China’s Demand to Buy Gold ‘Gets Voice’ as Shanghai Fix Starts, Silver Jumps 5%

Bullion.Directory precious metals analysis 19 April, 2016

Bullion.Directory precious metals analysis 19 April, 2016

By Adrian Ash

Head of Research at Bullion Vault

The price of silver meantime leapt almost 5%, hitting its highest Dollar level since May 2015 above $17 per ounce, as commodities bounced hard and Western stock markets rose once more.

“Chinese demand to buy gold struggles to move the international price,” said state newspaper The China Daily, leaving “domestic investors, consumers and miners, retailers to follow the European market” rather than help set prices.

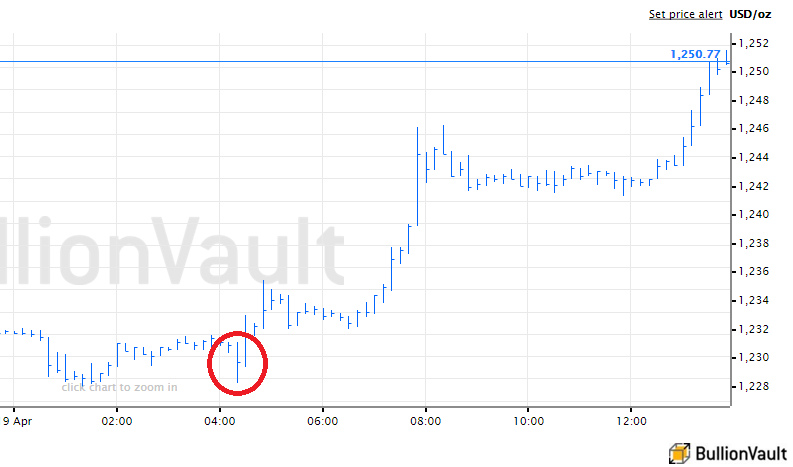

Built from demand and supply to buy gold gathered together by 12 banks and 5 other players, the SGE’s first afternoon benchmark in Yuan fixed Tuesday at CNY257.29 per gram at 2.15pm in Shanghai.

Equivalent to more than $1236 per ounce, that showed a premium to international spot-market mid-prices of $5.80 per ounce.

The auction coincided with a small blip in global prices, marking the start of Tuesday’s sharp 1.7% rise in Dollar terms.

Trading volume in Shanghai’s main spot contract meantime fell to an 8-session low, down by almost one-third from Monday’s total.

Despite rising in Yuan terms, the price of that Au(T+D) contract then ended Tuesday trade at a $5 discount to global quotes, as the Chinese price lagged the jump in Dollar prices to buy gold.

“The price is in accordance with China’s standard .9999 fine kilobars,” explains Jiang Shu, chief analyst for Shandong Gold Financial Holding Co., a subsidiary of the giant state-owned Shandong mining and processing group, “to better reflect market supply and demand in China, rather than the international movement.

“The new benchmark isn’t intended to follow price fluctuations in London or New York. The more important issue is China’s voice in gold pricing.”

“As long as it exists inside a closed monetary system,” agrees French investment bank and bullion market maker Societe Generale’s analyst Robin Bhar to Bloomberg, the new China Gold Fix “will have limited global repercussions.”

China is the world’s heaviest importer of gold, but exports of bullion – back onto tradable markets elsewhere – are banned.

“For a truly efficient benchmark,” says Bhar, “the market has to be as unimpeded and unfettered as possible.”

The surge in silver prices meantime pushed the Gold/Silver Ratio of relative prices down to its lowest level since November at 73.7 and sharply below February’s near-decade highs above 80 ounces of silver per 1 ounce of gold.

“Silver looks poised to grind higher towards 18.50,” reckons a new chart note from Bhar’s technical analysis colleagues at SocGen, pointing to several factors “but not least the projected target” from the inverted Head and Shoulder pattern which the metal “confirmed [by] breaking $16.15 levels.”

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply