As the dollar climbs the proverbial stairway to heaven, we’re left wondering how high it can go.

Bullion.Directory precious metals analysis 18 January, 2015

Bullion.Directory precious metals analysis 18 January, 2015

By Terry Kinder

President, Senior Technical Analyst, Terry Kinder’s Gold and Silver Prices

While the dollar climbs ever higher up its seeming stairway to heaven, I’m reminded that price moves higher climb stairs while moves lower take the elevator shaft.

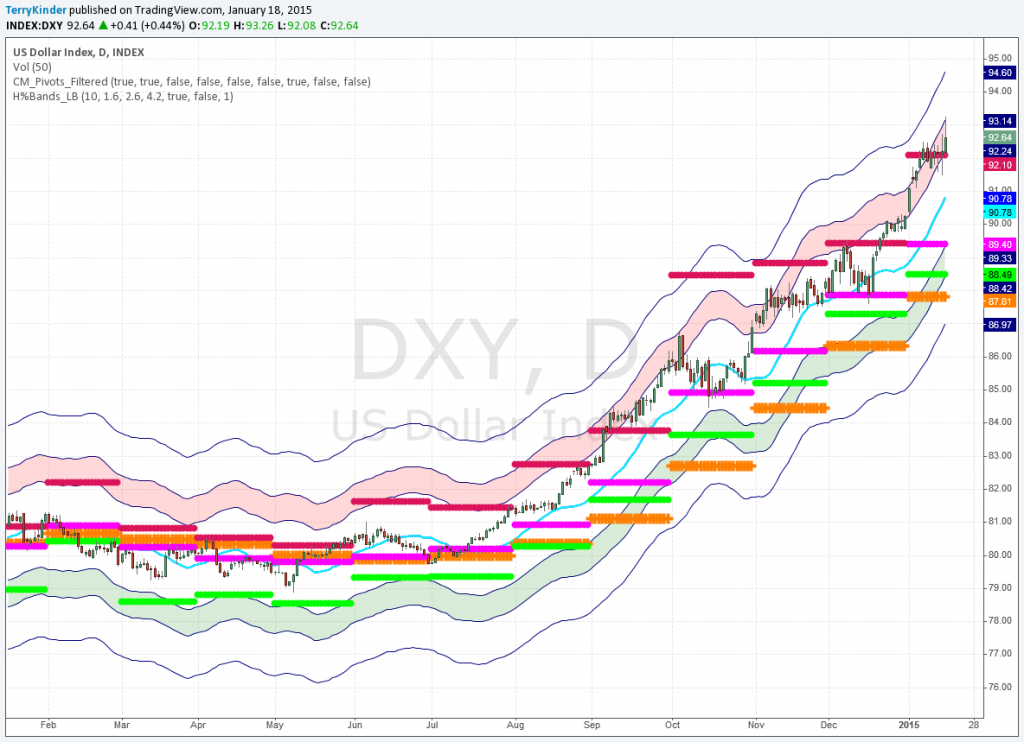

Since May of last year it seems that the U.S. Dollar Index (DXY) can do nothing but move higher. It’s been an impressive move, from the May low of $78.90 the dollar has climbed to $92.64.

Although not visible on the above chart, the last time that the dollar was oversold on the Hurst Bands (green shaded area) was back in September of 2013. But, as the dollar climbs higher, it’s easy to lose historical perspective.

The last time the dollar was at $92.64 was back in 2003, in those glory days before Too Big to Fail and Quantitative Easing. The DXY had been in an over 11-year long price channel, aka Purgatory, before breaking higher. It’s a little difficult to see on the weekly chart above, so let’s take a look at the daily chart.

Dollar Climbs Stairway to Heaven: Can the dollar remain above the channel or is this a fake-out breakout?

In the chart above you can see – just barely – that the dollar moved above the upper boundary of the 11-year channel by a whole penny. So, it will be interesting to see if the dollar climbs higher next week. With RSI bumping up against levels on the weekly chart not seen since 1997 and MACD at levels last seen in 2008, you might think the dollar would take a breather. Yes, looking back, after the dollar came off its high RSI level in the 1990’s, the price climbed higher, as the RSI remained relatively elevated for a number of years.

Dollar Climbs Stairway to Heaven: Is it Heaven or Hades for the U.S. Dollar? Image: pixabay

With continued stress in Europe, as Martin Armstrong has pointed out, we could see the dollar climb higher even as the gold price advances.

We are in a very fluid period, which can be confusing, yet it is important to comprehend that NOTHING but NOTHING is ever PERMANENT. On the one hand, gold will eventually decline for its final low on the benchmarks. The only thing that will call that into question is a Monthly Closing ABOVE 1350. Yet, gold is rising WITH the dollar.

This paradox centers around a simple game – who has the confidence now. Since the confidence is fleeing Euroland, then capital and confidence will move into dollar and Swiss franc. This means that gold will rise WITH the dollar and franc as a HEDGE against the Euro.

However, we will eventually reach that point more-likely-than-not on the benchmarks where the shift in confidence will take place and gold will then rise AGAINST the dollar. After the confidence has crashed against everyone else, then it will turn against the USA. This is when we will thereafter see the next solution as a one-world reserve currency.

Given the ongoing economic stress worldwide, but especially centered in Europe, there is a good chance the dollar may continue to move higher. While technical indicators such as RSI and MACD are elevated, that doesn’t mean the dollar could not advance higher. The next few weeks should give us a better idea if the dollar climbs higher up the stairway to heaven or if this is a fake-out breakout of the 11-year old channel (aka Purgatory) the dollar has seemed trapped in.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply