Bidenomics Coverup – Latest Inflation Report Hides Something Big

Bullion.Directory precious metals analysis 19 January, 2024

Bullion.Directory precious metals analysis 19 January, 2024

By Peter Reagan

Financial Market Strategist at Birch Gold Group

Some categories of goods have finally moved into deflationary pricing. That is, a handful of items are starting actually decline in price.

Better late than never, even though all consumer price inflation isn’t deflationary just yet…

Finally, a few things are more affordable

Looking at year-over-year price decreases, some of the more notable items are:

- At the grocery store: eggs (-23.7%), lettuce (-16.7%), and tomatoes (-7.2%)

- In the energy sector: fuel oil (-14.7%), and natural gas piped to buildings and homes (-13.8%)

- Appliances and home goods: Washers and dryers (-13.6%), televisions (-10.3%), furniture (-6%)

- Services: Health insurance declined significantly (-27.1%)

- Apparel: Men’s suits (-6%)

Unfortunately, gasoline didn’t decrease in price enough to make a noticeable difference for most Americans (-2.2% or about six cents per gallon), after prices at the pump hit record levels in 2022.

Even so, it’s refreshing to have some good news!

So what economic dynamics are driving this shift?

Sarah House, senior economist at Wells Fargo Economics, claims this is a return to normality:

You have seen some [price] give-back in some categories that were most affected by the shift in consumer demand, as well as being affected most severely by some of the supply-chain issues we saw over the course of the pandemic.

Well, that’s one version of the story… It leaves out a few significant factors though.

Including:

- The Fed repeatedly flooded trillions of dollars into the financial system via loose monetary policy that it only reluctantly started to reverse back in March 2022. So far, the Fed’s managed to undo $1.3 trillion of the approximately $5 trillion in emergency liquidity deployed during the pandemic panic.

- Out of control spending under the last two Presidents, including but not limited to funding wars and sending out pandemic stimulus checks. How much? Since 2017, the national debt has risen from $19.8 trillion to $34.4 trillion, an astonishing 73% increase. To put this in perspective, that’s about twice as much as the UK owes, or four Japans worth of debt. Adjusted for inflation, it’s the financial equivalent of fighting World War II THREE times.

- An overall 21% loss in the dollar’s purchasing power over the last eight years.

Clearly, supply chain issues are not the only factor affecting prices.

If House is correct, though, expect to see a reversal in many of these price declines, courtesy of the current military kerfuffle in the Red Sea.

If I’m correct, though (and I believe I am), ongoing CPI declines certainly aren’t guaranteed. And it’s WAY too soon to start celebrating imminent interest rate cuts.

Here’s why…

The Fed can’t cut interest rates if they really care about inflation

The financial crisis of 2008 was the last time inflation spiked significantly, topping 5%, although it eased relatively quickly to a real deflationary state (less than 0%).

In 2010-2012, inflation heated up again. During the latter part of that time period, prices increased at a rate similar to the last quarter of 2023 (3-4%).

Then, from May 2021 to June 2022, inflation went crazy. Historic price increases month over month reached a pace not seen since 1980 (almost 10%).

Bottom line: Inflation is still having a major economic impact. Remember, inflation is cumulative. Even though the rate of price increases has slowed recently, overall costs are still higher.

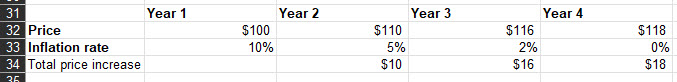

Those of you who are puzzled by higher prices when mainstream media outlets are celebrating “a decline in inflation,” consider the following chart:

Not even a drop to 0% inflation brings prices back down to their starting point!

That’s why prices are still higher, and still rising…

Here’s a breakdown of the latest official producer price index (PPI) and consumer price index (CPI) updates.

First, a CNBC summary of the price inflation that resides upstream from the “price on the shelf” that we end up paying:

Prices for final demand goods declined 0.4% in December, the third straight month of decreases, according to the release. Diesel fuel prices tumbled 12.4%, even though gasoline increased 2.1%.

The overall PPI picture is summarized in the official release:

On an unadjusted basis, the index for final demand rose 1.0 percent in 2023 after increasing 6.4 percent in 2022.

That means the rate of producer-level price increases has slowed down a bit from 2022, but prices are still increasing – just more slowly.

The same update revealed that all categories of services increased year-over-year.

Clearly, producers are still paying higher prices – soon to be seen on store shelves near you.

Overall, the CPI update isn’t much better:

The consumer price index increased 0.3% for the month, higher than the 0.2% estimate at a time when most economists and policymakers see inflationary pressures easing. On a 12-month basis, the CPI closed 2023 up 3.4%.

By comparison, the annual CPI gain in December 2022 was about 6.4%.

Prices are still rising, albeit at a slower rate.

After 3 years of relentless price increases, this is an improvement! Hardly a reason to celebrate, though.

Good news could be defined like this: Some sign of dramatic price deflation across the board, including housing prices, that becomes the norm.

Right now, inflation looks to be playing “musical chairs” as it appears like it’s jumping from category to category with each update.

Now, I don’t have a crystal ball, but I strongly suspect that demand destruction is also playing a role in declining prices. Consider the staggering levels of credit card and “phantom” debt, announcing that the typical American family is, quite simply, broke.

Even if the Fed maintains reasonable interest rates along with its current schedule of quantitative tightening, at this rate they’ll need 11 and a half YEARS to unwind the monetary damage caused by the pandemic panic.

So get used to higher prices. Or consider insulating your savings against inflation (and uncertainty)…

Planning for the future means planning for inflation (and recession, too)

At the global level, the World Bank added some critical perspective for you to consider. They appear to think the next 5 years are going to head into recessionary territory on a global level:

The global economy is on course to record its worst half decade of growth in 30 years.

The only thing worse than a recession at home? A recession everywhere.

When any recession strikes, that generally crushes the value of any economically-sensitive assets you might own. And we all know how central banks respond to recession. Cheap and easy money, touching off a firestorm of inflation…

But the good news is, you still have an option that could help to keep your retirement safe through proper diversification. Now is a great time to consider diversifying with physical gold and silver to preserve the buying power you’ve worked so long and hard to accumulate.

Physical precious metals have historically served as safe-haven stores of value, preserving wealth during troubling economic times. In fact, the price of physical gold in 2023 grew almost 13% overall (beating inflation).

You can get all of the information you need to think about diversifying with precious metals in our free information kit.

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply