The move in France is the newest in the gold repatriation scramble.

Bullion.Directory precious metals analysis 25 November, 2014

Bullion.Directory precious metals analysis 25 November, 2014

By Christopher Lemieux

Senior FX and Commodities Analyst at FX Analytics

In the last year, there has been a movement among countries to repatriate their gold reserves held outside their respective countries. Perhaps, this is a front-running move to avoid last minute scrambles for gold during impending economic slowdown.

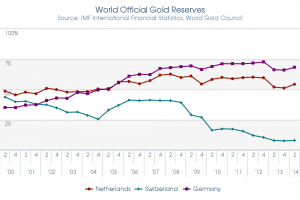

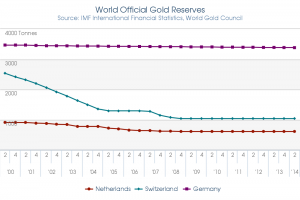

Earlier this year, Germany attempted to repatriate its gold held deep within the New York Federal Reserve vaults, roughly 1,536 tones in total. The attempt was denied by the Fed on the front of “national security.” The Germans were not even allowed to have an audit of their reserves. Remember, the US government acts on its “full faith and credit,” when it comes to such matters.

What many do not know is, Germany has been trying to audit their gold for years and always had been denied. In 2007, Bundesbank officials were finally allowed into the facility, but they were only able to get into the anteroom of the German reserves. Again in 2011, officials were allowed into the NY Fed, but only one of nine said compartments where reserves were held could be viewed. It was unlikely that Germany wanted to repatriate every ounce because that would likely spark a hysteria-like event that would hit the Fed’s already flimsy credibility. Nonetheless, the Bundesbank did say they wanted their gold in case a currency crisis arises.

Another big move to repatriate gold comes in the form of the Swiss gold referendum, which will be voted on in a mere five days. The referendum would require the Swiss National Bank (SNB) to hold at least 20 percent of its reserves in gold and do so within five years (in need of roughly 1,500 tons). The vote would also force the SNB to repatriate all of its gold held outside Switzerland. The polls show that those not in favor slightly ahead of those that choose a sound Swiss franc. The outcome will likely spark volatility in both the gold and foreign exchange markets.

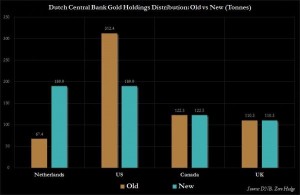

Just last week, it was found out that the Netherlands was secretly withdrawing its gold from the NY Fed vaults. Reserves cut from the vaults were 122 tons, or roughly $5 billion in gold stores. What is interesting is that the Dutch central bank apparently had no problems withdrawing gold reserves. The Dutch central bank said that it made no sense to keep half of their gold across the world. Netherlands has gold stored in Canada and the United Kingdom, too, yet none of those reserves were touched. Are the Dutch outright attacking the credibility of the Fed and the unsoundness of the current money system? Only time will tell.

Now, there is a movement in France that could look to repatriate gold reserves. The conservative Front National party candidate Marine Le Pen, who is ahead of Hollande in a hypothetical presidential election, has sent a letter to the governor of Banque de France. In the letter, Le Pen wants the central bank to repatriate all of its gold held outside of the country, while recommending that the bank keep at least 20 percent of its reserves in gold. Le Pen also wants France’s gold to be fully audited by an independent French entity. The letter states her reasons:

In monetary Cold War played between the Western countries and the BRICS countries, gold gradually takes an important role. According to the World Gold Council, China’s official gold reserves, India and Russia have increased significantly between 2007 and 2013.

For these reasons and because of the rapid growth of global systemic risk, it is of utmost importance to the future solvency of our nation to engage, by mid-2015, a detailed audit procedure, the results will be the subject of a report. This report must obtain validation of French macro-prudential authorities, ACPR, and will be made public in the year.

France could be the newest member of the repatriation party. Countries looking to get their gold back share an underlying reason to do so. Gold is the ultimate form of money, and it has an uncanny ability to hedge ongoing risks in this ever-growing complexity of the current financial system. Whether it is a currency crisis, global economic slowdown, or downright loss of faith in those at the Fed, not having full ownership of the country’s gold could prove costly. The fact that the Federal Reserve is insolvent on a mark-to-market basis does not help either.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply