![]()

At Bullion Directory we want to help our users make informed choices and better understand gold’s role in a suitable retirement account (Gold IRA) by providing useful interactive gold IRA calculators.

Our full suite of calculators are available on our Gold Calculators page.

Simply click the required gold IRA calculator below to get started…

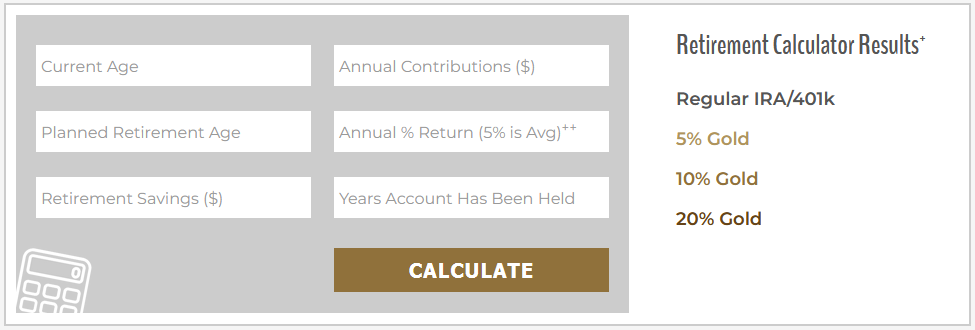

Gold IRA Comparison Calculator

This calculator will estimate your retirement account’s final value without gold and compare this with similar accounts maintaining a 5%, 10% and 20% gold allocation for the whole duration.

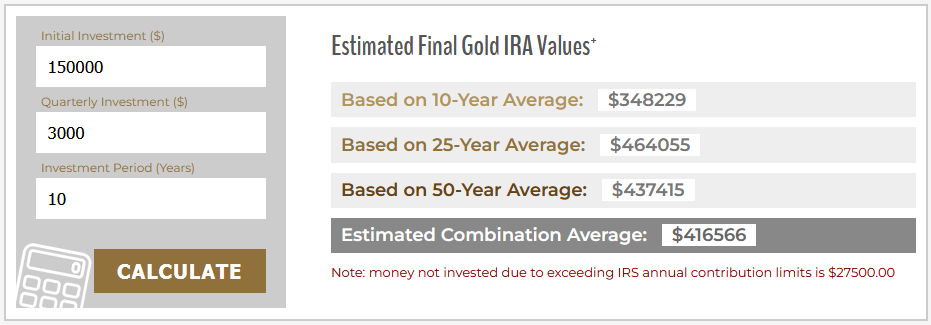

Gold IRA Accumulation Calculator

This calculator will estimate a gold IRA’s final value based on your initial investment, any quarterly additions allowing for IRS limits and uses historical price change data over 10-50 years.

Why the Need for Gold IRA Calculators?

In the U.S., Individual Retirement Accounts (IRAs) represent a significant part of retirement savings, offering tax advantages as outlined in IRS Publication 590. These accounts, supported by government tax incentives, encourage long-term investment for retirement.

The field of IRAs can be complex and you may hear conflicting information from different suppliers.

Whilst our gold IRA calculators make a good start, it’s important to fully understand the options available in the market. There are several types of IRAs, but Traditional and Roth IRAs are the most prevalent. Roth IRAs feature post-tax contributions with the benefit of tax-free withdrawals during retirement. On the other hand, Traditional IRAs allow for pre-tax contributions, with taxes applied upon withdrawal in retirement. For many, Traditional IRAs are preferable, especially if they anticipate a lower income and thus lower tax rate post-retirement.

Both IRA types offer greater wealth accumulation than standard taxable accounts due to their tax-efficient nature.

Additionally, SEP (Simplified Employee Pension) IRAs are a favorite among self-employed individuals and small business owners, while SIMPLE (Savings Incentive Match Plan for Employees) IRAs cater to small businesses with fewer than 100 employees.

IRA Overview

Traditional IRAs are widely utilized retirement plans that offer tax benefits on retirement savings. They are particularly suitable for individuals looking to save for retirement while also reducing their current tax liability.

Traditional IRAs are widely utilized retirement plans that offer tax benefits on retirement savings. They are particularly suitable for individuals looking to save for retirement while also reducing their current tax liability.

The taxation on these IRAs applies upon withdrawal, either before or during retirement, with early withdrawals incurring penalties unless under specific circumstances. The contributions to these IRAs are tax-deductible under certain conditions, relating to income and tax-filing status. Withdrawals post 59 ½ years of age are penalty-free, and mandatory distributions begin at age 73.

Roth IRAs

Roth IRAs are managed by individuals and funded with after-tax income, allowing tax-free growth and withdrawals.

Post 59 ½ years, withdrawals are penalty-free, and there’s no mandatory distribution within the owner’s lifetime, enabling continued tax-free growth. For calculations and more details, our Roth IRA Calculator can be a valuable tool.

SEP IRAs

SEP IRAs, established by employers, are simple to set up and maintain, making them ideal for small businesses and self-employed individuals.

Similar to Traditional IRAs in their tax treatment and growth, the contribution limits in 2023 are significantly higher – either 25% of income or up to $66,000. These plans feature immediate 100% vesting of proceeds, though they lack catch-up contributions for those over 50.

SIMPLE IRAs

Designed for small businesses, SIMPLE IRAs offer lower administrative costs compared to 401(k)s.

Employers have two options for matching employee contributions: a match up to 3% of compensation or a fixed 2% contribution. The annual limit for 2023 is $15,500 (or $19,000 for those over 50). It’s important to note the higher early withdrawal penalty of 25% compared to Traditional or Roth IRAs.

IRA Rollovers Explained

Qualified retirement plans like 401(k)s, 403(b)s, and others can be rolled over into Traditional IRAs without incurring taxes.

Qualified retirement plans like 401(k)s, 403(b)s, and others can be rolled over into Traditional IRAs without incurring taxes.

It’s crucial to report these rollovers on tax returns using specific IRS forms.

Rollovers provide similar investment options as the original plans and can be combined with ongoing contributions. Choices also exist to retain assets in previous employer’s plans or transfer to a new employer’s plan.

401(k) vs. Traditional IRA

Both Traditional IRAs and 401(k)s offer tax-deferred savings and are popular retirement plan choices.

In 2023, the contribution limits are $6,500 ($7,500 for over 50) for Traditional IRAs and $22,500 for 401(k)s, for those in the applicable income range. While similar in many ways, key differences include higher contribution limits and potential employer matching in 401(k)s.

Traditional IRAs, however, offer a broader range of investment options.

SEP and SIMPLE IRAs vs. Traditional IRAs

SEP and SIMPLE IRAs include employer matching, unlike Traditional IRAs.

These IRAs are tailored for smaller businesses that may not be able to offer 401(k) programs.

IRA Investment Choices

![]() IRAs, accessible through most financial institutions, offer a variety of investment options.

IRAs, accessible through most financial institutions, offer a variety of investment options.

Active investing in stocks, mutual or index funds, and robo-advisors are common choices, each with its own set of pros and cons. Some will allow annuities, land, REITs, or CDs, depending on individual preferences.

Where this gets interesting for Bullion.Directory users is that IRAs can also invest in precious metals – and this is the reason we built these free gold IRA calculators.

Self-Directed IRA (SD-IRA) Opportunities

SD-IRAs, constituting about 2% of all IRAs, allow investment in precious metals as well as a range of unique assets like private companies, real estate, and cryptocurrencies.

While offering flexibility, they do require more expertise and are subject to stringent IRS scrutiny – and this is why we only ever recommend dealing with Gold IRA specialists when adding physical precious metals to your retirement fund.

Note that certain investments, are prohibited in all IRAs, including life insurance, certain derivatives, and personal-use real estate.

Gold IRA Fees Versus Regular 401k/IRA Management Fees

The gold IRA calculators do not take into consideration management fees and other charges, which for a typical paper-asset based 401k or IRA tend to run from 0.5% to 5% depending on the level of holdings and services provided.

The gold IRA calculators do not take into consideration management fees and other charges, which for a typical paper-asset based 401k or IRA tend to run from 0.5% to 5% depending on the level of holdings and services provided.

Clearly these fees will have an impact on overall annual gains, especially if these gains are lower than the average 5%++

Gold IRAs or IRAs containing part of their investment basket in physical gold will also be subject to management fees and storage costs, however with the majority of our best-rated gold IRA providers these fees and costs are fixed, rather than percentage based, and typically total $80 – $250/year, with several leading companies charging zero set-up or storage fees.

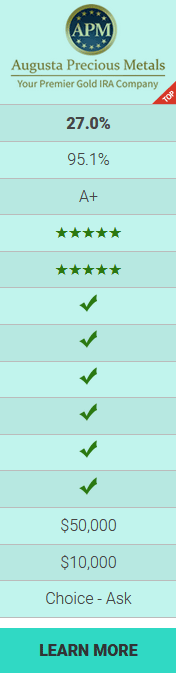

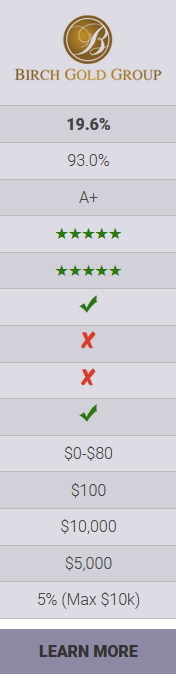

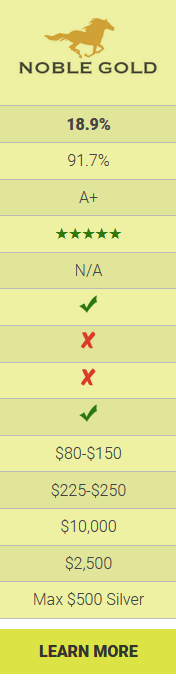

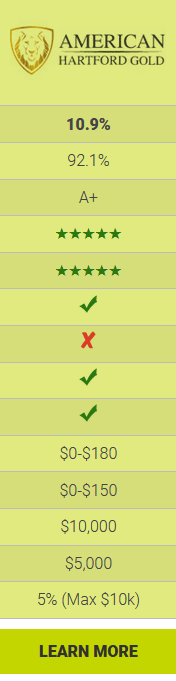

Bullion Dealer of the Year Winners Compared on Fees, Costs and Bonuses

The following table illustrates the low fees and sign-up bonuses that can be available to new investors with our current Bullion Dealers of the Year winners in the specialist Gold IRA category.

The following table illustrates the low fees and sign-up bonuses that can be available to new investors with our current Bullion Dealers of the Year winners in the specialist Gold IRA category.

As can be seen, annual fees and costs can be zero or significantly lower than regular percentage-based IRA charges seen across the whole market, meaning you keep more market gains where it matters – in your account!

Savings become even more apparent when considering bonus metals deals available as loss-leader incentives for new customers. These can range from $500 to $10,000 in bonuses depending on initial qualifying investment amounts.

*Free storage, free IRA set-up fees and free annual fees are available on qualifying accounts and under certain minimim order values – check with companies concerned

**Applies only to qualified orders with Goldco’s premium products. Get up to 5% back in FREE Silver when you invest $50,000 – $99,999. Get up to 10% in FREE Silver when you invest $100,000 or more. Cannot be combined with any other offer. Additional rules may apply.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.