The Gold Fan and the future price of gold

Bullion.Directory precious metals analysis 19 January, 2015

Bullion.Directory precious metals analysis 19 January, 2015

By Terry Kinder

Investor, Technical Analyst

Who is this gold fan and what can this fan tell us about the future price of gold?

Click above chart to enlarge

What, I’m not the gold fan? I guess it depends on how you look at it. I have held gold and/or silver for the better part of the last 40 years. That’s twice as long as I have been married to my wife. Sorry, dear. So, I suppose after all of those years I wouldn’t have stuck it out with…gold if I didn’t believe in its value. But, seriously, let’s look at this actual gold fan before this gets any weirder.

First, what is a Pitchfan? A Pitchfan is a combination of a pitchfork and a Gann Fan.

There are a few features of the Pitchfan, that are noteworthy:

1) Marked by the letter A – A resistance level which has been drawn in at $1,306.40. It’s a bit of an approximation, but it is at or below that level where gold would need to break out of the triangle formed by the downward sloping price resistance line drawn from around the $1,487.00 level and the upward sloping support line drawn from around $1,130.40;

2) The support line that forms the lower portion of the triangle has been extended out to the purple shaded area marked 1.00. This should act as price support. Should price fall below this line and continue below the triangle apex, then expect the gold price to move lower.

3) Marked by the letter B – The median line. Price tends to move back toward the median line, not all of the time, but the vast majority of it;

4) You will also notice various support and resistance levels labeled 0.25, 0.382, 0.50, 0.618, 0.75, 1.00, 1.50, 1.75, and 2.00.

So, what is this fan telling us about the future price of gold?

1) The gold price is currently trading within a triangle pattern. The price has been moving nearer to the upper boundary of the triangle. We should probably expect some resistance at this upper boundary;

2) Price recently crossed into the 0.618 level, something which hadn’t happened since February of 2013, indicating positive price momentum;

3) The next challenge presented by our true gold fan is the 0.75 level, which gold hasn’t seen since February 2013;

4) More challenging will be the 1.00 level, which hasn’t been visited since late 2012;

5) Beyond that the true gold fan level of 1.50 hasn’t been crossed, so that should give some idea of how challenging things could get for the upward climb of the gold price should it begin to near $1,500.00.

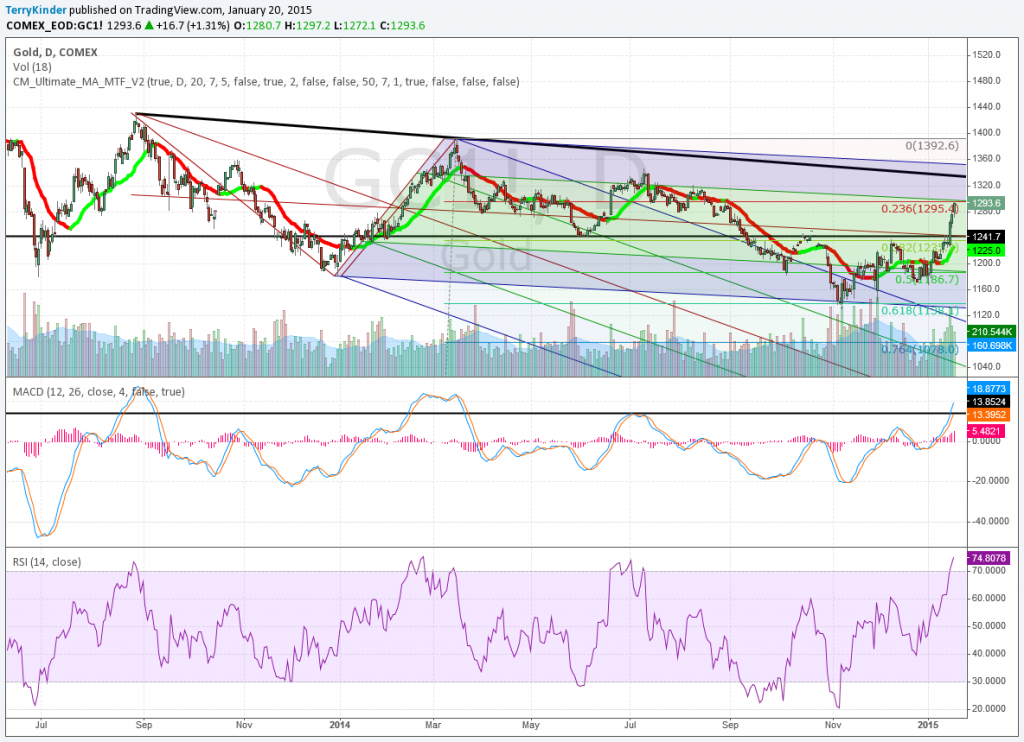

For a little more clarity, let’s look at a chart of gold with a couple of pitchforks and Fibonacci Retracement levels to put our true gold fan in context.

Looking at our chart above, we see the following:

1) A Schiff Pitchfork which is more darkly shaded;

2) A standard Andrews’ Pitchfork which is more lightly shaded;

3) Fibonacci Retracement levels on the right side of the chart.

Gold’s price run higher has definitely been impressive, but it still has some obstacles to overcome in order to demonstrate whether or not it has made a durable reversal or not.

First, it needs to overcome convincingly the 0.236 Fib Retracement level at $1,295.40.

Next, the gold price would need to move above the descending price trigger drawn from the $1,432.90 pivot high to the third and highest level of the Andrews’ Pitchfork. If you look toward the right portion of the chart you’ll see the trigger line crossing down into the shaded purple area of the Schiff Pitchfork.

If price moves above the price trigger, it would be a positive indication that the move higher in gold could have legs.

After that, gold would need to have a weekly close above the upper parallel line of the Schiff Pitchfork. Depending on if and where this occurs it could be around $1,350.00 or lower since the pitchfork is a gently descending one.

Beyond that is the 0 Fib Retracement level or $1,392.60.

Let’s get some more focus on the true gold fan

OK, we have looked at a lot of important price levels for gold over two different charts. It’s a lot to digest. Something that Martin Armstrong, perhaps the best forecaster alive today, wrote can help bring the gold price into focus for us.

We are in a very fluid period, which can be confusing, yet it is important to comprehend that NOTHING but NOTHING is ever PERMANENT. On the one hand, gold will eventually decline for its final low on the benchmarks. The only thing that will call that into question is a Monthly Closing ABOVE 1350. Yet, gold is rising WITH the dollar.

What does that mean in terms of our charts?

1) Gold will need to move through the price trigger line and above the Schiff Pitchfork on our second chart if it is to reach and hold above $1,350.00 on the monthly chart;

2) Gold will have to break out of the triangle pattern on our true gold fan chart and continue to move higher until it is within the 1.00 level, something it last achieved in late 2012.

I’m not saying it will or won’t happen, only the gold price will determine that. However, those are the mileposts that the pitchfan has “told us” must happen if gold is to make durable it’s current march higher.

Postscript: If $1,350.00 is good, even better would be $1,392.60 or $1,400.00. Even better, gold above $1,432.90 – the point where the Andrews’ Pitchfork was drawn from.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply