If repeating historical events are any indication, the grim shadow of deflation is looming on the horizon.

Bullion.Directory precious metals analysis 11 December, 2014

Bullion.Directory precious metals analysis 11 December, 2014

By Christopher Lemieux

Senior FX and Commodities Analyst at FX Analytics

This year, I have been writing on numerous events that have been occurring within various markets and economic indicators. Many of them have been reaching levels not seen since 2008, with many of them playing out as if it were 2008. Whether it is diverging optimism and market internals, suppressed gold and higher dollar, crude or inflation expectations, if one thing is certain 2015 may be turbulent.

In “Did Gold Say ‘Bring on Deflation’,” gold reacted positively to the fact that the University of Michigan’s inflation expectation data utterly collapsed.

We are led to believe that disinflation, or deflation, is bad for gold; and, some were probably confused at gold’s decision to reverse losses in a $30-plus turn around, following the data release.

However, most fail to see that gold still remains a hedge against the actions of central banks. To assume that the Fed, among others, would allow asset prices to free fall from these levels without injecting further stimulus would be naive. Even if the Fed – as in 2008 – was completely clueless that a total economic calamity was waiting in the wings, the stimulus package needed to scrape asset prices back from the abyss when all is said and done would be massive.

We have witnessed a global disinflation environment as central banks printed nearly $13 trillion within the last six years.

A large problem is that quantitative easing, as it was used, did not work.

Consumer prices and demand have declined, and inflation remains low in central banking terms. Coupled with nearly a decade of zero interest rate policy (ZIRP), the Fed cannot lower rates anymore. The fact that inflation is even as low as it is indicates that central banks will keep rates lower for longer. And, this only fuels the ongoing, foolish speculation.

Credit is what is fueling even the little two percent growth the US is seeing, and it is a highly leveraged system. Deflation will put credit expansion in vice grips. Without the expansion of credit (i.e debt), growth will be no more.

We can see what the deflationary pressures on oil can do, with West Texas Intermediate (WTI) now trading below $60/bbl. There are fears that prolonged pressure on oil prices will cause defaults to ripple throughout the energy sector, which has a large chunk in high-yield debt, and bring on another credit crisis. The spreads on high-yielding energy debt exploded to all-time highs, now at 952 bps.

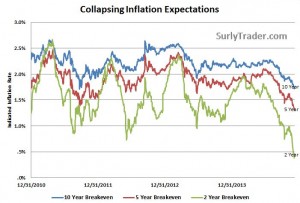

Here is a chart from of inflation expectations, provided by Surlytrader.com:

Market participants seem to have noticed the deflation threats in Europe and some emerging economies, but they are so bullish on the US that the threat of falling prices need not apply.

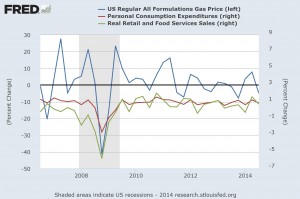

In order to spin the parabolic nature of the US dollar, falling prices are now good for the US because consumers will now boost their consumption. A popular talking point on mainstream financial media is that lower gas prices are indicative of more spending, as if the $8-10 one saves per week on gas will drive the economy higher.

A look at lower gas prices and real retail and food sales (as a percentage change) do not seem to support this theory:

Lower gas prices, the Federal Reserve or upbeat economists cannot force consumers to buy more, especially when the vast majority missed this so-called recovery. Russell Napier, an independent analysts and founder of the Electronic Research Interchange, has show that even in recent times, a decline in inflation expectations brought on a decline in asset prices via the S&P 500.

Following the complete taper of QE 1 and QE 2, in 2010 and 2011 respectively, the perception of lower inflation rates brought on double-digit declines.

In 2010, the forecasted rate of inflation from April to August fell from 2.1 percent to 1.1 percent, and there was a subsequent 16 percent decline in the S&P 500. In 2011, the forecasted rate of inflation from April to September fell 2.5 percent to 1.4 percent, and a 19 percent decline in the S&P 500 followed.

However, this time it is suppose to be different. Napier’s research showed that inflation forecasts this year fell from 2.1 percent in June to 1.3 percent in December, yet the S&P 500 rose six percent.

Something has got to give. Either the economy roars back with economic expansion, or it will succumb to the mounting challenges that lay ahead.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply