Could the current Artificial Intelligence (AI) revolution boost gold demand? According to a report by the World Gold Council, the answer is yes.

Bullion.Directory precious metals analysis 21 November, 2024

Bullion.Directory precious metals analysis 21 November, 2024

By Mike Maharrey

Journalist, analyst and author at Money Metals Exchange

Gold’s excellent conductivity and its malleability make it an important component in the manufacture of electronic devices. Gold can be formed into extremely thin wires, making the metal ideal for use in small computer chips.

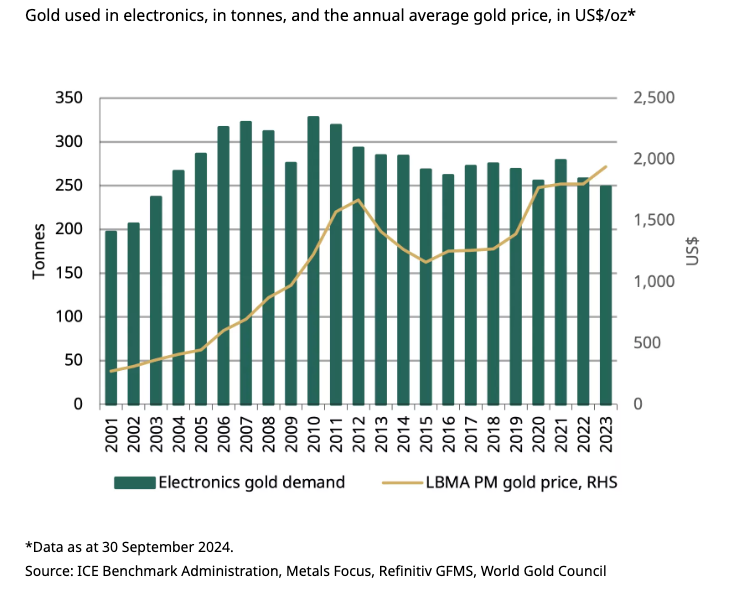

Demand for gold in the electronics sector peaked in 2010 at 328 tons. But as the cost of gold skyrocketed (rising from $250 to $1,800 an ounce between 2001 and 2011), manufacturers scrambled to reduce their gold usage. In 2023, the electronics sector used 249 tons of gold. Through the first three quarters of this year, demand for gold in electronics stood at 245 tons.

Electronics manufacturers decreased their use of gold by using alternatives such as silver and copper, along with thrifting.

The World Gold Council notes that retooling and process development don’t happen overnight. It is a multi-year process.

“This shift coincided with consumer demand for ever more powerful, functional, and reliable devices powered by advanced electronics and increasingly complex chips – think the proliferation of now-ubiquitous smartphones and the vast growth in laptops, smart TVs,and electric vehicles. … Manufacturers had to balance cost reduction with gold’s indispensable role as they addressed the growing need for high-end, durable components during this unprecedented period of ‘electrification.'”

According to the WGC analysts, gold’s superior performance limits the extent of substitution, and the advent of AI may begin driving demand higher.

AI requires a significant electronics infrastructure, and gold is an essential component in the manufacturing of AI-enabled devices. Gold’s conductivity makes it ideal for transmitting data at extremely high speeds with minimal energy loss, a crucial requirement for AI systems. Gold’s resistance to corrosion also extends the life of electronic components. This is critical for continuous and intensive AI operations.

The World Gold Council projects that the demand for more sophisticated hardware will rapidly increase with the advancement of AI.

“This, in turn, is likely to drive demand for gold, as manufacturers seek to enhance the performance and reliability of their AI-enabled devices. Meanwhile, sectors such as healthcare and finance are looking to AI in order to improve efficiency and innovation, and this can only further amplify demand.”

Manufacturers of AI hardware will continue to face price pressures as gold scales record levels. However, the WGC believes the environment is different than it was a decade ago.

“Most of the ‘easy’ thrifting and substitution has already been implemented; there is a limit to how thin wires and coatings can be and it is highly likely that they are already close to – if not at – that point.”

The World Gold Council noted several other areas in the tech sector that could boost demand for gold, including its use in medical devices, aerospace applications, and “clean” technologies.

The WGC concluded that “gold will continue to be a critical component in the electronics industry, with AI applications bolstering its demand in the near term.” However, it cautions that in this cost-driven sector, manufacturers will continue to innovate.

“This will inevitably impact how gold is used in certain applications. Beyond electronics, gold’s unique properties make it a valuable resource across multiple areas, ensuring its continued relevance in the ever-evolving technology landscape.”

Industrial and tech demand for gold is a very small percentage of overall demand. However, it underscores an important point – gold is a valuable metal with a multitude of applications, undercutting the notion that is “a useless metal” you’ll sometimes hear bandied about by commentators on mainstream financial networks.

This is absurd. From jewelry to tech, gold is in high demand.

And fundamentally, gold is money. Everybody wants to have money – especially real money.

Mike Maharrey

Mike Maharrey is a well-known author, journalist, financial analyst and writer at Money Metals Exchange, one of our top-rated US dealers and two-times winner of Bullion Dealer of the Year

He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida. Mike also serves as the national communications director for the Tenth Amendment Center and the managing editor of the SchiffGold website.

This article was originally published here

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply