Coronavirus Just Inflicted This Devastating Blow on Social Security

Bullion.Directory precious metals analysis 24 June, 2020

Bullion.Directory precious metals analysis 24 June, 2020

By Peter Reagan

Financial Market Strategist at Birch Gold Group

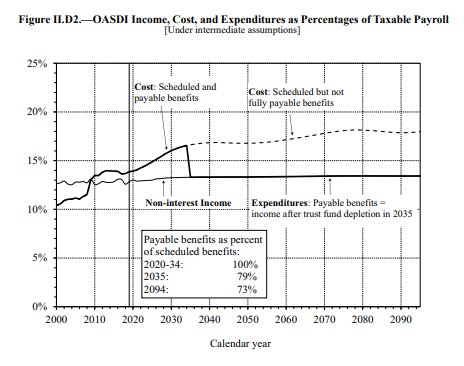

Before coronavirus hit the scene, most experts agreed that if nothing was done, Social Security would be facing a 21% cut by 2035.

A chart from page 13 of the latest Trustees Report illustrates this prediction:

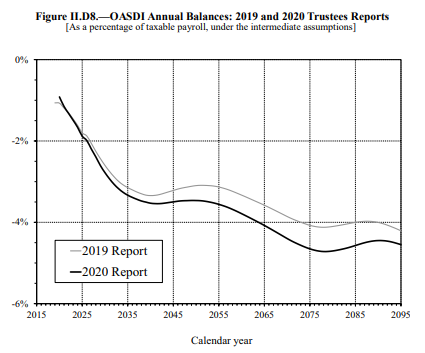

As bad as this outlook is, it’s been getting worse and worse over the years. You can see a marked decline in just the past year – from 2019 to 2020 – in the following chart:

And now that the virus is hitting the economy with full force, any of those forecasts could be generous at best. Here’s why…

Thanks to lockdown restrictions implemented across the country, official U.S. unemployment still sits at 13.3% (one of the highest since 1939). Some unemployment estimates are even higher.

Whatever statistic you choose to believe, there’s no arguing that the main revenue source for Social Security has been significantly reduced.

The newest Trustees Report did not factor in these impacts, either:

The projections and analysis in these reports do not reflect the potential effects of the COVID-19 pandemic on the Social Security and Medicare programs. Given the uncertainty associated with these impacts, the Trustees believe that it is not possible to adjust their estimates accurately at this time.

This could mean Social Security will face drastic cuts before 2034 if the trust fund follows the “worst case scenario”. According to the Independent Institute:

With U.S. unemployment now estimated to be “north of 20 percent,” Social Security is experiencing something much closer to its worst-case scenario, where its trust fund that provides money to boost the retirement income of millions of Americans will run out of money years sooner.

In fact, according to Bipartisan Policy, the trust fund that pays retirement benefits may experience drastic depletion eight years from now:

Our preliminary analysis finds that the Disability Insurance (DI) trust fund’s reserves may be depleted during the next presidential term, and the Old-Age and Survivors Insurance (OASI) trust fund’s reserves may be depleted right around the time of the 2028 presidential election.

The main reasons for this rapid depletion of Social Security funds can be linked to (1) less workers paying into the fund and (2) older workers tapping funds earlier.

“The coronavirus pandemic has moved up Social Security’s day of reckoning,” according to the Independent Institute.

To put it succinctly, this is NOT good.

Tired Solutions to an Increasing Social Security Problem

To solve the Social Security conundrum, lawmakers present the same old solutions over and over again, each time hoping for a different result.

These tired solutions include:

- Raising the payroll tax rate

- Increasing the wages subject to Social Security taxes

- Raising the full retirement age

- Reducing the annual cost-of-living adjustments

- Cutting benefits

Any of these solutions could work, at least temporarily. But do you want to bet your retirement on theoretical solutions that could work?

Don’t Let Their Debt “Games” Weigh Down Your Retirement

Whether Social Security runs out of money in 2028, 2034, or later, one thing is certain: the future is far from certain. Each expert has their own idea of what may happen, but who knows if and when any of it will come to pass?

What you can do right now is consider adding protection from instability to your retirement savings through diversification.

Whatever you decide to do, don’t wait for the lawmakers to outline your future. Take control for yourself, and prepare your savings for anything that may come.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply