Gold Bullion +40% Under Obama, Quiet as Trump Sworn In

Bullion.Directory precious metals analysis 20 January, 2017

Bullion.Directory precious metals analysis 20 January, 2017

By Adrian Ash

Head of Research at Bullion Vault

World stock markets were also quiet ahead of Trump’s inauguration, and the Euro was little changed on the forex market, holding 3 cents above December’s 14-year lows at $1.03 versus the Dollar.

US government bonds slipped again in price however, nudging 10-year Treasury yields up to their highest in 2017 so far at 2.48% – almost exactly where they stood when Barack Obama was inaugurated at the start of 2009.

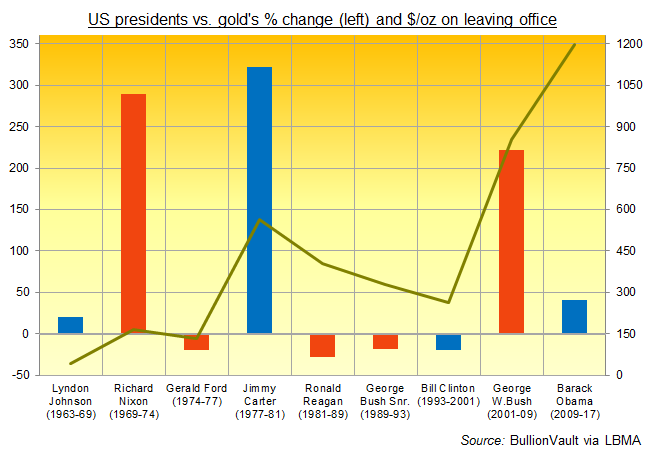

The S&P500 index of US-listed corporations has risen 180%, not including dividends, while the US Dollar has risen 13% against a basket of the world’s other major currencies.

Gold bullion has risen over 40%.

After Trump’s victory speech on 9 November saw equities jump but gold bullion start a 5-week fall, “We’d expect an appropriately presidential tone to be struck [today],” says Jonathan Butler at Japanese conglomerate Mitsubishi.

“The Dollar will gain and bullion will once again be under pressure, along with the rest of the precious metals complex…[unless] we get any of the campaign-trail divisive rhetoric.

“That’s probably going to sink the reflationary trade and boost gold as a safe haven.”

Looking futher ahead in 2017, “[We] stick with our Icarus Trade view,” says a note from Bank of America-Merrill Lynch, pointing to equities and other assets recently soaring in price, “[with] any Jan/Feb wobble followed by one last 10% melt-up in stocks & commodities.

“[But] investor ‘hubris’ [will then] signal the ‘Big Top’.”

Europe’s Brent crude oil price benchmark today rose near $55 per barrel, more than double the “twelve-year low of $27 hit a year ago today,” notes the commodities team at German financial services group Commerzbank.

“One key role in this has been played by the production cuts” from oil cartel Opec, “yet it is too early to judge if [they] and a number of non-Opec countries [will now] reduce their output as agreed.”

Copper slipped Friday however, dropping over 3% from last week’s return to December’s 18-month highs but still one-third above January 2016’s seven-year low.

Gold meantime ended the week dead-flat in Shanghai versus the Yuan, fixing at ¥292 per gram but cutting the premium for bullion landed in the world’s No.1 consumer market to just $10 per ounce over London quotes.

That was well below last month’s 3-year peak of $40 – some 16 times the typical Shanghai gold bullion premium – when stockpiling ahead of the coming Lunar New Year’s retail demand met tighter import licensing by Beijing.

Now the No.2 consumer nation, India this week saw premiums recover to $2 per ounce according to dealers, inclusive of the country’s 10% import duty, amid the current wedding season on Hindu calendars.

“Buyers are anticipating a cut in import duty in the [February 1st] budget,” Reuters quotes Chennai wholesaler MNC Bullion’s Daman Prakash.

“That is prompting them to delay purchases.”

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply