Now that Biden knows he’s going out, he’s determined to go out spending. So just how bad could the fiscal insanity get – and what will it cost us?

Bullion.Directory precious metals analysis 29 July, 2024

Bullion.Directory precious metals analysis 29 July, 2024

By Peter Reagan

Financial Market Strategist at Birch Gold Group

Now we might be able to see some light at the end of the tunnel. Unfortunately, now that Biden knows he won’t be the next president, the gloves are off. He can do whatever he wants until he’s out of office, without much political pressure.

An article on the PBS website summarized a part of how this Administration wants to leave its legacy:

Biden hopes to keep the spigot flowing with hundreds of billions of dollars in federal funding from a series of major legislative wins early in his term — signature policy victories that could be undone should Republican Donald Trump return to the White House.

White House chief of staff Jeff Zients on Monday urged aides to keep their heads down and remain focused on the work that remains. He listed lowering housing and health care costs, implementing the administration’s key legislative achievements, and safeguarding democracy as among Biden’s top priorities for the final months of the administration.

William Howell, a political scientist at the University of Chicago was quoted in the last line of the piece: “His most important job over the next few months is setting the conditions to make Kamala Harris successful.”

With the above in mind, let’s focus on what could be part of the potential economic fallout of Biden’s last few months in office. We can start doing that by briefly examining the bolded parts of the quote above in the next section.

Biden’s last few months of fiscal insanity

Insanity can be defined as doing the same thing over and over again, while expecting a different result each time (as the saying goes).

So you might think that more spending would be the last thing Biden would want to do as he leaves office, if he wanted to potentially help the inflation rate ease further.

Unfortunately, that doesn’t seem to be the case. The first bolded part of the PBS quote above refers to the trillions of dollars in spending that Biden secured early on. As you’ll soon read, he still hopes to spend the rest.

According to a recent MIT study, federal spending was the main cause of the historic inflation that defined Biden’s first term in office:

“Our research shows mathematically that the overwhelming driver of that burst of inflation in 2022 was federal spending, not the supply chain,” said Mark Kritzman, a senior lecturer at MIT Sloan.

They found that federal spending was two to three times more important than any other factor causing inflation during 2022.

So if Biden does succeed in actually spending some (or all) of the $1.2 trillion left over from those early policy “victories,” you can bet on seeing potentially higher rates of inflation in the months after he leaves office in January 2025.

According to a Politico analysis from back in April, President Biden had only spent about 20% of the total amount, which were slated for clean energy, climate, and semiconductor projects.

Some highlights from that analysis included:

- Less than 17% of the green energy funding has been spent after two years.

- The government has awarded less than 2% of CHIPS and Science Act funding included in the spending packages.

- Under 25% was spent from the infrastructure law and the “Inflation Reduction Act” that (perhaps) slowed rather than reduced inflation.

Senior Clean Energy Advisor John Podesta made it clear that this Administration doesn’t plan on letting the funds just “sit there”:

“Well, there’s a lot left to do,” Podesta answered amid a ripple of polite laughter. “First of all, that money needs to be deployed.”

The same Politico piece also revealed that even if Trump wins in November, he won’t be able to do much to stop Biden-era spending projects that are in motion:

Trump’s ability to frustrate the aims of the Biden-era laws would be limited because congressionally created grant programs would be legally obligated to go forward, argued Douglas Holtz-Eakin, who heads the conservative American Action Forum and led the Congressional Budget Office during the George W. Bush administration.

“They can negotiate contracts slowly and obligate the money less rapidly, but they can’t simply not do it,” he said.

Biden’s got about six months to get another trillion-plus dollars in deficit spending out the door.

With about six months to go in Biden’s only term, the amount of spending he can actually “deploy” remains to be seen. The rate of inflation that spending could fuel is unknown at this point.

But if, as the PBS piece stated, President Biden actually wanted to “lower housing and healthcare costs,” then accelerating to a higher rate of inflation wouldn’t be the best way to accomplish that (if that happens).

Which leaves the most important question…

What does this mean for our financial futures?

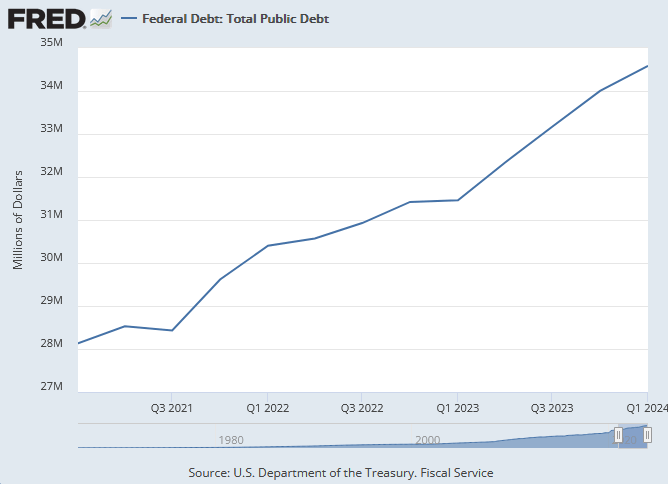

The federal debt is about to increase even further as Biden leaves office. That spending spree further threatens the security of our nation.

Increasing the debt could also mean that you would eventually end up footing the bill in the form of higher taxes.

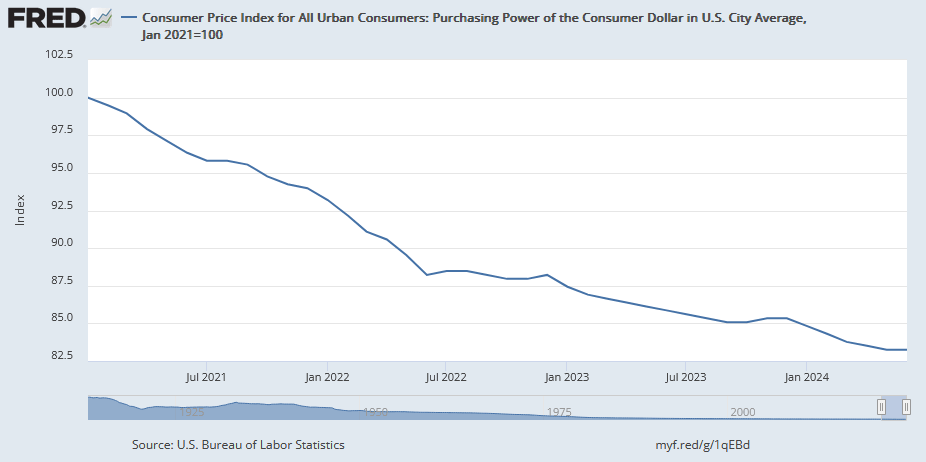

Not only that, but dollar debasement would continue. Put simply, your dollars would continue to buy less and less.

So far, under the Biden administration, our nation has racked up $6.4 trillion in debt:

And the dollar has lost 16.8% of its purchasing power:

Now that we learn there’s some $1 trillion not yet spent, that means we still haven’t seen the end of the inflationary spike – not to mention the additional $2 trillion in deficit spending Biden has slated for 2024.

Never forget this: Deficit spending devalues our dollars.

That’s how politicians pay for their pork-barrel programs without raising taxes. Instead, they let inflation pick our pockets (without even touching our wallets).

Maybe you remember what Ronald Reagan said on this subject:

“Inflation is as violent as a mugger, as frightening as an armed robber and as deadly as a hit man.”

I do NOT think President Reagan was overstating the case!

That means right now is a great time to consider diversifying your hard-earned dollars with inflation-resistant investments.

One of the most effective hedges against inflation is physical precious metals, especially gold but also silver.

That’s because physical gold and silver been a stable store of wealth for thousands of years. In times of economic uncertainty and geopolitical crisis alike, humankind has always relied on gold as a safe haven for preserving wealth.

If you’re planning to diversify your savings to protect against the next wave of inflation, it’s important to get started sooner rather than later.

Every day that passes robs your dollars of purchasing power – so the longer you wait, the more dollars you’re likely to need to buy the same amount of gold or silver.

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply