Russia vs USA – Russia isn’t going to defeat the USA no matter how much gold they have

Bullion.Directory precious metals analysis 7 December, 2014

Bullion.Directory precious metals analysis 7 December, 2014

By Terry Kinder

Investor, Technical Analyst

For some unknown reason there are a lot of articles being published pushing the idea that Putin and Russia, along with their large stack of gold, will somehow defeat the United States in a new cold war.

It’s not quite clear how the Russian economy, making up roughly 3% of global GDP, plus that stack of gold, are supposed to bring the USA to its knees, but for some it’s an article of faith that somehow just possessing the yellow metal is sufficient to win the day. It’s quite frankly a ridiculous idea, and as a former army propagandist, I couldn’t sell it to an audience on my best day and do so with a straight face.

It’s miles past absurd, and I’m going to tell you why.

I suppose at some point my gold bug membership card is going to be revoked because I simply can’t listen to the embarrassingly awful arguments being made under the gold bug label and simply give them a pass.

There is some sub-section of the gold community that believes that, when it comes to Russia vs USA, that the mere fact that the Russian central bank has been accumulating gold, that somehow tips the balance of power in favor of Russia. Never mind that if we measure GDP (not the golf-handicap type where we adjust GDP up so it looks greater than it really does) in terms of what can be spent (and you can’t spend fictional adjustments), then the USA alone has a greater GDP than Russia and China combined. But, the Russia vs USA standoff is often framed as a West vs East battle.

Put that way, the GDP difference is even more lop-sided.

Russia vs USA Round 1:

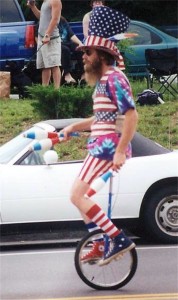

Russia vs USA – Uncle Sam: “I will teach the Russian Bear to ride my unicycle.” That’s my entry for worst article caption contest. Source: morgueFile

So, the first problem in the Russia vs USA meme is that Russia simply has a much, much smaller economy than the USA. We are supposed to believe, perhaps as an article of faith, that an economy around the size of Brazil will serve up a cold dish of defeat to the United States and the West. How will Russia do this? Well, Russia is buying gold. How is Russia buying all of this gold? Russia is selling oil either for gold or converting whatever currency it receives into gold. There is one teeny problem with this. The price of oil has fallen considerably so Russia is being squeezed. What is Russia’s solution to this? Why the Russians will use their gold reserves and currency reserves to ride out the storm. But, what happens to Russia’s shiny pile of gold that it is supposed to use to defeat the West? Oh, it will have to spend it to buy other stuff. What kind of stuff does Russia import. Take a look here to find out. Scroll down further from the page just linked and you will see that much of that stuff comes from western countries or countries aligned with the West.

Russia vs USA Round 2:

Russia exports huge amounts of oil, minerals, metals, and other things mined from the earth. But, in terms of manufacturing its output in minuscule. So while Putin may argue that the West is cutting off its nose to spite its face by sanctioning Russia, the fact is that Russia needs the West far more than the West needs Russia.

If gold prices stay even to down and oil stays even or drops in price, then Russia is going to have very serious economic problems. That doesn’t even take into consideration the very real problem Russia has with its quickly falling Ruble. To survive these trends, Russia will have to spend its currency reserves and eventually, sell its gold. Perhaps the Chinese will help the Russians through some of their difficulties, but likely with terms that are very favorable to China and will only be enough to keep the Russian economy on life support.

Russia vs USA Round 3:

The above, of course, goes strongly against the idea that possessing gold is all you need to do in order to ultimately prosper. Nothing could be further from the truth. If merely possessing gold were the path to prosperity then all of the countries listed here should be doing well. For example:

- Argentina

- South Africa

Yes, I cherry picked these two countries because they are examples of countries that mine substantial amounts of gold and are going backwards in terms of GDP. Gold, by itself, is not a panacea. It isn’t a panacea as an individual or as a nation. As a nation you need to have several elements in order to have a prosperous society:

1. Rule of law;

2. Respect for property rights;

3. Some degree of respect for individual rights;

4. Limits on government power;

5. A business, taxation, regulatory regime (in combination with other factors) that encourages entrepreneurship and investment;

6. Offer something of value to others;

7. Make and keep more friends over time than enemies

I’m sure I’m missing something on the list, so feel free to add any suggestions in the comments section.

Russia vs USA Round 4:

Now Russia has some very smart and good people. I have nothing bad to say about the Russian people. When I worked for an motorcycle parts wholesaler in international sales I had a Russian customer and he was a great person and easy enough to work with.

Russia vs USA – Putin: “Surrender to me or the puppy gets it!” Source: flickr

However, if we apply the above seven points to the Russian nation things don’t necessarily look that great. Is Russia widely viewed to respect the rule of law? Is Russia seen as being highly respectful of property rights or individual rights? Who limits Putin’s power in Russia? Is Russia winning friends and influencing people in the West?

From a public relations standpoint my guess would be no. Despite having a very well-educated population in mathematics, computer sciences, etc. Russia has little to show for it in terms of high tech companies. In the end, Russia is highly reliant on one commodity – oil. Despite all of the talent of the Russian people and the vast natural resources, Russia has basically put all of their eggs in one basket, making it very easy to crack the Russian economy and bring the nation, if not to its knees, at least very low.

I’m still somewhat stunned that despite having some of the best technical minds in the world, Russia imports over $7 billion worth of computers. Sure, the United States also imports far more computers than we export, but Russia effectively has zero computer exports. None. This highlights almost perfectly Russia’s dilemma.

Russia Vs USA – Barbara: “Vladimir, I thought you’d be taller in person.” Source: wikimedia

They can stockpile all of the currency reserves and gold they want to. However, if the price of oil stays low for a long enough period of time Russia will likely need to spend their currency reserves and then their gold.

Despite the popularity of the meme that Russia will harm the U.S. Dollar by transacting for oil in gold or other currencies, there is nothing from keeping the West from doing the same. So, if Russia wants tractors, for instance, the United States can simply demand payment in gold. What is Russia going to say? We (Russia) no longer accept “worthless fiat” currency, but we expect you (the United States) to accept it in payment for goods.

Russia vs USA Conclusion:

In the final analysis, the idea of Russia overthrowing the United States, and therefore the West, with an economy built almost entirely on oil, with few of the elements necessary to build a durable and lasting economic prosperity, and based somehow on the idea that a pile of gold will conquer all, is nothing but a cotton candy fantasy. It looks substantial at first glance, but when you sink your teeth into it, it dissolves into nothing.

The only real claws the Russian bear has are nuclear and its doubtful they will want to use them any more than the U.S. will. So, in the end, the danger to the U.S. and the West is not Putin and his Russian bear. Instead, it is straying from our own principles and rotting from within. It won’t be Russia that brings the U.S. down. If anyone does it, it will be ourselves, Russian gold or no.

PS: Happy Birthday Dad. I always remember how you celebrated your birthday over two days – December 7th and 8th. You were never one to do things small. You were one of the most generous people I ever met, always willing to give your last dollar or last bit of groceries off of your shelf if you thought someone needed it more than you. Your knowledge of business, merchandising, marketing, baseball and so much more always amazed me. Although you have been gone more than fourteen years, you’ll never be forgotten. Happy Birthday Dad. I’ll love you forever.

PPS: When I was in grade school my Dad decided to buy a farm with about 12 acres and a big warehouse. His friends thought it was funny and called him a city farmer because he really knew nothing about farming. Dad bought some cows, chickens and pigs. He gave the cows, and later calves, names, which made it a little tougher when it came time to butcher them. I scooped a lot of chicken poop, cow poop, pig poop, fed chickens, cows, and pigs. I chased chickens when they escaped and tried to wrangle pigs when they escaped. It was a lot of fun.

One day, we had a sick chicken. I think it had some weird mange or something. So, Dad put it into a box and took it to the veterinarian. Dad sat down beside someone in the waiting room with the chicken inside the box making odd chicken sounds. The guy beside him asked Dad what he had in the box. My Dad replied, “I have a dog that thinks it’s a chicken.” I wish I could have seen the guys face when my Dad said it. Dad had a great sense of humor. I’d like to think I got just a bit of his strange and wonderful sense of humor.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Terry,

An outright war with the US is not going to happen, as we both know. Where I think Russia can gain a leg up is by trading with countries while not using the dollar via local currency swaps. We’ve seen this with Russia and China, and China does it with the EZ. Countries despise the dollar, and I can see within the next decade, the dollar amount in int’l trade will be reduced. I don’t think it will cripple the US, but if there is less demand for dollars that could be an issue with nearly 50% of all printed dollars outside the US.

Jim Rickards also has a unique view through financial warfare. Russia couldn’t beat us militarily, but they could in other ways. He believes that the sanctions on Russia have been so weak simply because the US has more to lose in the end. Russian hackers could shut the US down. We have seen an increase in Chinese attacks. A couple of years ago, they found a a bug in one of the stock exchanges of Russian origin just dormant.

You got it right when you said that the US will be the source of its own destruction. Russia is just giving it a gentle nudge towards oblivion by playing a very clever game, using the suicidal economics of the Fed and Wall St against the US and to Russia’s benefit. The price of gold is being artificially suppressed – that is clear. The USD is being artificially boosted by QE and other snake oil economic skulduggery and sleight of hand tricks. By selling oil for artificially cheap gold or converting artificially expensive dollars for artificially cheap gold, Russia is playing the US at its own game and hastening the collapse of the ponzi scheme that is the US economy…only a matter of time.