After moderating credit card spending in January, American consumers pulled out the plastic yet again in February

Bullion.Directory precious metals analysis 10 April, 2024

Bullion.Directory precious metals analysis 10 April, 2024

By Mike Maharrey

Journalist, analyst and author at Money Metals Exchange

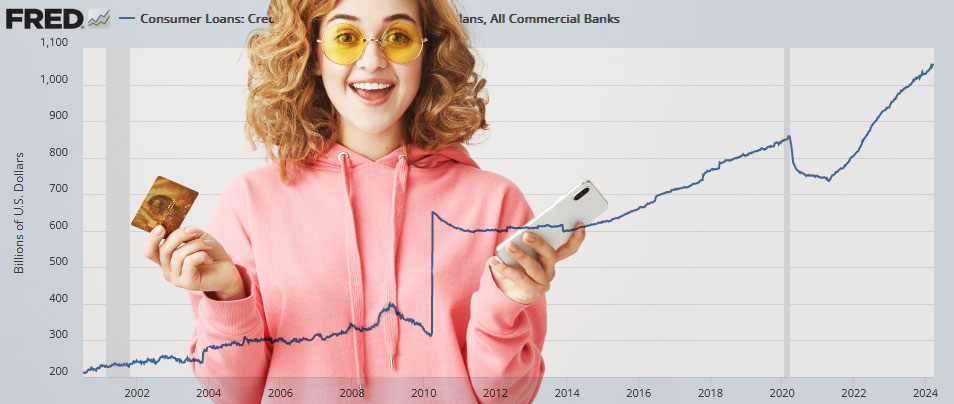

Credit card balances surged, driving overall consumer debt up by another $14.1 billion, a 3.4 percent annual increase. Americans now owe $5.05 trillion in consumer debt, according to the latest data from the Federal Reserve.

Meanwhile, borrowing for big-ticket items has collapsed, indicating that consumers are feeling the strain of their ever-increasing debt load.

The Federal Reserve consumer debt figures include credit card debt, student loans, and auto loans, but do not factor in mortgage debt. When you include mortgages, U.S. households are buried under a record level of debt. As of the end of 2023, total household debt stood at $17.5 trillion.

Pundits and politicians keep talking about the robust economy and the resilient American consumer, but this economic growth is courtesy of Visa and Mastercard. It’s not exactly a sustainable economic trajectory.

Revolving debt, primarily reflecting credit card balances, grew by 10.2 percent in January as Americans added another 11.3 billion to their credit card bills. American consumers are now buried under a record $1.34 trillion in revolving debt.

To put the percentage increase into perspective, the annual increase prior to the pandemic in 2019 was 3.6 percent.

The double whammy of rising debt and interest rates exacerbates the debt problem. Average credit card interest rates eclipsed the previous record high of 17.87 percent months ago.

The average annual percentage rate (APR) currently stands at 20.75 percent, with some companies charging rates as high as 28 percent.

That underscores the fundamental problem of running an economy on credit. It’s expensive and credit cards have an inconvenient thing called a limit.

This is one of the problems confronting the Federal Reserve. Even though inflation remains sticky, the central bank needs to ease interest rates before they bury debt-saddled American consumers.

Consumers are already laboring under the strain of rising debt. According to the New York Fed, delinquencies increased in every debt category during the fourth quarter of 2023, with about 8.5 percent of credit card balances in delinquency.

“Credit card and auto loan transitions into delinquency are still rising above pre-pandemic levels,” said Wilbert van der Klaauw, economic research advisor at the New York Fed. “This signals increased financial stress, especially among younger and lower-income households.”

Consumer debt is also putting strain on banks. The net charge-off rate on credit card loans came in at 4.15 percent as of the end of 2023. It was the highest rate for this portfolio reported by the banking industry since the first quarter of 2012.

Non-revolving debt reveals a completely different problem. Americans have run out of spending power and they are cutting back on big purchases. This is bad news for an economy that relies on consumer spending.

As prices skyrocketed in 2022, Americans blew through their savings to make ends meet. Aggregate savings peaked at $2.1 trillion in August 2021. By the summer of 2023, the San Francisco Fed estimated that aggregate savings had dropped to $190 billion.

In other words, Americans ate away $1.9 trillion in savings in just two years.

Then they turned to credit cards.

Now it appears that Americans may be maxing out their credit.

Non-revolving debt, primarily made up of auto loans, student loans, and loans for other durable goods, tanked in February, increasing by just $2.9 percent, a 0.9 percent annual increase.

This continues a trend we’ve seen in recent months. Before the pandemic, revolving credit growth averaged 5 percent.

Joe Biden, Jerome Powell, and the talking heads can brag all they want about the “strong economy,” but Americans are borrowing to buy it.

There is one word to describe this dynamic.

Unsustainable.

Mike Maharrey

Mike Maharrey is a well-known author, journalist, financial analyst and writer at Money Metals Exchange, one of our top-rated US dealers and two-times winner of Bullion Dealer of the Year

He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida. Mike also serves as the national communications director for the Tenth Amendment Center and the managing editor of the SchiffGold website.

This article was originally published here

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply