Dollar Divergence Update: Embrace Uncertainty

Bullion.Directory precious metals analysis 3 February, 2015

Bullion.Directory precious metals analysis 3 February, 2015

By Terry Kinder

Investor, Technical Analyst

In case you haven’t guessed it, I’m not a big fan of narrative – aka stories. Stories are wonderful to tell little children before bedtime. However, at a certain point, it is time to grow up and accept that not everything that occurs needs an immediate explanation. It’s okay to give a bit of room to let uncertainty breathe.

I don’t have anything against someone trying to get to the bottom of why things happen. What does concern me, however, is the steady stream of stories every day that provide cookie cutter explanations about why things happened that day or the day before. These stories are cotton candy analysis – sweet, light, fluffy and soon forgotten.

Rather than engage in such analysis and assuming my powers of reason are so great that I can tell you definitively why the dollar moves up or down, I would rather provide you with the tools and analytical mindset to anticipate the dollar’s movements based on price. So, let’s begin.

On the 19th of January I posted Dollar Divergence: Is Momentum Weakening? Notice, whether or not the dollar was weakening was posed as a question. It would have been easy enough to have left off the question mark. However, the question mark wasn’t used simply because of some uncertainty (although the situation is uncertain), but rather out of principle. What principle? The simple idea that no one can know everything. Better still, the fact that it is impossible, or nearly so, for one individual to accurately capture through personal opinion the information encapsulated in the dollar price which is determined by the knowledge and actions of millions upon millions of individuals.

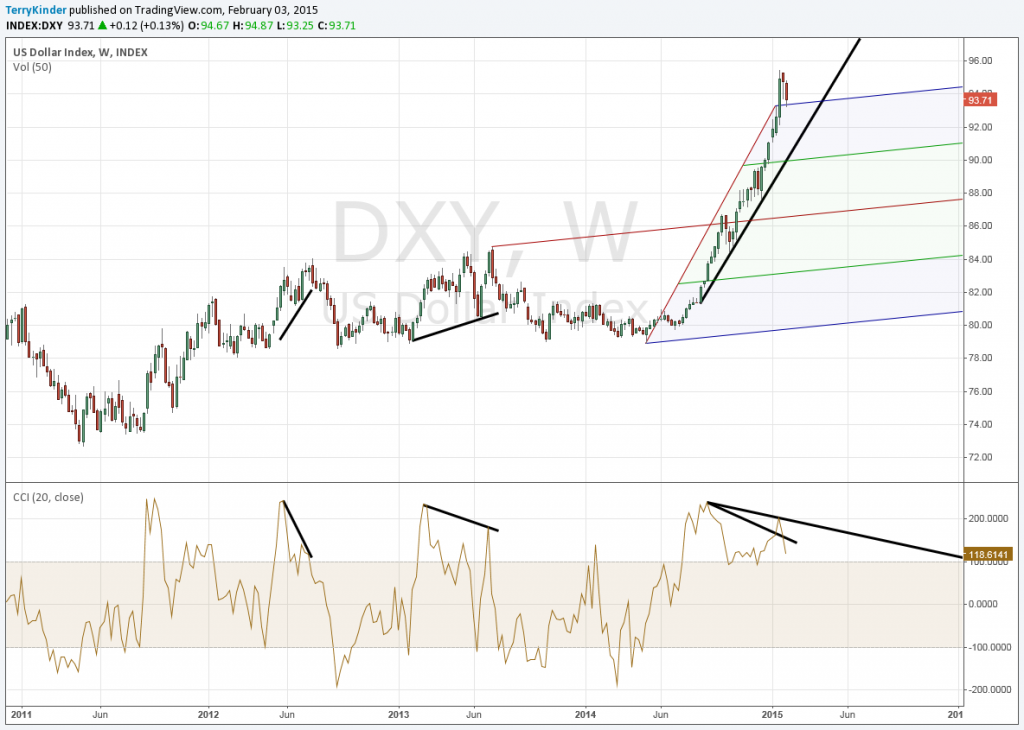

Here’s what the dollar chart looked like when the original article was posted:

As you can see, at the time, the dollar was still within a Schiff Pitchfork, and despite a marked divergence between the Commodity Channel Index and the U.S. Dollar Index (DXY) the price was still climbing.

Fast forward to today and the chart looks like this:

It took several weeks for the dollar’s upward price momentum to let up, and it is far from certain whether the dollar is taking a breather, turning down or something else. But the bigger takeaway from the above charts is that over time divergences will resolve. Don’t misunderstand, I’m not saying the current divergence is resolving or has resolved. I would prefer to see a much more significant move of the price back into the pitchfork toward the red median line. By definition, for the dollar price to move back to the median line of the pitchfork it has to break the support line for the uptrend.

Note too: The dollar price found weekly support right on the upper parallel line of the Schiff Pitchfork. Before considering the possibility of a bigger dollar decline I would look for an entire weekly price candle to fall below the upper parallel line.

So, it’s far too early for anyone to say with certainty that the dollar price divergence has ended and its dramatic move higher has ended.

A final chart to consider…

The dollar has broken above a more than decade-long channel with an RSI level not seen since the 1980’s.

A few noteworthy features of the above chart:

Will the dollar divergence ultimately resolve with a lower DXY price? Image: pixabay

2) The two previous times RSI reached the elevated levels we’re seeing today, it stayed elevated for years and the dollar price climbed;

3) MACD is not too elevated so has room to run higher.

At a certain point we all have to embrace uncertainty and move on.

Maturity, one discovers, has everything to do with the acceptance of ‘not knowing.’

Mark Z. Danielewski, House of Leaves

Beware those who tell you they know with certainty that something will happen. Beware of pat explanations regarding why something happened. It’s unlikely that you or anyone else is smarter than the multitude of people and their collective knowledge, experience, judgment, etc. that are the ingredients of the ever changing price.

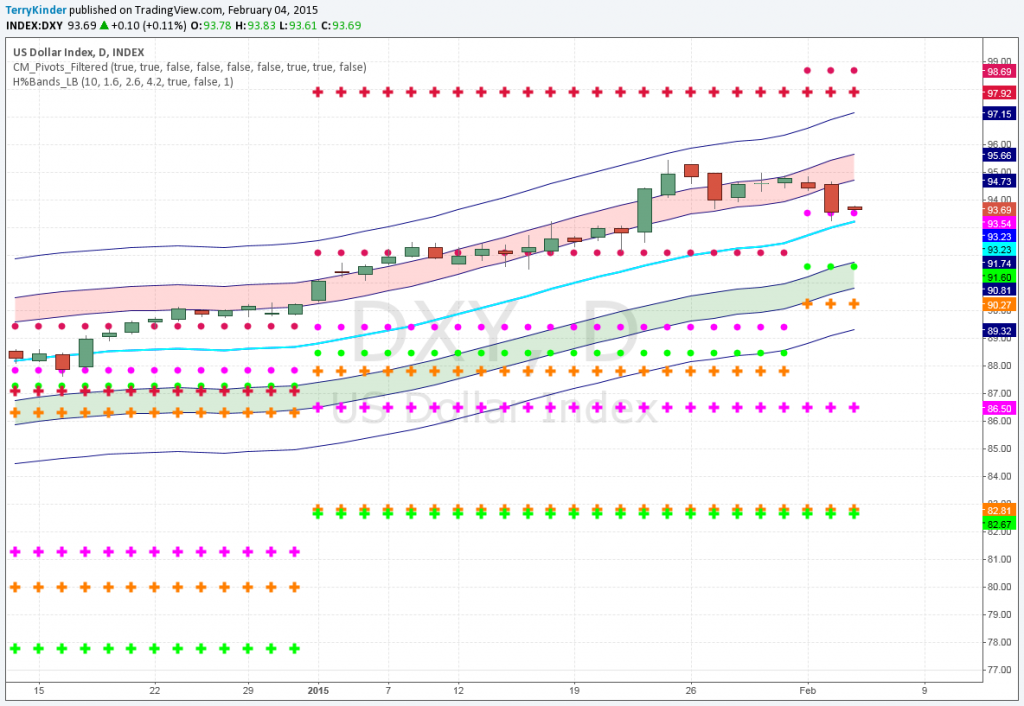

Bonus Chart:

The last time the dollar price touched the green oversold Hurst Band was September of 2013. Current price is hovering just above a support pivot.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.