The recent FOMC minutes confirm the Fed’s commitment to curb inflation and, apparently, gold prices.

Bullion.Directory precious metals analysis 13 October, 2022

Bullion.Directory precious metals analysis 13 October, 2022

By Arkadiusz Sieroń, PhD

Lead Economist and Overview Editor at Sunshine Profits

Well, if these economic geniuses hadn’t maintained for several months that inflation would be transitory and acted sooner, we wouldn’t have the current problem. Thus, Fed officials have to be very hawkish right now, simply because they let the inflationary genie get away.

Hence, “participants reaffirmed their strong commitment to returning inflation to the Committee’s 2 percent objective, with many stressing the importance of staying on this course even as the labor market slowed.” It means that the Fed is not likely to reverse its stance immediately when the unemployment rate increases.

The softening of the labor market is expected or even desired by the FOMC participants, so they will react only to a surprisingly strong deterioration, which is bad news for the gold bulls.

The Labor Market Shows Resilience

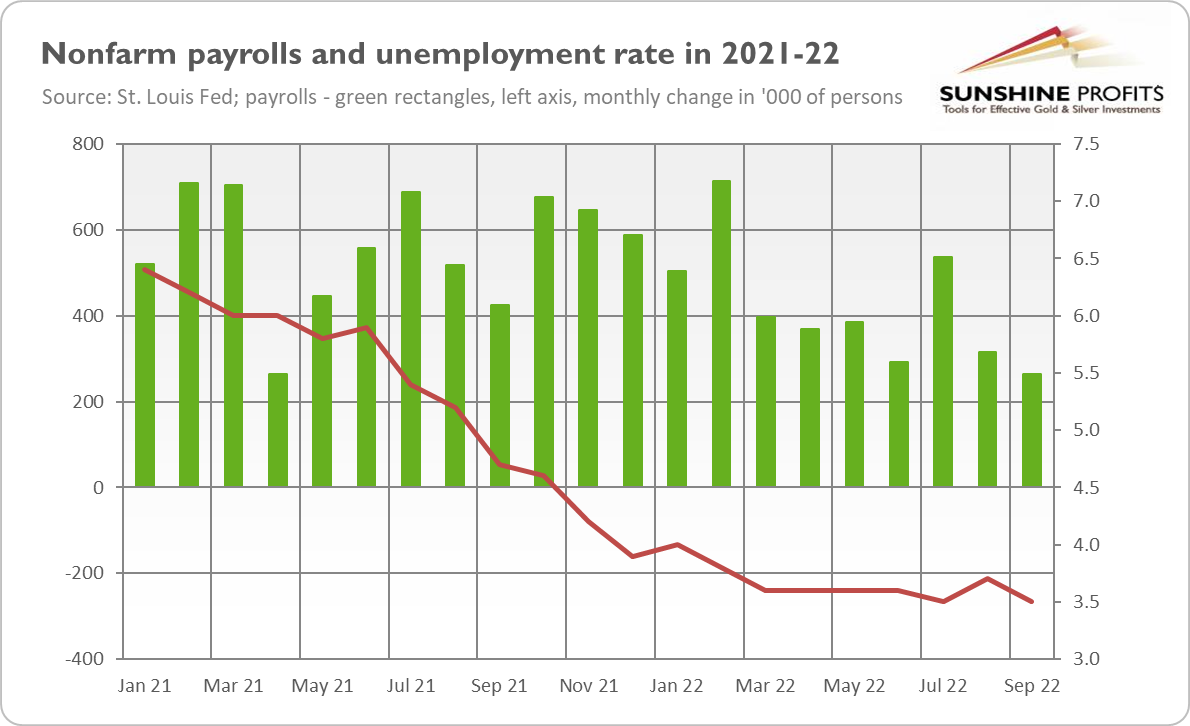

The US labor market added 263,000 jobs in September, according to the BLS. The number was lower than in August (+315,000) and came slightly below expectations (275,000). However, job growth has averaged 420,000 per month this year and the U.S. labor market continues to show resilience during the Fed’s tightening cycle.

What’s more, the unemployment rate declined from 3.7 to 3.5%, as the chart below shows. The drop was largely caused by a decline in labor participation, but the labor market remains relatively tight, allowing the Fed to hike the federal funds rate again. Hence, gold prices could remain under downward pressure.

Implications for Gold

What does it all mean for the gold market? Well, the recent FOMC minutes don’t offer any dovish hopes. Although participants acknowledged that “as the stance of monetary policy tightened further, it would become appropriate at some point to slow the pace of policy rate increases,” this is still a matter of the distant rather than near future.

Sure, we’re moving to the peak, but the Fed remains concerned about high inflation and seems really determined to lower it.

They see the labor market as very tight and inflation as broad-based and unacceptably high. Given such an outlook and the upside inflationary risk, FOMC members “continued to anticipate that ongoing increases in the target range for the federal funds rate would be appropriate to achieve the Committee’s objectives.” After all, the tightening so far hasn’t reduced inflation, which is staying at a higher level than expected:

Most participants remarked that, although some interest-sensitive categories of spending—such as housing and business fixed investment—had already started to respond to the tightening of financial conditions, a sizable portion of economic activity had yet to display much response. They noted also that inflation had not yet responded appreciably to policy tightening and that a significant reduction in inflation would likely lag that of aggregate demand.

What’s more, Fed officials believe that current aggressive monetary policy is the best strategy, even if the labor market softens, as it would be better to be too hawkish than too dovish right now. As perhaps the most important part of the FOMC minutes states,

In light of the broad-based and unacceptably high level of inflation, the intermeeting news of higher-than-expected inflation, and upside risks to the inflation outlook, participants remarked that purposefully moving to a restrictive policy stance in the near term was consistent with risk-management considerations.

Many participants emphasized that the cost of taking too little action to bring down inflation likely outweighed the cost of taking too much action. Several participants underlined the need to maintain a restrictive stance for as long as necessary, with a couple of these participants stressing that historical experience demonstrated the danger of prematurely ending periods of tight monetary policy designed to bring down inflation.

As the chart below shows, gold was slightly moved by both the nonfarm payrolls and the FOMC minutes, and remains traded below $1,700. Although the minutes didn’t include any big surprises, they are hawkish and offer no clear hope for the gold bulls.

It means that the price of gold could go lower further in the near future. Gold will rebound one day, but it’s not likely to occur before the Fed pauses or reverses its stance amid an economic slowdown or outright recession.

It’s going to arrive, but not right now. Winter is coming, but it won’t come before the fall is over.

Arkadiusz Sieroń

Arkadiusz Sieroń – is a certified Investment Adviser, long-time precious metals market enthusiast, Ph.D. candidate and a free market advocate who believes in the power of peaceful and voluntary cooperation of people.

He is an economist and board member at the Polish Mises Institute think tank, a Laureate of the 6th International Vernon Smith Prize and the author of Sunshine Profits’ bi-weekly Fundamental Gold Report and monthly Gold Market Overview.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply