Quick Estimator: Gold IRA Final Values with Quarterly Contributions

Simply fill your starting sum, estimated quarterly additions (DCA) and full years before your retirement.

The calculator will estimate+ your account’s final value based on historical price change data over the past 10, 25 and 50 years – plus an average of these averages. Dollar Cost Average investment sums over anticipated annual IRS annual limits are excluded and shown in red++

Note: If you do not wish to add regular quarterly sums type zero (0).

Estimated Final Gold IRA Values+

Based on 10-Year Average: $0

Based on 25-Year Average: $0

Based on 50-Year Average: $0

Estimated Combination Average: $0

Would the Dollar Cost Averaging Method of Investing Work in Your IRA?

![]() Dollar Cost Average investing is one of the most popular methods for retail investors to buy gold, making regular fixed-sum additions over a given term – ignoring short-term volatility while capitalizing on long-term compounding growth.

Dollar Cost Average investing is one of the most popular methods for retail investors to buy gold, making regular fixed-sum additions over a given term – ignoring short-term volatility while capitalizing on long-term compounding growth.

Where annual investments are over the IRS annual contribution threshold however, this method could leave sums uninvested – and this is where the calculator will show you how your plans will (or will not) work by clearly signposting monies not added.

Starting at $7000 (the contribution limit for 2024) the calculator will make allowances for an increasing limit over time based on past IRS changes++

If you find your proposed quarterly / annual investments are considerably over these thresholds, try and compare our non-IRA calculator based on the same data.

Of course, the tax-advantaged nature of a Gold IRA will have an impact on any plans you make, and these limits may be a price worth paying!

Gold IRA Fees and Charges

The retirement calculator does not take into consideration management fees and other charges, such as premiums over spot typical in all physical gold products.

The retirement calculator does not take into consideration management fees and other charges, such as premiums over spot typical in all physical gold products.

Gold IRAs or IRAs containing part of their investment basket in physical gold will be subject to set-up and management fees, plus storage and insurance costs, however with the majority of our best-rated gold IRA providers these fees and costs are fixed, rather than percentage based, and typically total $80 – $250/year, with several leading companies charging zero set-up or storage fees.

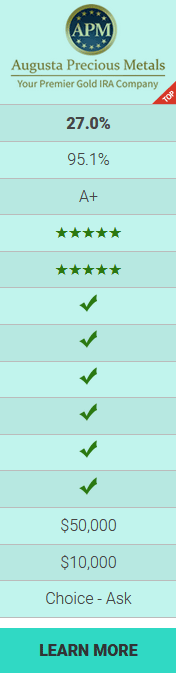

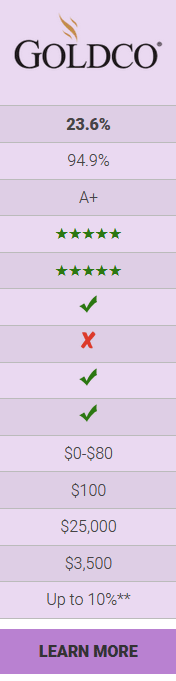

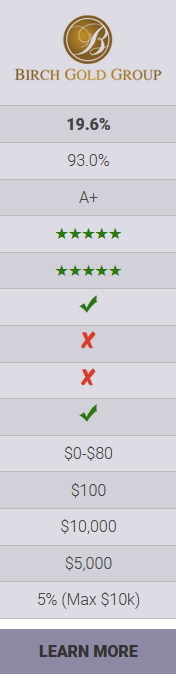

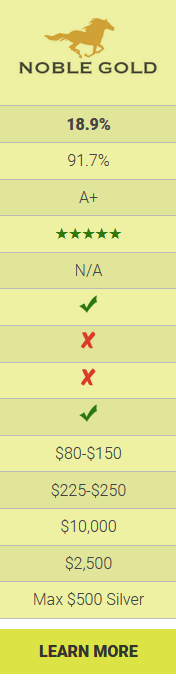

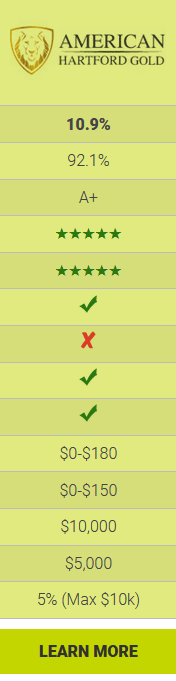

Bullion Dealer of the Year Winners Compared on Fees, Costs and Bonuses

The following table illustrates the low fees and sign-up bonuses that can be available to new investors with our current Bullion Dealers of the Year winners in the specialist Gold IRA category.

The following table illustrates the low fees and sign-up bonuses that can be available to new investors with our current Bullion Dealers of the Year winners in the specialist Gold IRA category.

As can be seen, annual fees and costs can be zero or significantly lower than regular percentage-based IRA charges seen across the whole market, meaning you keep more market gains where it matters – in your account!

Savings become even more apparent when considering bonus metals deals available as loss-leader incentives for new customers. These can range from $500 to $10,000 in bonuses depending on initial qualifying investment amounts.

*Free storage, free IRA set-up fees and free annual fees are available on qualifying accounts and under certain minimim order values – check with companies concerned

**Applies only to qualified orders with Goldco’s premium products. Get up to 5% back in FREE Silver when you invest $50,000 – $99,999. Get up to 10% in FREE Silver when you invest $100,000 or more. Cannot be combined with any other offer. Additional rules may apply.

This calculator does not offer personalized financial advice and does not take into account your individual circumstances, financial situation, or specific investment objectives. Any decisions made based on the output of this calculator are taken at your own risk. Bullion.Directory is not responsible for any financial losses or gains incurred as a result of using this tool. We strongly recommend consulting with a qualified financial advisor before making any investment decisions. A professional can provide personalized advice and a comprehensive investment strategy that aligns with your goals and risk tolerance.

++The calculator assumes an annual IRS contribution allowance starting at $7,000 for 2024, increasing by $500 each year. These figures are estimates and may not reflect actual future IRS allowances.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.