If there ever was an “uh-oh” moment for the U.S. economy, it’s coming very soon.

Bullion.Directory precious metals analysis 25 August, 2023

Bullion.Directory precious metals analysis 25 August, 2023

By Peter Reagan

Financial Market Strategist at Birch Gold Group

Ever since, thanks to a combination of high inflation and “revenge spending,” consumer spending exploded to what Wolf Richter calls “drunken sailors partying hard” levels.

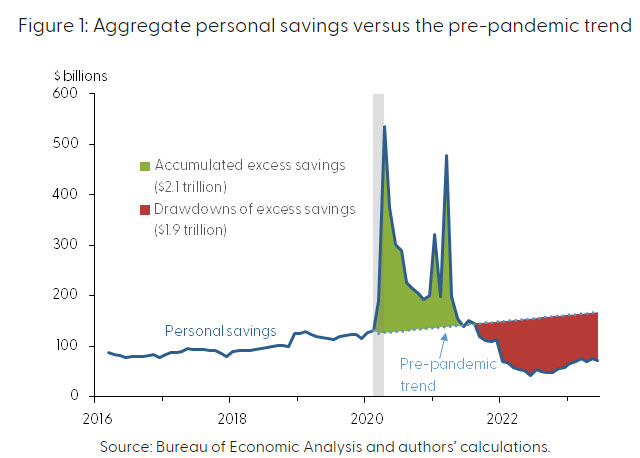

Today, we’re seeing the consumer savings stockpiled during the pandemic are exhausted, according to the Federal Reserve Bank of San Francisco:

Americans currently have less than $190 billion left from the $2.1 trillion windfall they had accumulated during the pandemic—and even that stash is likely to be gone by next month. Our updated estimates suggest that households held less than $190 billion of aggregate excess savings by June…

There is considerable uncertainty in the outlook, but we estimate that these excess savings are likely to be depleted during the third quarter of 2023. [emphasis added]

This chart clarifies the point:

Now, spending excess savings alone isn’t really a problem. (That’s what savings are for, right?)

As you can see from the chart, though, the pendulum has swung in the opposite direction. We aren’t only spending excess savings, we’re actually saving significantly less than we were before.

That’s an unhealthy long-term trend. It means households will have fewer resources to fall back on in the event of an emergency down the road.

Spending money you don’t have is a bigger problem…

But unfortunately, as you’ll soon read, depleted savings only represent a small part of a much bigger problem for the United States economy (which relies on spending).

No money? No problem!

During economic booms, the availability of credit drives economic activity – from mortgages to credit cards, companies line up to offer the most competitive terms. Zero down and 0% financing offers clutter your mailbox. Dozens a week.

Credit isn’t evil. Debt isn’t necessarily bad (Phillip Patrick wrote a great explanation of the difference between good and bad debt.)

However, credit only has one purpose. It allows you to spend future earnings today. Economists call it “advancing demand.” I call it “borrowing from future you.”

Whatever you call it, future earnings spent today can’t be spent in the future.

The problem with “advancing demand” is that it inevitably lowers future spending.

And when the vast majority of the economy is powered by consumer spending (a near-record high 68.2% of U.S. GDP at present), any spending slowdown can have catastrophic effects on the entire economy.

Since the end of the pandemic, we’ve seen consumer debt reach historic levels.

After all, even smart shoppers still needed to pay for food, electricity, gas and mortgage or rent despite the historic inflation trend. And their pandemic savings are gone.

What do they do?

Whip out the credit cards…

So it may not surprise you to learn that, earlier this month, credit card debt breached a shocking $1 trillion nationwide.

Wolf Richter calculated the approximate amount of the total credit card debt that isn’t paid off monthly as 28% – or some $280 billion. That’s a lot, made even worse by “usurious interest rates.” Credit card APRs are at 38-year highs today.

When both debt and interest rates are high, we look at debt delinquencies as a “canary in the coal mine.”

Credit card delinquencies usually creep up first. They’re mostly unsecured (there’s no collateral), so people forced to choose which bills to pay generally stiff their credit card companies first.

According to the Federal Reserve Bank of New York, credit card and auto loan delinquencies are reaching Great Financial Crisis levels for some demographics.

Macy’s is warning of a spike in customers who are failing to make credit card payments, adding to the evidence of mounting financial stress on consumers.

Over most of the last two decades, if you were in a tight financial spot, you could always cash out some of your home equity.

That’s not really an option anymore…

Higher interest rates limit home equity loans

Relying on their homes as ATMs gave many Americans much-needed cash over the last 20 years.

But the APR for home equity loans (HELOCs) has more than doubled in the last year! At 9.16%, it’s much lower than “usurious” credit card APRs. But any family with a 4% or lower mortgage rate would have to be truly desperate to tap their home for liquidity.

In other words, the ATM that supported consumer spending regularly for decades is no longer an option.

To summarize:

- Excess savings are gone

- Credit card debt is at a record high

- …and credit card delinquencies are suriging

- Home equity isn’t an option for most families

- And the return of student loan repayments in October will make financial matters even worse

Do you see why the spending spree might be ending?

Here’s why it matters…

When American households are broke, a recession is imminent

Consumer spending powers the majority of the U.S. economy. That means that reductions in consumer spending have a massive ripple effect across the entire financial system.

Unfortunately, there’s no way for you or I to delay or postpone the recession. All we can do is make sure our own houses are in order – and that our financial futures will be safe during both good economic times and bad.

Instead of worrying about the inevitable recession, take a moment to learn more about diversifying your savings with real assets like physical gold and silver.

Precious metals are inflation-resistant and can add some much-needed stability to your savings. Both gold and silver have historically proven to be a safe haven during recessions.

You can get all the information you need about both gold and silver for free to make an informed decision right here.

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply