Global equities are not data dependent but central bank dependent.

Bullion.Directory precious metals analysis 31 October, 2014

Bullion.Directory precious metals analysis 31 October, 2014

By Christopher Lemieux

Senior FX and Commodities Analyst at FX Analytics

The S&P 500 hit another all-time new high, pushing over 2,010. Not because the economic data is showing “underlying” strength, like the Fed proclaims, but because the Bank of Japan (BoJ) is handing out free candy.

Global equities saw monster gains this Halloween, as the BoJ’s quantitative easing program just hit event horizon. So, as the FOMC minutes pin a hawkish tone to the markets due to underlying economic strength, the US economic data continues to miss the mark.

This week, pending home sales came under par and mortgage applications hit 19-year lows. Durable goods missed horribly across the mark.

Now, with analysts continuing to say the consumer is strong, spending data contracted .2 percent from a .5 percent expansion in the previous month. This was the first move lower in eight months, just in time as the Fed “finishes” QE. Demand for goods fell sharply, added doubt to the recent 3.5 percent expansion in Q3 GDP figure – largely rose on government spending.

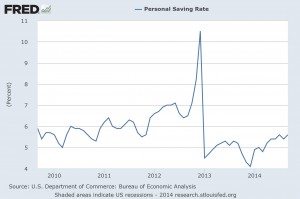

The savings rate increased to 5.6 percent to a total of $732.2 billion. In an economy with so-called improving labor markets and a stronger consumer, the savings rate has steadily increased to levels not seen since 2012.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs assots.ciated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply