Underlying factors that are keeping US rates near to zero

Bullion.Directory precious metals analysis 11 September, 2014

Bullion.Directory precious metals analysis 11 September, 2014

By Christopher Lemieux

Senior FX and Commodities Analyst at FX Analytics

Precious metals, although mildly up this year, have been volatile. Gold and silver saw some demand on headline risk out of Ukraine and the Middle East, but analysts and talking heads see no reason to hold onto gold because the key driver of inflation remains “low.”

However, there are underlying factors to consider on why inflation is low and why it will not be low for much longer. Since the financial meltdown, the Federal Reserve has embarked on a senseless money printing scheme to try and prop up the U.S. economy amid a lack of fiscal policy.

Operation Endless Balance Sheet, as I’ve dubbed the multiple QE-expansions, ballooned the Fed’s balance sheet from roughly $800 billion in 2008 to over $4.5 trillion in 2014 and growing. In order to purchase assets under the QE programs, the central bank has had to literally print money out of thin air, and the money supply continues to increase.

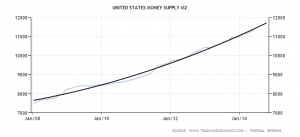

The M2 money supply, including savings and deposits, is widely regarded as a key factor in determining inflation. This M2 money supply has not stopped growing since 2008 and is forecasted to continue growing:

In laymen’s terms, a growing money supply cheapens the U.S. dollar (or any other currency) and the purchasing power of the currency weakens: a dollar today is not worth a dollar tomorrow. As inflation rises, prices of goods become more expensive. If prices of goods grow uncontrollably, then shortages begin and a crisis can kindle.

This is why inflation is not as good as central bankers want you to believe.

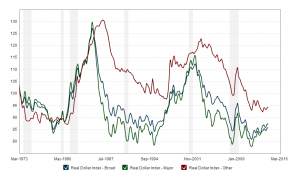

The value of the US dollar remains near lows (data provided by the Federal Reserve):

The Federal Reserve wants the American populous to believe inflation is a good thing, and that it is healthy.

It is as healthy as fast food, and those who experienced real inflation in the US during the ’70s and ’80s would beg to differ.

The Fed, though, is greatly flawed. It is flawed because their monetary policies are based on neo-Keynesian principles learned throughout academia. They have little evidence of actually working, yet they have been directly linked to numerous boom and bust cycles in recent history.

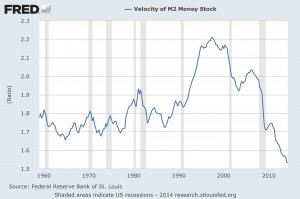

So, why has inflation remained relatively low considering irresponsible monetary policy? There is no velocity of money. Money velocity measures the rate of exchange a unit of currency has from one person to another, or its turnover.

The higher the money velocity, the more frequently transactions are occurring. However, U.S. M2 money velocity is at all-time lows since data has been available. This is a contributing factor on the low level of inflation given the degree of money supply expansion.

The velocity of the M2 Money Stock (shown above) tends to increase when the Fed increases interest rates. Notice how sharply the velocity drops off after the Fed introduced their near-zero interest rate policy (ZIRP).

This could correspond to why former Fed Chair Ben Bernanke and current Fed Chair Janet Yellen are so reluctant to increase interest rates regardless of how “good” the economic data may seem. An increase in the Fed funds rate will likely trigger money velocity, which will generate inflation.

Traditionally, if interest rates increase, then investors will seek higher-yielding investments and money demand will shrink. However, the unconventional monetary policy by the Fed, and major central banks, has created bubbles in risk assets.

The Fed, Bank of Japan and the European Central Bank all have official rates under .1 percent, while the Bank of England has kept their .5 percent official rate since 2009. This caused investors to seek out highly speculative investments in order to seek returns. Equities in major markets have gone straight up, and bubbles exist in high-end housing, junk credit and other speculative ventures.

A rapid turnover of dollars could potentially increase inflation to painful levels. In turn, the Federal Reserve will be forced to increase interest rates in order to keep a lid on frothing inflation. This will be beneficial to savers, but this will cause havoc on borrowers and investors exposed to interest rates sensitive instruments, such as bonds and credit. New loans and credit will likely dry up, which will hurt an economy comprised of 70 percent consumption.

It is prudent for the Fed, and alike, to keep rates near zero because fragile economies depend on it. Unfortunately, the ignorance, or downright arrogance of modern central banking, will undertake its swan song sooner rather than later. Complacency will become catastrophe. Given the level of complacency, the negative pushback will be amplified greatly.

Silver will do very well during economic hardship, while gold will do especially well during higher periods of inflation.

Gold will become a hedge against currency risk, too.

Investors should carry a diversified portfolio that includes gold and silver. It might not be a sexy investment from day to day, but getting a 401(k) cleaved in half, as many experienced during the 2008 financial crisis, is not too sexy either.

One does not buy car insurance after a crash or medical insurance after a broken leg. Why try to buy inflation and monetary policy insurance after a crisis? The cost basis will be substantially higher, and retail investors will likely be priced out of the market.

From 2008 to 2011, gold increased from $681 to $1923.70 per ounce as the Fed implements its reckless policy – that’s sexy.

Currently trading between the mid-$1,200s and $1,350, gold could be ready to breakout when financial markets loose confidence in the Fed, and central banking in general.

Although pricey relative to 2008, investors can still develop a base in their portfolio. Gold bullion is still trading at roughly a 22 percent discount from last year, and gold miners are nearly 50 percent undervalued when compared to the price of gold.

Be smart, and be diversified for any situation that determines financial health.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply