Amelia in Minnesota is wondering what the differences are between numismatic, collectible and ancient coins – and if there are any risks to look out for as a new investor.

Bullion.Directory’s Ask Ally Service

Bullion.Directory’s Ask Ally Service

By Alison Macdonald

Commercial Editor at Bullion.Directory

In the world of gold and silver investment, precious metal coins aren’t always ‘merely’ coins. They can be gateways to history, art – and sometimes – a tidy profit.

This is a specialized subject, populated by both numismatists and collectors. Many of the most passionate investors are both. Numismatists will typically know the most minute details about given coins struck on given dates at certain mints – and collectors tend to be obsessed with particular coins for a vast array of different reasons, whether it’s their aesthetic, a personal connection, a focus on a country, an era or subject matter.

Numismatic coins are the historians of the coin world.

They’re valued not just for their metal content but for their rarity, historical significance, and condition. Numismatic gold coins are often ancient, rare, or have some historical connection that makes them more valuable to collectors.

Collectible coins, on the other hand, are often more contemporary.

They might be commemorative issues, special editions, or part of thematic series. Their appeal lies in their unique designs, limited mintages, or special features. Unlike numismatics, their value isn’t deeply rooted in history but in their rarity and demand among collectors.

In essence, while all numismatic coins can be collectibles, not all collectibles qualify as numismatics.

It’s a fascinating world where the value of a coin transcends its metal content, delving into the realms of art, history, and collector interest.

What are Numismatic Coins?

Numismatics is a term that ignites the imagination of history buffs and coin enthusiasts alike. It’s the study and collection of currency, particularly coins, with an emphasis on those of historical and cultural significance.

Numismatics is a term that ignites the imagination of history buffs and coin enthusiasts alike. It’s the study and collection of currency, particularly coins, with an emphasis on those of historical and cultural significance.

The value of numismatic coins is influenced by several key factors:

Age: Generally, older coins tend to be more valued. They’re pieces of history, snapshots of eras long gone. However, age alone isn’t enough; the coin’s context and rarity during its time play a crucial role.

Rarity: This is the heartbeat of numismatics. A coin’s rarity can stem from limited mintages, historical events that limited its survival, or being a unique variant. The rarer a coin, the higher its potential value. It can be like finding a rare first edition of a classic book.

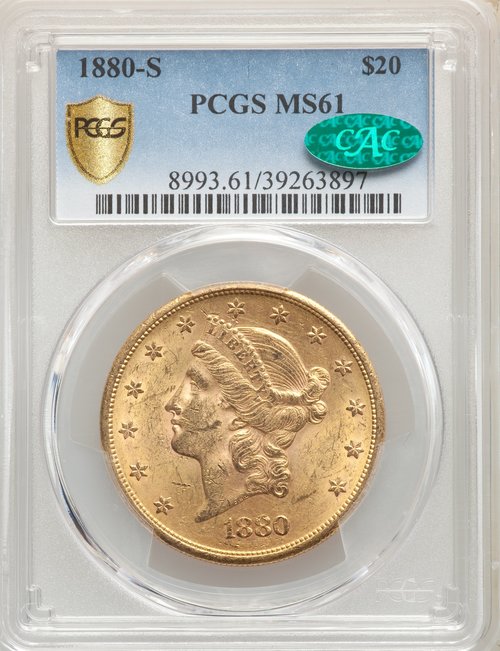

Condition: Known as the coin’s grade, the condition significantly impacts its value. Coins in pristine, or ‘mint’ condition, are often the most sought after. But in numismatics, even coins with wear can be valuable if they are rare or historically significant.

Historical Significance: Coins with a rich history or a fascinating backstory often carry more value. This might be due to their association with historical events, famous figures, or groundbreaking mints.

In short, numismatic coins are a blend of art, history, and market rarity. They’re not just investments; they’re treasures of human history, each with a unique story to tell – and for some collectors, coins from the past few hundred years or so are simply not historic enough…

Ancient Coins – a Special Category

Ancient coins are the elders of the numismatic world, each with a story that dates back many centuries and in some cases millennia.

Ancient coins are the elders of the numismatic world, each with a story that dates back many centuries and in some cases millennia.

These coins, minted by long-gone civilizations like the Romans, Greeks, or Egyptians, are not just currency; they’re artifacts of human history.

The allure of ancient coins lies in their direct connection to historical eras. Holding a Roman denarius or a Greek drachma is like holding a piece of history in your hand. For many collectors, it’s this tangible link to the past that makes ancient coins so captivating.

The world of ancient coins, while fascinating, is fraught with challenges. Authenticity is a major concern; the market has seen its fair share of sophisticated forgeries. Additionally, the condition and provenance of ancient coins can significantly affect their value. Collectors need to be knowledgeable, or work with trusted experts, to navigate these waters.

So whilst part of the numismatic scene ancient coins can be considered a category unto themselves, requiring a careful and educated approach to collecting.

Understanding Collectible Coins

Collectible coins are a modern treasure trove in the world of investments and hobbies. Unlike numismatic coins, which are prized for historical significance, collectible coins are valued for their uniqueness, design, and limited availability.

Collectible coins are a modern treasure trove in the world of investments and hobbies. Unlike numismatic coins, which are prized for historical significance, collectible coins are valued for their uniqueness, design, and limited availability.

Commemorative Coins: These are issued to honor significant events, people, or anniversaries. For instance, the U.S. Mint has released coins celebrating everything from national parks to historical figures. They’re like tangible pieces of contemporary history.

Limited Editions: These coins are minted in limited quantities, adding to their conductibility. An example is the Canadian Mint’s series of wildlife-themed silver coins, which have been a hit among collectors for their intricate designs and limited runs.

Thematic Series: These coins are part of a series revolving around a particular theme. Take, for example, the Perth Mint’s Lunar Series, which celebrates the Chinese Zodiac with beautifully crafted designs. Each year introduces a new coin corresponding to the Chinese lunar calendar, making them highly anticipated and collectible.

In essence, collectible coins are a fusion of craftsmanship, artistry, and modern minting technology. They are often more accessible to the average collector and can be a delightful entry point into the world of coin collecting.

Numismatic and Collectible Risks

Numismatic and collectible coin markets are not without risks, demanding both caution and at least some level of expertise if an investor is not to be burned in the niche.

I’m now going to look at some of the common risks in both the numismatic and collectable worlds, where a new investor could potentially lose money if not careful.

Market Risks and Expertise: The value of numismatic and collectible coins can be volatile, often influenced by factors far beyond precious metal content — like collector demand, historical significance, and rarity. Expertise is crucial in assessing these variables. Without a deep understanding of the market, it’s easy to overpay or misjudge a coin’s future value – something I’ll look at in more depth later.

Counterfeits and Authenticity: A significant risk in numismatics is the prevalence of counterfeit coins. Authenticity verification is vital, requiring expert evaluation or certification by reputable grading services. Collectors need to be vigilant, as the sophistication of forgeries can sometimes deceive even seasoned enthusiasts.

Coin Grading Variances: Coin grading is both an art and a science, and subjectivity can come into play. Different graders might assess the same coin differently, leading to variances in grading that can significantly impact a coin’s perceived value and market price.

Refinished or Polished Coins: Another risk involves coins that have been refinished or polished. Such alterations can dramatically affect a coin’s value, often negatively. Grading services usually mark these coins as altered, which savvy collectors tend to avoid due to their reduced collectible value.

Navigating these risks requires a blend of knowledge, experience, and sometimes, the guidance of trusted professionals in the field. Nuances in coin grading is crucial for collectors to make informed decisions and avoid potential pitfalls in the numismatics market.

Market Abuse Focus: Mislabeling and Misleading Marketing

In the gold market, there’s a concerning ongoing trend where basic bullion coins are misleadingly marketed as collectibles. This practice can significantly impact unsuspecting investors, particularly in the realm of Gold IRAs.

It’s been an issue since gold IRAs first peaked in popularity after the crash of 2008 and it seems barely a year passes without a gold IRA specialist being sued by the FTC or a branch of law enforcement for selling bullion or IRA-eligible proof coins at grossly inflated prices, typically to seniors at a time when they will need their money most.

Some dealers will exploit the allure of the term ‘collectible’ by applying it to ordinary bullion coins. This can lead to inflated prices based on perceived rarity or future value appreciation, which often does not materialize.

What makes a collectible not a collectible?

In many cases a bullion dealer will buy a full mintage of a particular coin, or arrange a deal with a mint to be the sole seller of a coin. In theory this makes the coin rare, because you can only buy it at a certain dealer, but the reality is the coin is common bullion and the premium charged is pure profit.

This mislabeling and misleading marketing can be especially detrimental in Gold IRA investments – which is why we always recommend going with our top rated dealers such as our current Gold IRA Dealers of the Year.

Investors may end up paying excessively high premiums for coins that don’t hold their marketed value, adversely affecting the long-term growth potential of their retirement savings.

Awareness of this practice is crucial to avoid falling into such traps. It underscores the importance of thorough research and dealing with reputable and transparent sellers in the precious metals market.

Numismatics in Gold IRAs

The IRS is not a fan of collectibles when it comes to the tax-advantaged retirement account, with most collectibles being banned outright.

The IRS is not a fan of collectibles when it comes to the tax-advantaged retirement account, with most collectibles being banned outright.

On first read-through of IRS regulations it does seems that no gold collectibles are allowed, but this is not the case, even if including numismatic coins in a Gold IRA does require navigating specific IRS regulations.

Generally, the only numismatic coins allowed in Gold IRAs are certain types of proof coins – specifically proof American Eagles and Buffaloes. Although they are collectibles and even though their overall value is based on more than the intrinsic value of their gold content, the IRS lets them in – I assume for patriotic America-first reasons.

Restrictions and Considerations: When considering numismatic coins for an IRA, investors need to be aware of the higher premiums these coins typically carry. Thankfully in many cases the buy premium is also carried through to become a sell premium – but this is not a given.

While they can add diversity to an IRA, the cost versus potential return should be carefully weighed. Bearing in mind everything I’ve said so far, would your IRA be better served by common bullion tracking the price of gold, or a premium product with potential for greater increase – but also potential for greater losses?

Conclusion: Making an Informed Choice

To wrap it up, numismatic and collectible coins offer a fascinating venture into the world of precious metals, combining history, art, and investment – however the line between being an investor and a hobbyist is a thin, dangerous and expensive one!

My key takeaways? Do your homework, understand market risks, beware of counterfeits, and approach grading with a critical eye. Remember, not all that glitters is gold, and not all collectibles will glitter in terms of investment returns.

Tread carefully, only partner with reputable dealers (such as our Bullion Dealer of the Year winners), and always prioritize authenticity and historical significance over hype.

The numismatic and collectible coin market is as enriching as it is complex – a true adventure for the savvy investor – but it’s a danger that’s even sucked in an old cynic like me.

I personally began as a bullion-only girl but have been bitten HARD by the bug and now pay far over spot for grizzly old blackened silver bars from the early 1900s, and early period Islamic coins.

It’s a slippery slope. But it’s also damn good fun.

Alison Macdonald

Ask Ally, is your direct line to gold investment wisdom. Alison “Ally” Macdonald, with her extensive experience and sharp tongue, cuts through clutter to offer honest, insider takes on your gold investment questions.

Need insights or industry secrets? Ally’s ready to deliver, combining professional expertise with a smattering of Glasgow patter. Get ready for straightforward, expert guidance from a one-time gold shill turned good guy. Ask Ally Today

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Thank you Ally I didn’t actually expect you to answer let alone in such a comprehensive manner! Much appreciated!

You’re welcome Amelia!

Ally

Best write up I’ve seen on this thank you although I note you list some of the guys who sell the not-so-legit ‘collectables’

Thank you Jack! We try to list all companies in the market, regardless of their marketing methods – and let customer reviews do the talking