A lot of gold has moved from London to New York in recent weeks.

Bullion.Directory precious metals analysis 27 February, 2025

Bullion.Directory precious metals analysis 27 February, 2025

By Mike Maharrey

Journalist, analyst and author at Money Metals Exchange

Mainstream analysts blame the dynamic on the threat of tariffs pushing the futures price of gold (and silver) higher in New York. There could also be a more fundamental issue at play: the fact that there is a lot more paper gold than physical metal.

No matter what’s driving the movement, there has certainly been a significant disruption in the gold market evidenced by this movement of metal across the pond.

Just how much gold has shifted to New York?

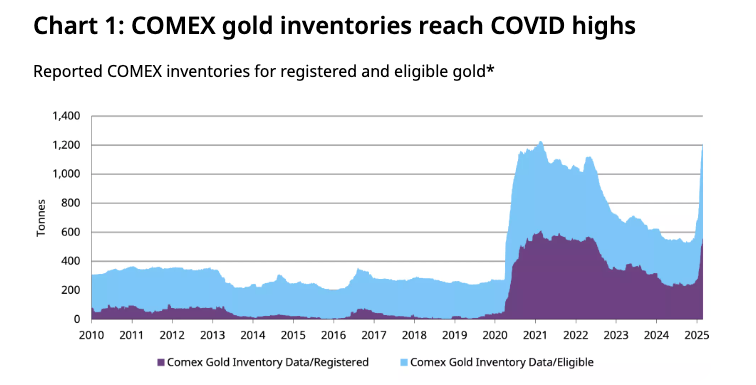

According to the most recent data, COMEX registered gold has increased by nearly 300 tonnes (9 million ounces). Eligible inventories have swelled by more than 500 tonnes (17 million ounces).

The last time we saw COMEX inventories spike this quickly was during the early stages of the pandemic.

Registered gold meets the exchange’s delivery standards including purity and weight and has been officially recorded with an exchange-approved depository or warehouse. This gold is ready to be delivered against a futures contract.

Eligible gold also meets the exchange’s delivery standards but has not been registered with an exchange-approved warehouse. With no receipt, this gold is not yet available for delivery under a futures contract, but it could be registered and made deliverable if necessary.

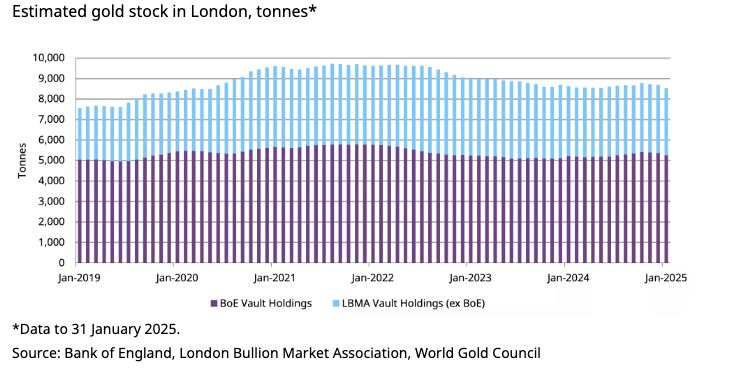

Meanwhile, the levels of gold vaulted in London have dropped, but still remain above their 2022 level.

The World Gold Council explains the situation this way, based on the assumption that the tariff threat is the primary driver:

“Short-term speculators and some investors often hold large net-long gold futures positions on the COMEX futures market, while banks and other financial institutions short these futures contracts as counterparties. But these financial institutions are generally not short gold; instead, they run long over-the-counter (OTC) positions to hedge their futures shorts. And because physical gold is more often found in the London OTC market – as a large trading hub and often a cheaper location in which to vault gold – financial institutions typically prefer to hold these hedges in London, knowing that they can quickly – in normal market times – ship gold to the US when there is a need. In recent months, many traders have chosen to pre-empt the threat of tariffs by moving gold to the US, thus avoiding the possibility that they may have to pay higher charges.”

In a nutshell, the premium on the COMEX has created an arbitrage opportunity that big institutions capable of quickly moving metal between trading hubs can take advantage of.

There could be more going on than meets the eye. Gold Newsletter publisher Brien Lundin believes cracks are spreading in the global gold market infrastructure, with tremendous implications for the price of the metal.

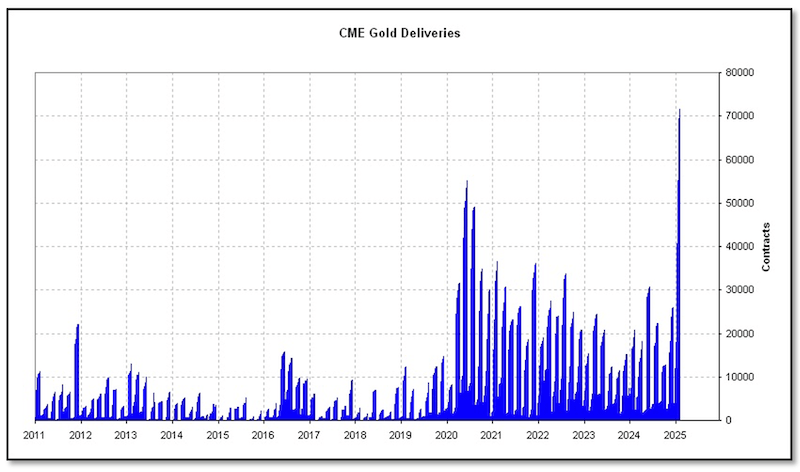

He points out that we’re also seeing a significant surge in gold being pulled from COMEX vaults as investors take physical delivery instead of rolling future contracts over.

“Now, the flow of gold from the London Bullion Market Association vaults into Comex could be explained away by the threat of tariffs… but that doesn’t explain the coincident surge of deliveries — physical demand — from COMEX.”

This movement of gold is definitely something to keep an eye on moving forward.

Mike Maharrey

Mike Maharrey is a well-known author, journalist, financial analyst and writer at Money Metals Exchange, one of our top-rated US dealers and two-times winner of Bullion Dealer of the Year

He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida. Mike also serves as the national communications director for the Tenth Amendment Center and the managing editor of the SchiffGold website.

This article was originally published here

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply