Silver production is failing to keep up with rising demand – but you wouldn’t know it by looking at the silver price.

![]() Bullion.Directory precious metals analysis 20 November, 2023

Bullion.Directory precious metals analysis 20 November, 2023

By Clint Siegner

Director of Money Metals Exchange

The presentation focused on silver’s expected role in the transition to green energy, but it included some interesting detail on the market in general.

According to the Institute’s press release, “Delegates asked Mr. Baker whether we will have enough silver for the green transition. He replied in the affirmative, explaining that while the silver market is currently in a structural deficit, above-ground stocks of silver will be mobilized to meet the demand.”

He added, however, that “there are no new significant silver deposit discoveries at present, and that geopolitical issues and mine permitting delays continue to be encumbrances to bringing new sources of mined silver supply to market.”

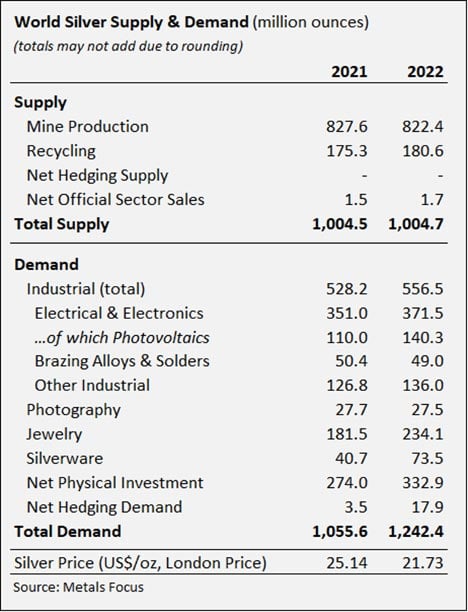

According to the 2023 World Silver Survey, demand outstripped supply in 2022 by nearly 238 million ounces – “possibly the most significant deficit on record.” Supply was about 20% short of what was needed to maintain equilibrium.

Silver demand rose in nearly all categories:

Meanwhile mine output fell versus the prior year – confirming what the Hecla CEO said about the difficulties miners face in bringing new production online.

It is getting harder to find high grade deposits, and it is more difficult and expensive to develop and operate a mine.

The structural deficit in silver has now run for two years consecutively. The shortfall was 50 million ounces in 2021. The massive imbalance between supply and demand should have generated an explosive move in the price last year, but it didn’t. The paper price of silver finished just 4% higher for the year.

The data for 2023 won’t be available for months, but another deficit is likely this year – making it the third consecutive year of deficits.

The shortfall must be met by pulling silver from above-ground supplies. There are well less than 2 billion ounces available on exchanges and other publicly disclosed silver stockpiles across the globe, and, beyond that, the amount of silver in the form of coins, bars, rounds, silverware, and other scrap is less known.

To be sure, the massive supply of paper silver contracts that can be created on the trading exchanges – especially with the use of leverage – does create the potential for abuse, manipulation, or price dislocations.

However, with silver demand outpacing new mine supply each year, these supply deficits seem likely to put upward pressure on the silver price in the coming years.

In the end, actual physical silver, not paper, is required to satisfy physical demand.

Clint Siegner

Clint Siegner is a Director at Money Metals Exchange, a precious metals dealer recently named “Best in the USA” by an independent global ratings group.

A graduate of Linfield College in Oregon, Siegner puts his experience in business management along with his passion for personal liberty, limited government, and honest money into the development of Money Metals’ brand and reach. This includes writing extensively on the bullion markets and their intersection with policy and world affairs.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Just read this and I’m amazed at the silver market dynamics! The gap between demand and supply is a clear indicator of silver’s potential value surge. It’s interesting to consider how this might affect prices in the near future. Definitely keeping an eye on this!

The rising demand for silver, especially in industrial sectors, is a bullish sign. However, I’m curious about the environmental and ethical aspects of silver mining given this growing demand. How sustainable is this trajectory in the long run?

While the demand-supply gap in silver is notable, I wonder how market forces and investor behavior will respond. History has shown that market predictions are often tricky. Could there be factors we’re overlooking that might impact silver differently?