Job creation disappointed in December. However, it could not be enough to counterweight rising real interest rates and save gold.

Bullion.Directory precious metals analysis 11 January, 2022

Bullion.Directory precious metals analysis 11 January, 2022

By Arkadiusz Sieroń, PhD

Lead Economist and Overview Editor at Sunshine Profits

This is because the minutes revealed that the Fed would be ready to cut its mammoth holdings of assets later this year.

Previously, the US central bank was talking only about interest rate hikes and the ending of new asset purchases, i.e., quantitative easing. Now, the reverse process, i.e., quantitative tightening, is also on the table.

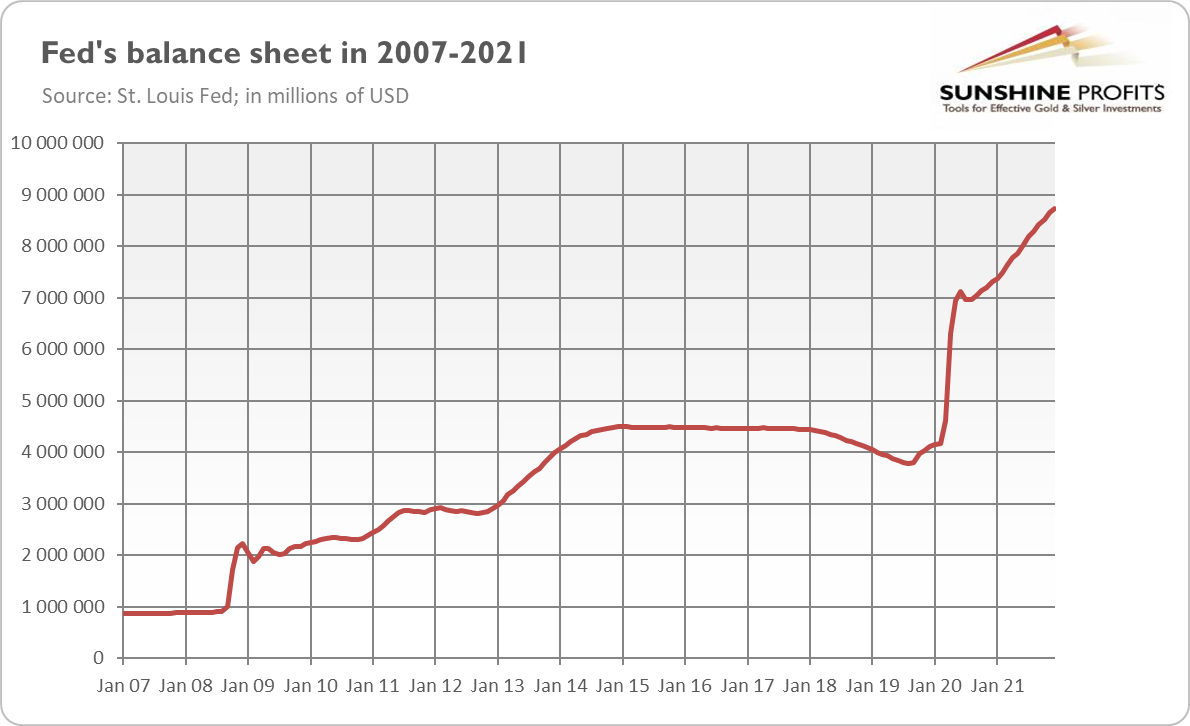

What is surprising here is not the mere idea of shrinking the Fed’s assets – after all, they have risen to $8.7 trillion (see the chart above) – but its timing. Last time, the central bank started the normalization of its balance sheet only in 2018, nine years after the end of the Great Recession and four years after the completion of tapering.

This time, QT may start within a few months after the end of tapering and the first interest rate hikes. It looks like 2022 will be a hot year for US monetary policy – and the gold market.

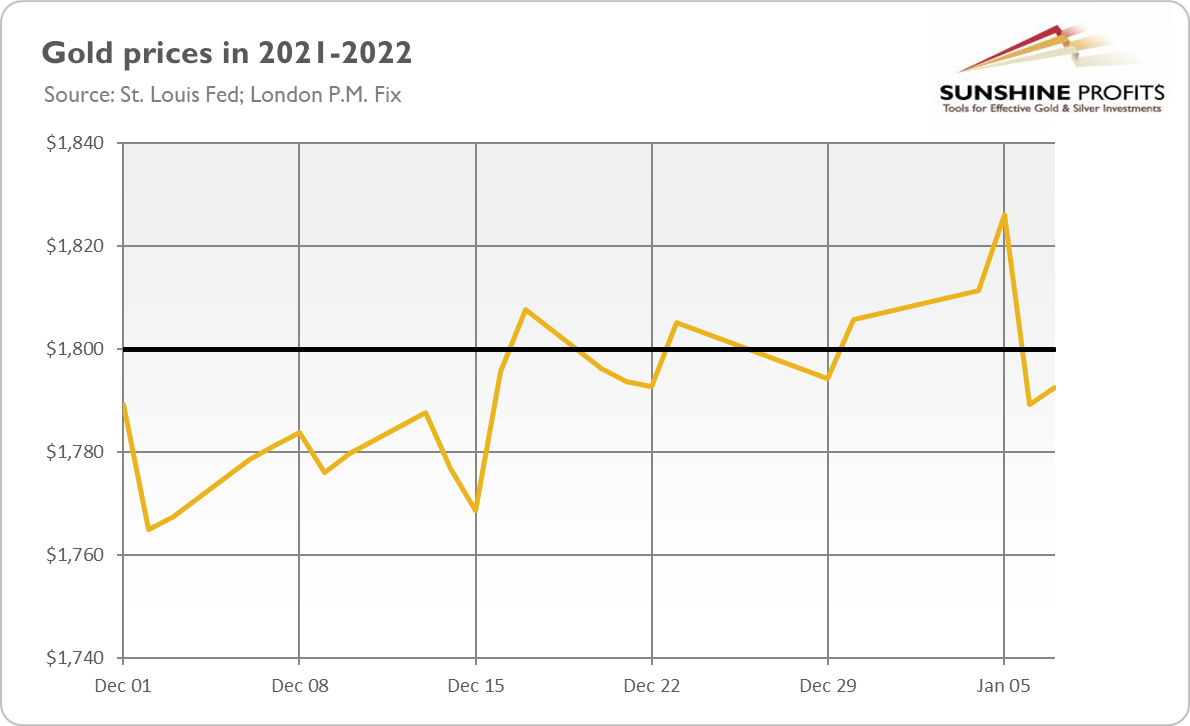

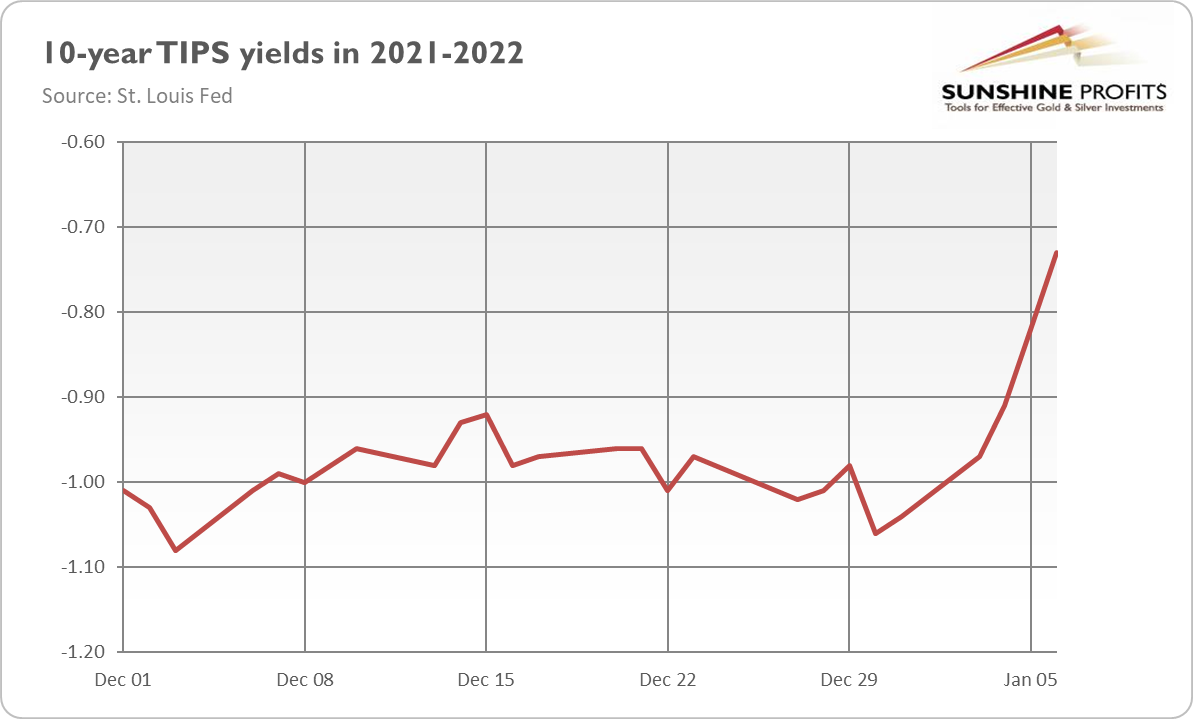

Consequently, markets have been increasingly pricing in a more decisive Fed, which boosted bond yields. As the chart below shows, the long-term real interest rates (10-year TIPS) jumped from -1.06% at the end of 2021 to -0.73 at the end of last week. The upward move in the interest rates is fundamentally negative for gold prices.

Implications for Gold

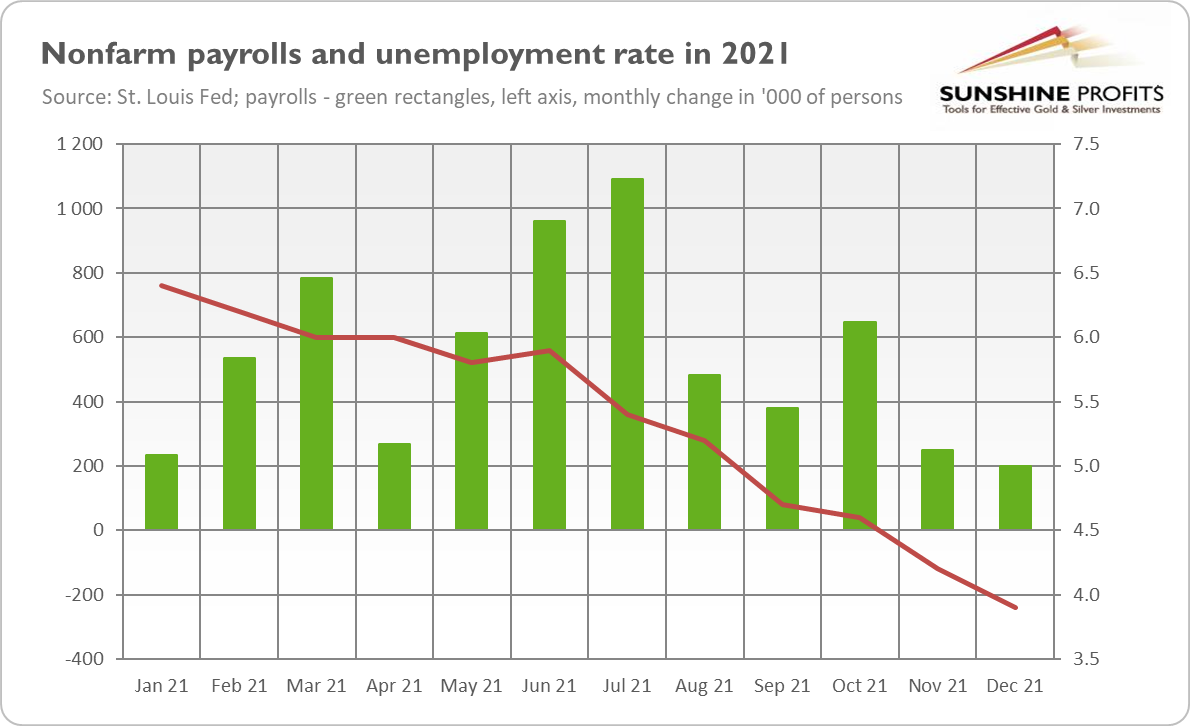

Luckily for the yellow metal, nonfarm payrolls disappointed in December. Last month, the US labor market rose, adding just 199,000 jobs (see the chart below), well short of consensus estimates of 400,000. This negative surprise lifted gold prices slightly on Friday (January 7, 2021). The latest employment report suggests that labor shortages and the spread of the Omicron variant of coronavirus are holding back job creation and the overall economy.

However, gold bulls shouldn’t count on weak job gains to trigger a sustainable rally in the precious metals. This is because the American economy is still approaching full employment. The unemployment rate declined further to 3.9% from 4.2% in November, as the chart below shows.

The drop confirms that the US labor market is very tight, so weak job creation won’t discourage the Fed from hiking the federal funds rate. As a reminder, in December, FOMC members forecasted the unemployment rate to be 4.3% at the end of 2021. What is crucial here is that disappointing job gains reflect labor shortages rather than weak demand.

Additionally, wage growth remains pretty fast, despite the decline in the annual rate from 5.1% in November to 4.7% in December.

The key takeaway is that, despite disappointing job creation, the US economy is moving quickly towards full employment. The unemployment rate is at 3.9%, very close to the pre-pandemic low of 3.7%. Hence, the latest employment situation report may only reinforce arguments for the Fed’s tightening cycle.

This is fundamentally bad news for gold, as strengthened expectations of the interest rate hikes may boost real interest rates further and put the yellow metal under downward pressure.

Some analysts believe that hawkish sentiment might be at its peak. I’m not so sure about that. I believe that monetary hawks haven’t said the last word yet, and that the normalization of the interest rates is still ahead of us. Anyway, Powell will appear in the Senate today, so we should get more clues about the prospects for monetary policy and gold this year.

Arkadiusz Sieroń

Arkadiusz Sieroń – is a certified Investment Adviser, long-time precious metals market enthusiast, Ph.D. candidate and a free market advocate who believes in the power of peaceful and voluntary cooperation of people.

He is an economist and board member at the Polish Mises Institute think tank, a Laureate of the 6th International Vernon Smith Prize and the author of Sunshine Profits’ bi-weekly Fundamental Gold Report and monthly Gold Market Overview.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply