Gold’s price closes at record high: This week’s moves will be in the limelight

Bullion.Directory precious metals analysis 04 March, 2024

Bullion.Directory precious metals analysis 04 March, 2024

By Peter Reagan

Financial Market Strategist at Birch Gold Group

For example, we found it interesting that Commerzbank’s team commented on the Thursday rise with the following:

Sometimes you have to be satisfied with being unable to explain a price movement fundamentally. Whether this will last longer than one day is another matter.

Their overview, which mostly dismisses consumer inflation as the cause, came in some days ago, and gold has since posted the aforementioned climb. So we know that it lasted for another day, and then some. What’s driving gold higher right now?

- A higher-than-expected round of inflation reports

- A return of fears about the banking sector

- An influx of investor money into commodities

- A recent speech from Federal Reserve Governor Christopher Waller on quantitative easing

Immediately after the $2,050 jump, MKS Pamp’s Nicky Shiels came in with some unusually bearish views. Here’s my choice quote from her in-depth technical analysis.

Was the PCE a game-changer? No, and not enough data to declare disinflation is about to end, and the Fed may just never cut.

Is she being figurative in saying that the Federal Reserve might never cut rates, or does such a first-ever play a necessary factor in the bearish outlook for gold? That’s a question we’d like answered, because, let me check a history book… The Fed has never “not cut!”

The Fed drives our economic boom-and-bust cycles. You may have noticed the last few busts have been a lot louder than the booms.

Not everyone is, or was, skeptical on gold’s ability to climb higher in the near-term. Alex Kuptsikevich, senior market analyst at FxPro, pointed out that both Thursday and Friday’s gains have affirmed gold’s ability to move past its 50-day moving average, which it didn’t manage a month ago.

This alone would suggest that another leg up is unwinding in the market, which Kuptsikevich believes to be the case. He said that $2,088 is the next major resistance level, which is why everyone is watching how gold will behave as it continues climbing above $2,080. And, as he notes, gains are likely to give way to more gains, as opposed to pullbacks.

The price of gold has surprised quite a few people recently…

- Rising 4.5% in the last month alone

- Up 9.2% over the last six months

- And a staggering 64.3% rise over the last five years

If you listened to me five years ago, I hope you’re feeling very happy with that decision!

“What’s the situation with our gold?” Mooney asks, and Powell evades:

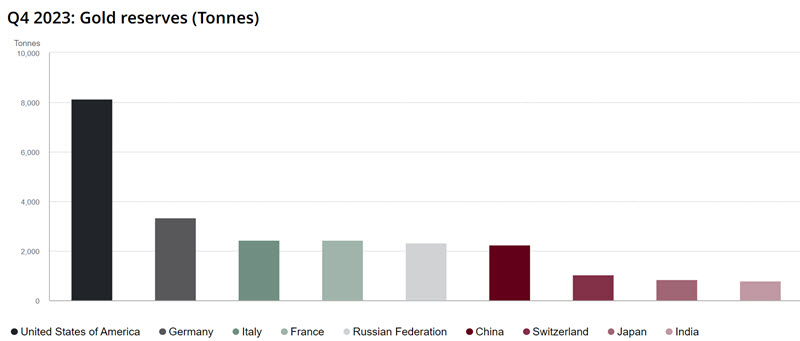

We’re supposed to have the largest gold reserve out of any sovereign nation by a wide margin. Officially, the U.S. Treasury owns as much gold as the next three largest national gold reserves combined.

The U.S. still has the world’s largest central bank gold reserve, as big as the next three nations combined. 2023 year-end data and chart via World Gold Council

Those 8,133 tons are what we have left from the peak of the nation’s prosperity, at the end of World War II, when the U.S. owned over 22,000 tons of gold.

So, on paper, the U.S. has the world’s largest gold reserve. But there have been zero third-party audits of the nation’s gold stockpile since President Nixon took the nation off the gold standard. Today, determining just how much gold the U.S. has in its official reserve (and where it’s stored) is more difficult to determine than it should be…

When, say, the Банк России or 中国人民银行 (the central banks of Russia and China, respectively) purchase gold for their national reserves, they store it in their own vaults. They don’t differentiate between the central bank, the nation and its national gold reserve.

In the U.S. things just aren’t as clear-cut…

The Federal Reserve acts as our central bank, but doesn’t actually own any gold according to Fed Chair Jerome Powell’s recent comments, which we’ll get to shortly. The Fort Knox Bullion Depository gold, as our national reserve is sometimes called, is owned by the U.S. Treasury. (If that sounds like it’s meant to complicate or obfuscate things, you might be on the right track.)

In 2021, Rep. Alex Mooney (R-West Virginia) wrote to Treasury Secretary Janet Yellen for some much-needed answers. These include:

- Why is Treasury Department gold kept with the New York Fed?

- How much of our gold is there?

- When was the last audit of the national gold reserve?

…and so on. We can mostly summarize the Treasury’s reply as follows: “Ask the Fed.”

Now that Mooney did just that, or more specifically did way back in December, he got a reply some three months from Jerome Powell himself! Unfortunately, all Powell had to say was, “Ask the Treasury Department.” Mooney is also interested in how the U.S. is dealing with repatriations – see, the Federal Reserve Bank of New York does hold some gold that’s actually owned by other nations. At the time, it seemed like a good idea:

Much of the gold in the vault arrived during and after World War II as many countries wanted to store their gold reserves in a safe location.

Imagine, just for a moment, that your national situation is so dire that it seems like a good idea to put your entire nation’s gold reserve on a ship and ask someone else to keep it safe for you…

Although I would like to take a moment and point out another point of interest:

All bars brought into the vault for deposit are carefully weighed, and the refiner and fineness (purity) markings on the bars are inspected to ensure they agree with the depositor instructions and recorded in the New York Fed’s records. This step is vital because the New York Fed returns the exact bars deposited by the account holder upon withdrawal – gold deposits are not considered fungible.

I point this out because that’s the same way depositories manage your Precious Metals IRA assets!

They weigh and test your assets to ensure they’re authentic. Then, they don’t “pool” your gold and silver, mingling it with assets owned by others, but keep them segregated so there’s total certainty about exactly what you own. (I just thought this was interesting.)

Well, 80 years after the end of World War II, trusting the U.S. to hang onto your nation’s gold reserve isn’t popular any more.

Fed Chair Powell told us nothing useful. So we’ll instead turn to Chris Powell, secretary-treasurer of the Gold Anti-Trust Action Committee, who has a few choice quotes on these issues. Regarding sovereign movements, Chris Powell had this to say:

The refusal of the chairman of the Federal Reserve Board even to acknowledge, much less reply to, the questions of a member of Congress about the repatriation of gold from the Federal Reserve Bank of New York confirms that something really big is going on with gold internationally.

The year-after-year record central bank gold purchases tell us as much.

Chris Powell went on strike at the heart of the matter:

What does the Federal Reserve know about international gold flows that it doesn’t want the American people to know? Does this knowledge involve the grotesque financial mismanagement of the U.S. government and its currency? Why shouldn’t the American people know?

Indeed, since gold is the ultimate measure of the value of ALL government currencies, why shouldn’t the whole world be allowed to know?

The whole issue about international gold appears to be a misdirection of its own. What Mooney and others seem to be moving towards is a glaring series of questions that have been asked by many, over and over, for a long time:

- Does the U.S. really own over 8,000 tons of gold?

- If we do, how much of that is physically resident in Fort Knox? And how much of it has been leased, loaned out, used as collateral or otherwise encumbered rather than owned free and clear?

- And if we don’t in fact still have the largest central bank gold reserve, should we be concerned about nations whose gold reserves are now larger than ours?

It took Mooney three months to get a reply from the Treasury and another three months from the Fed. And both gave him the runaround! We don’t expect any of the above questions to be answered clearly, if at all.

That’s concerning. Today, gold is more important to the global financial system than it has been since the end of Bretton-Woods.

Remember, the value of the U.S. dollar depends entirely on trust in the good faith of the federal government. If the federal government won’t answer really simple questions about one of our nation’s most valuable assets, we’re forced to ask some hard questions. Because “Trust us, the gold’s really there” and “We don’t need audits because we have faith” is not how “faith and trust” are supposed to work.

No wonder so many nations worked so hard to have their gold reserves repatriated from the U.S. safe in their own vaults!

Poland discovers silver deposits that could pay the nation’s debts twice over

The U.S. Geological Survey (USGS) now confirmed last year’s rumors that Poland has the world’s largest silver deposits, with reserves amounting to 170,000 tons.

Peru, previously the world’s leader in silver deposits, is now #2 with 110,000 tons.

It’s a massive update, though Poland wasn’t exactly short of silver to begin with. The previous report placed the Poland’s silver deposits at 65,000 tons. A massive, conspicuous discrepancy, but really good news for the nation.

Headlines have abounded, with some saying this revelation could reshape the global silver market. But the Mint of Poland has already said that having deposits is one thing, while mining and refining them into silver bullion another. With silver deposits dispersed, and with silver mining not popular to begin with, getting the infrastructure in place to explore and exploit all that silver is going to be a challenge.

Some think that this could drive down prices, which makes sense in theory. Massive increase in supply and all that. But there again arises the issue of silver in the ground compared to silver bullion.

Consider: Is it a threat to gold prices that some mines are relatively abundant in ore? No, it is not (as we can see from gold’s spot price).

If this potential increase in supply doesn’t threaten price, what does the demand side look like?

The Silver Institute, whose forecasts have been on the low-end, projects the second-highest rise in silver demand on record this year, to 1.2 billion ounces. It also projects a deficit of 176 million ounces, the fourth consecutive year of high silver deficits. The Silver Institute was surely well-aware of the Poland story when it made the February report, which tells us that said story is coming off as a dual lesson of sorts.

The first is that mining innovation remains lackluster to the point that one has to curb their enthusiasm even when finding a massive ore deposit. For that matter, those flocking to California during the gold rush might have had less to contend with than miners do now, all things considered.

The second is that real, tangible value always has and continues to trump paper money.

Theoretically, the estimated $127 billion of silver reserves could pay off Poland’s national deficit twice and leave them with money to spare.

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply