The latest market crash has sent many investors into a panic, but it opens a window for those paying close attention.

Bullion.Directory precious metals analysis 19 March, 2025

Bullion.Directory precious metals analysis 19 March, 2025

By David Merkur

CEO and co-founder at Gold Silver Mart

This correction comes just as I predicted in my recent article, “The Markets Are at a Tipping Point: Overextension Signals an Impending Correction”, a big pullback was coming—and it’s here.

I thought gold would get pulled down with the market, but surprisingly, it didn’t. This unexpected resilience sets the stage for a new market setup where gold could perform extremely well in the future. Let’s break it down.

The Correction I Predicted—and Gold’s Unexpected Stand

The correction I anticipated has arrived, with markets tumbling under the weight of overextension. The S&P 500 and Nasdaq have wobbled, oil prices have dipped, and consumer confidence has cratered, as detailed in my earlier analysis.

This was driven by overextension, sky-high valuations, U.S. tariffs of 25% on Canada and Mexico, and possibly government policies tightening to curb inflation — a theory aligning with recent fiscal moves.

I expected gold, at $4,223.09 CAD per ounce, to crash with the market, as precious metals often dip during sell-offs, but it held firm, defying expectations and hinting at deeper forces supporting its resilience amidst the chaos.

Gold’s Resilience: A Surge in Swiss Trade

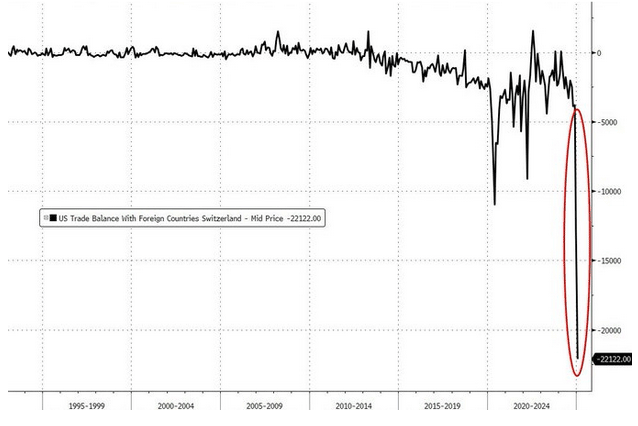

One of the primary drivers behind gold’s surprising strength lies in a dramatic increase in trade flows from Switzerland to the U.S.

Recent data highlights a significant spike in gold shipments, with exports reaching some of the highest levels since early 2022, as the U.S. has emerged as a major recipient amid global economic realignment. This surge, which began gaining momentum in late 2023, reflects a broader shift in gold reserves as investors and institutions seek to secure physical assets during uncertain times.

Unlike the assumption that this movement was merely tariff arbitrage, the data suggests a deeper strategic accumulation, bolstering gold’s availability and demand in the U.S. market. This influx has provided a critical buffer, enabling gold to withstand the correction’s downward pressure and maintain its value, even as other assets like equities and industrial commodities falter.

Economic Context: A Historical Perspective

To understand gold’s resilience, it’s worth looking at historical parallels. During the 2008 financial crisis, gold initially dipped but then surged by over 25% in the following year as investors flocked to safe-haven assets amid prolonged uncertainty.

Today’s correction, while not as severe, mirrors that dynamic—global trade tensions, coupled with a consumer sentiment index at 64.7 in February 2025, reflect a similar flight to safety.

Moreover, the U.S. trade balance with Switzerland, which has shifted dramatically since late 2023, underscores a renewed focus on physical gold as a hedge. This historical context reinforces why gold has defied the market crash, positioning it as a cornerstone for investors navigating the current storm.

A Favourable Setup for Gold’s Future

This correction has reshaped the market landscape, creating an environment where gold is poised for exceptional performance.

Inflationary pressures are easing, thanks to recent actions by President Trump to stabilize volatile regions through military engagement, targeting threats like the Houthis in Yemen to secure key trade routes such as the Suez Canal and Red Sea.

These efforts, aimed at ensuring the free flow of global commerce, have reduced supply chain disruptions that previously drove up prices. Additionally, the introduction of DOGE (Department of Government Efficiency) initiatives signals a push for fiscal restraint, which, alongside a notable drop in consumer sentiment following the crash, is tempering demand-driven inflation.

Lower inflation reduces the pressure on interest rates, making gold—a non-yielding asset—more attractive than bonds or savings accounts, especially as central banks may ease monetary policy to support a recovering economy.

Broader Market Dynamics Supporting Gold

Beyond inflation, other market dynamics further enhance gold’s outlook. The stock market remains fragile, with the S&P 500 and Nasdaq still grappling with the aftermath of overextension and tariff impacts have disrupted supply chains, particularly in manufacturing sectors.

Meanwhile, central banks, particularly in emerging markets like India and China, are also increasing gold reserves to hedge against currency volatility, a trend that saw a 15% rise in purchases in 2024.

This sustained demand, combined with gold’s historical role as a wealth preserver during geopolitical unrest, positions it to capitalize on the current uncertainty.

Why Now is the Time to Act

Gold’s surprising endurance amid this market crash is unmistakable evidence that it stands on an unshakeable foundation and is poised to do extremely well with the new setup.

The influx of Swiss trade, bolstered by Trump’s stabilizing economic policies and evolving consumer trends, underscores gold’s solid foundation, offering gold investors a golden opportunity.

This new environment, characterized by reduced inflation and surging safe-haven interest, presents an exceptional opening as gold gears up for a significant upward trajectory.

Gold and silver continue to serve as vital safeguards in turbulent times, and this market shift could be the perfect springboard to fortify your financial future.

David Merkur

David Merkur is co-founder, CEO and financial analyst at Gold Silver Mart, one of Canada’s leading precious metals dealers, serving both the local market and with extensive global reach.

With a degree from Seneca Polytechnic and a distinction from The Institute of Trading and Portfolio Management, David writes regular expert market and trading analysis both at Gold Silver Mart and other financial publishers.

This article was originally published here

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply