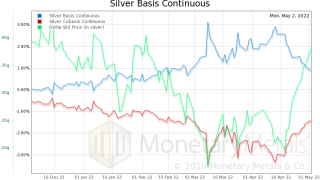

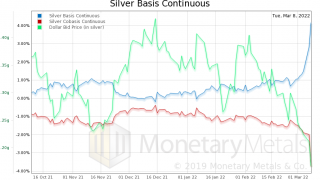

The price of silver has been going down, and then down some more. From over $28 a year ago, and over $26.50 a month ago, it’s now at a new low under $22.50. Four bucks down in a month. However, it’s been behaving differently than gold behind the scenes…

Full Article →Keith Weiner

Keith Weiner is founder and CEO of Monetary Metals, the groundbreaking investment company monetizing physical gold into an interest-bearing asset, paying yields in gold, not paper currency.

Keith writes and speaks extensively, based on his unique views of gold, the dollar, credit, the bond market, and interest rates. He’s also the founder and President of the Gold Standard Institute USA. His work was instrumental in the passing of gold legal tender laws in the state of Arizona in 2017, and he regularly meets with central bankers, legislators, and government officials around the world.

Can we all recognize the simple fact that every government price-fixing scheme, ever, has failed? For example, banana republics have declared their pesos to be worth $1. But when the market decides to redeem pesos for dollars 1-to-1, the central bank abandons the peg.

Full Article →Often, Narratives pile up lots of baggage. To effectively deal with it, one must unpack it. One bit of luggage sticking up from the heap is the assertion that now the ruble has a link to oil…

Full Article →There is a Narrative about Russia and how it will change the monetary system. Many analysts in the gold community are promoting this story. There’s just one problem. It is like how Michael Crichton described the Gell-Mann Amnesia Effect: the newspaper is full of stories explaining how “wet streets cause rain.”

Full Article →It’s not fair. It seems these days everything claims to be *something something* gold. Oil is black gold. Melted cheese is liquid gold. There’s even red gold, a tomato company. It’s just not fair! It’s time to turn the tables, and the tide. To flip this thing on its head.

Full Article →We have recently seen an increase in social media posts about the big increase in short positions by the bullion banks. What would motivate them to short a commodity during this period of inflation, much less a monetary metal when central banks are printing money with reckless abandon?

Full Article →Can they do it? How would the world react? The Russian central bank reportedly has over 2,000 tonnes of gold. We have seen three arguments repeated many times, both in finance/economics articles and on social media.

Full Article →The term inflation is used by many people to mean rising consumer prices, regardless of the cause. Though most are aware of non-monetary causes, there is a tendency to scrutinize the quantity of dollars whenever prices are rising.

Full Article →Every once in a while, one regrets not acting sooner, or not acting soon enough. In our case, we did not publish this Tuesday evening. We should have. Today the price is down, and others may also call for lower silver prices.

Full Article →The Zugzwang Position

It’s a funny bull market, this gold thing. Unloved by the mainstream commentariat, who desperately cry “barbarous relic”, and by the bitcoin bettors, who call it an “ugly yellow rock”, its price is now with a hair’s width of the all-time high. $1,905, as this Report is being written…

Full Article →2022 Gold Outlook

In the full Outlook Report, we take an in-depth look at the market players, dynamics, fallacies, drivers, and finally give our predictions for gold and silver over the coming year. Our unique analysis of precious metals, encapsulated in our Supply and Demand model, is a true signal in an otherwise very noisy market.

Full Article →Fed Digital Currency Paper: A Response

The Federal Reserve published Money and Payments: The U.S. Dollar in the Age of Digital Transformation, and solicits comments about its ideas for a central bank digital currency (CBDC). This is our extended commentary offered in response…

Full Article →The Ship of Theseus is an old philosophical thought experiment and asks a question about identity. Suppose you replace all of the boards of a ship with new ones—is it still the same ship? We are not going to try to resolve this millennia-old paradox. Instead, we are going to add one more element, and then tie it to the monetary system.

Full Article →Inflation and Gold: What Gives?

The Different Theories on What Moves Gold and Silver Prices: In the last Supply and Demand update, we discussed some different theories which attempt to explain what causes the gold and silver prices to move. We mentioned the:

Full Article →What’s In Your Loan?

El Salvador has a scheme to borrow dollars to use bitcoin as a means to make more dollars. Those dollars will (they hope) be forked over by savers who will buy from them at a million bucks. Presumably, these new speculators will buy at a million bucks because they hope to sell at two million.

Full Article →Breaking Down the Dollar Monetary System

If you ask most people, “what is money?” they will answer that money is the generally accepted medium of exchange. If you ask Google Images, it will show you many pictures of green pieces of paper. Virtually everyone agrees that money means the dollar. What does it mean to have a dollar?

Full Article →The Rising Fundamentals of Gold and Silver

Prices move up and down, in the restless churn of our irredeemable monetary system. There are several schools of thought whose theories attempt to describe, if not predict, the next price move…

Full Article →Why a Yield on Gold Matters

Picture, if you can, a world in which gold circulates as the medium of exchange. People pay for everything, from groceries to rent, in gold. Employers pay wages in gold. Productive enterprises borrow gold to finance everything from food production to constructing apartment buildings.

Full Article →Why Isn’t Gold Going Up With Inflation?

Many voices in the gold community are making a simple point. Look at the prices of oil, copper, and other commodities. They are skyrocketing. The mainstream explanation is that the cause of this skyrocketing is the increase in the quantity of what is called “money”.

Full Article →Gold 1 – Bitcoin 0

A leader of the crypto revolution is borrowing dollars. Without any awareness of the irony, crypto promoters say that this validates crypto. That a crypto company borrowed dollars supposedly validates crypto. Think about it, take as long as you need.

Full Article →Gold and Silver Price Fundamentals Update

There is a pattern we see often in both metals. Price weakness tends to be driven by futures speculators liquidating positions. This means that the metal becomes scarcer. It stops going into the warehouse. Instead, it can begin coming out if it gets scarce enough.

Full Article →A few recent articles bring to the public’s awareness that wealthy investors are preferring not to sell their assets, and thereby pay capital gains taxes. Instead, they borrow against them, on margin…

Full Article →One way to look at the price of gold, is that it dropped from its high around $1,900 in early June… Another way is to zoom out, and look at the big picture…

Full Article →Sometimes, bad luck can strike. But other times, a catastrophe comes from a series of bad decisions, each the reaction to the consequences of the previous one. On August 15, 1971, President Nixon decreed that the US dollar would no longer be redeemable for the gold owed, even to foreign governments

Full Article →Most gyms have a punching bag in the corner. When someone feels frustrated or wants to show off, he can hit it. The gold standard is the punching bag in the economists’ gym. In an InsideSources op-ed, David Beckworth and Patrick Horan argue, “A new gold standard would do much more harm than good.”

Full Article →This is significant, as it’s what one expects to see if the post-Covid bull market in silver is still intact. Leveraged speculators are just trying to front-run whatever move they expect next. They do not move and hold the price durably.

Full Article →The government’s liabilities are the assets of everyone else: individuals, pension and insurance funds, commercial banks, and the Federal reserve. All of these parties lend to the government, though often without knowing.

Full Article →We’re seeing the argument, again, that silver stocks are being consumed in solar panels, medical applications, and of course, electronics. This argument has a certain temptation. After all, the standard assumption is that value is inversely proportional to quantity…

Full Article →Keith Weiner

Keith Weiner is founder and CEO of Monetary Metals, the groundbreaking investment company monetizing physical gold into an interest-bearing asset, paying yields in gold, not paper currency.

Keith writes and speaks extensively, based on his unique views of gold, the dollar, credit, the bond market, and interest rates. He’s also the founder and President of the Gold Standard Institute USA. His work was instrumental in the passing of gold legal tender laws in the state of Arizona in 2017, and he regularly meets with central bankers, legislators, and government officials around the world.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.