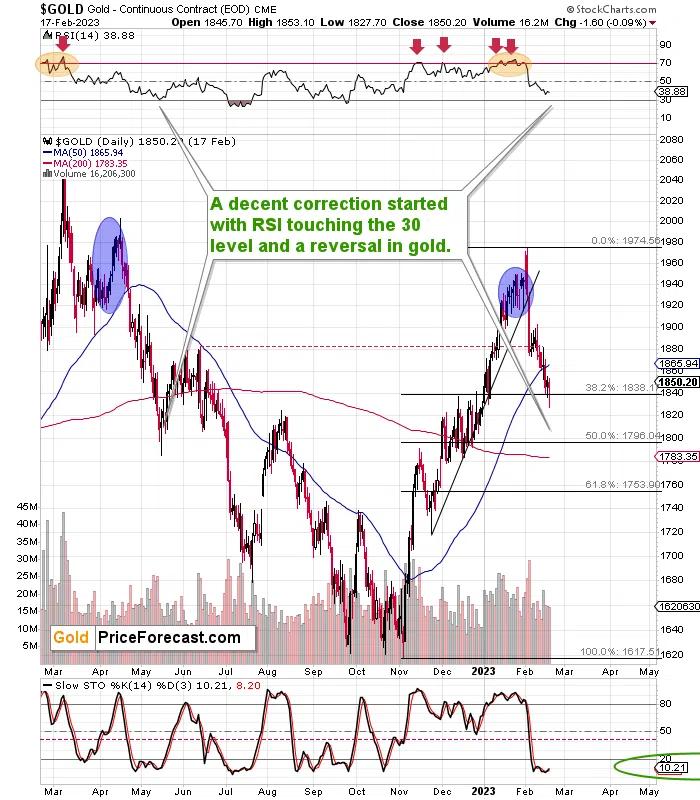

Gold moved sharply higher during Friday intraday trading, and since it moved higher after reaching its 38.2% Fibonacci retracement level, many investors and traders were probably led to believe that this was a true reversal.

To be honest, looking at the price action alone could indeed give this impression! Fortunately, we don’t have just the price data; we have other datasets, and one of them is volume. If daily reversals are to be taken seriously, they must be confirmed by high (ideally, extreme) values. Without big volume, we can’t tell if one part of the market (here, the bulls) really overpowered the other side (here, the bears) in a fierce fight.

Conversely, in the case of moderate (or, in particular, low) volume, it looks like both parts of the market got a little bored and one of them was a bit more active than the other.

While the high-volume victory is meaningful, the we’re-not-as-bored victory is not.

But you already knew that, as I already wrote that while we might get a breather here, it’s not likely to be anything to write home about. Quoting what I wrote on Friday (Feb. 17):

Now, since yesterday’s volume wasn’t huge, there was no “huge battle” to speak of.

This means that the reversal is not really meaningful.

Interestingly, I had written the above about Thursday’s reversal. What we saw on Friday was another, bigger reversal that was – once again – accompanied by unimpressive volume. Consequently, we saw the same no-indication indication twice.

When US markets closed, gold futures (which are also traded on non-US exchanges) moved slightly higher before reversing. Today, they are once again moving lower.

In other words, the gold market did exactly what I wrote about on Thursday (Feb. 16):

Will there be no other corrections before gold hits $1,800? It’s unclear – we might see a rebound right now given that the 38.2% Fibonacci retracement was reached, but it’s unlikely that this rebound would be big enough for most people to really care about it. Remember the late-April and early-May 2022 corrections? We might see something of similar size and length.

Looking at the GDXJ ETF (a proxy for junior mining stocks) price performance during today’s London session (I’m writing these words before the markets open in the U.S.), we see more of the same.

Junior miners reversed yesterday, and they are moving lower today. This confirms the price action coming from the gold market. Namely, we saw a breather – a quick corrective upswing within a bigger trend.

Moreover, please note that quick corrections are the norm in the case of the GDXJ ETF – at least as far as this medium-term decline is concerned. I marked the early-February and mid-February breathers, and the current one is actually the smallest of them. That’s yet another sign pointing to the fact that what we just saw was not the start of another powerful upswing, but rather a pause within a powerful downswing.

It’s quite likely that gold, silver, and mining stocks will launch their – much more meaningful (perhaps even tradeable!) – corrective upswings this month, and the price and time targets that I had previously indicated to my Gold Trading Alerts subscribers remain up-to-date.

Przemyslaw Radomski

Przemyslaw K. Radomski, CFA, has over twenty years of expertise in precious metals. Treating self-growth and conscious capitalism as core principles, he is the founder of GoldPriceForecast.com

As a CFA charterholder, he shares the highest standards for professional excellence and ethics for the ultimate benefit of society and believes that the greatest potential is currently in the precious metals sector. For that reason it is his main point of interest to help you make the most of that potential.

This article was originally published here

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply