In a rare moment of honesty, Federal Reserve Chairman Jerome Powell admitted he and his fellow central bankers don’t know what they’re doing as they wrapped up the May Federal Open Market Committee (FOMC) meeting. As was expected, the Fed held interest rates steady at the meeting, taking a “wait and see” attitude.

Full Article →Mike Maharrey

Mike Maharrey is a well-known author, journalist, financial analyst and writer at Money Metals Exchange, one of our top-rated US dealers and two-times winner of Bullion Dealer of the Year

He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida. Mike also serves as the national communications director for the Tenth Amendment Center and the managing editor of the SchiffGold website.

Demand for physical gold surged in the first quarter. But not in the United States. Asian investors primarily drove demand for gold bars and coins as American investors continued to sit on the sidelines. Chinese investors gobbled up 126.7 tonnes of gold bars and coins. That was a 47 percent increase from Q4 ’24 and a 12 percent rise year-on-year.

Full Article →The LBMA gold price hit multiple record highs in Q1, with the average price coming in at $2,860 an ounce. That was a 38 percent year-on-year increase. The gold price was driven by multiple factors, including the specter of a trade war, geopolitical turmoil in the Middle East and Ukraine, stock market volatility, and dollar weakness.

Full Article →China ranks as the world’s largest gold market. The price of gold climbed 8.4 percent in yuan terms in March. It was the strongest month for the yellow metal since March 2024. The RMB gold price recorded its strongest Q1 since 2002 when the Shanghai Gold Exchange (SGE) was established.

Full Article →As gold marches ever higher, silver continues to lag. Don’t get me wrong. Silver hasn’t done horribly so far this year. It is up a little over 12 percent. However, it has failed to close the gap with gold, and that has many investors questioning what’s going on with the white metal.

Full Article →The American economy is a bubble. The thing about bubbles is that they eventually pop. All they need is a pin. Tariff policy might be the pin that pops this bubble, but even if it isn’t, there is a pin out there with this bubble’s name on it. I’ve been calling this a “debt-riddled, bubble economy” for months (years, really), but…

Full Article →After plunging for several days, stocks soared Wednesday afternoon after President Trump announced a tariff pause. The S&P 500 rocketed 9 percent, charting its third-largest single-day gain since World War II. Gold also whipsawed, having dipped below $3,000 an ounce, the yellow metal regained much of its loss and closed over $3,100.

Full Article →If you wonder why so many central banks continue to load up on gold, Russia’s experience with the yellow metal provides the answer. Russia launched a gold buying spree beginning in 2014. Over the next six years, the Bank of Russia increased its reserves by around 40 million ounces (1,244 tonnes).

Full Article →Indian investors are turning to gold as the domestic stock market tanks. This isn’t a surprise, but there is a twist. Indians are increasingly turning to ETFs to gain exposure to the yellow metal. Indians have a long love affair with gold. The yellow metal is highly valued as a store of wealth, especially in poorer rural regions.

Full Article →Gold has broken above $3,000 and appears poised to push even higher. So far, platinum has not followed gold’s lead but seems to be watching from the sidelines. What is causing this divergence? To put the platinum price into perspective, the metal hit an all-time high of $2,213 an ounce in March 2008.

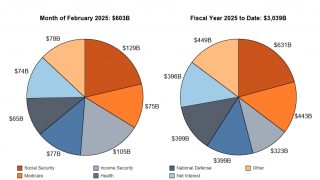

Full Article →The Federal Reserve lost $77.6 billion in 2024. And by the way, a Fed loss is ultimately your loss. The central bank began bleeding red in late 2022. In 2023, it reported an operating loss of $114 billion. On top of its operating loss, the Federal Reserve reported unrealized losses totaling $1.06 trillion.

Full Article →The Federal Reserve loosened monetary policy significantly during the March FOMC meeting that wrapped up Wednesday. “But wait,” you say. “The Fed held interest rates steady, right?” Yes. Yes, they did. The Federal Reserve ALSO make a BIG move during the March meeting… but it largely flew under the radar.

Full Article →Gold topped $3,000 an ounce Friday and continued to drive higher. A lot of mainstream analysts forecast $3,000 gold for this year, but the pace of gold’s climb has been faster than most expected. The price of gold hit new highs 40 times in 2024. This year, the yellow metal has already broken 14 records.

Full Article →The federal government spent $307.01 billion more than it took in last month. That drove the cumulative deficit for fiscal 2025 to $1.15 trillion with seven months left. It is the biggest deficit ever through five months. Meanwhile The Treasury collected ‘only’ $296.42 billion in February.

Full Article →The National Bank of Kazakhstan (NBK) announced plans to sell dollars to ease inflationary pressure caused by its gold purchases. Kazakhstan ranked sixth in the world in gold production in 2023. According to the Astana Times, the domestic gold purchases are set up “to boost international reserves and protect the economy from external shocks.”

Full Article →Led by North American funds, ETF gold holdings grew globally for the third straight month. ETFs in every region reported inflows of gold totaling 108.3 tonnes. That drove total ETF gold holdings to 3,353 tons, the highest month-end level since July 2023.

Full Article →How Much Gold Is Moving From London to New York?

A lot of gold has moved from London to New York in recent weeks. Mainstream analysts blame the dynamic on the threat of tariffs pushing the futures price of gold (and silver) higher in New York. There could also be a more fundamental issue at play: the fact that there is a lot more paper gold than physical metal.

Full Article →Fifth Straight Significant Silver Supply Deficit for 2025

The silver market is forecast to record a fifth straight market deficit in 2025, with demand once again outstripping supply. Analysts at the Silver Institute call the projected market deficit “sizeable.” The Silver Institute projects record silver offtake this year, with overall demand coming in at around 1.20 billion ounces.

Full Article →Is Arizona Getting Gold & Silver-Backed Transactional Currency?

A well-meaning bill filed in the Arizona Senate seeks to establish a state-sanctioned transactional currency backed 100 percent by gold and silver, along with a state-operated bullion depository. Interestingly, the state would also issue physical gold and silver coins, even as such actions by a state are explicitly barred by the U.S. Constitution.

Full Article →Silver Historically Underpriced: Gold-Silver Ratio Over 90-1

The gold-silver ratio has surged to over 90-1. This indicates that silver is extremely underpriced from a historical perspective. In other words, silver is on sale. The last time we saw a gold-silver ratio over 90-1 was in the early days of the pandemic lockdowns. In the modern era, the ratio has averaged between 40-1 and 60-1.

Full Article →Are Tariff Worries Setting Up a Gold Squeeze?

We could be setting up for a significant squeeze in the gold and silver markets. We’re seeing signs that tariff concerns are growing, creating an interesting dynamic in the London precious metals market. Owners of gold in London vaults can loan their metal on a short-term basis and last week, lease rates suddenly surged to over 3.5 percent.

Full Article →Debt, Bonds and Gold: Has the Federal Reserve Overdone It?

Over the last four months, the Federal Reserve has cut interest rates by a full percentage point. It started with a supersize 50 basis point cut in September, followed by quarter-point cuts in November and December. But despite slashing rates, Treasury bond yields have risen sharply. What’s going on in the bond market?

Full Article →China Reports More Gold Buying, but…

China announced an increase in its official gold reserves in November. It was the first reported increase after a 6-month pause, and it appears it wasn’t a one-off event.

And by the way, the Chinese have a lot more gold than they admit.

ETF Gold Holdings Increase in December – First Time Since 2019

For the first December since 2019, gold-backed ETFs globally reported net inflows of gold. Asian funds drove the global increase in ETF gold holdings to close out 2024. On the year, ETF gold holdings dropped modestly by 6.8 tons, but assets under management rose 26 percent to a record high of $271 billion thanks to skyrocketing gold.

Full Article →Just How Good Was Gold in 2024?

Gold was one of the best-performing asset classes in 2024, outgaining the red-hot U.S. stock market. People who follow financial news know that gold had a great year. Despite its typical apathy toward gold, even the mainstream was forced to sit up and take notice. But you may not realize just how well gold did.

Full Article →British Royal Mint Using Electronic Waste to Produce Jewelry

How awesome would it be to dig around in your garbage can and find gold? Well, that’s pretty much what the British Royal Mint is doing. No, you won’t find mint employees dumpster diving, but they have developed a process to turn electronic waste into gold and silver jewelry.

Full Article →Wall Street Banks: Expect the Gold Rally to Continue

Analysts at major Wall Street banks expect the gold bull rally to continue into 2025. And mainstream analysts tend to think the year will remain free from any kind of significant economic chaos or crisis. Gold had a tremendous 2024, setting multiple records and closing the year with a 26.5 percent gain – one of the best-performing assets last year.

Full Article →Is Selling Gold Right Now a Mistake?

Producer prices came in hotter than expected in November. This came on the heels of a CPI report showing price inflation is sticky. With inflation worries mounting, investors sold gold. Wait. People sold an inflation hedge with increasing signs of inflation? Yes. You read that correctly.

Full Article →Mike Maharrey

Mike Maharrey is a well-known author, journalist, financial analyst and writer at Money Metals Exchange, one of our top-rated US dealers and two-times winner of Bullion Dealer of the Year

He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida. Mike also serves as the national communications director for the Tenth Amendment Center and the managing editor of the SchiffGold website.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.