Gold Prices ‘Set to Rise 9%’ in 2020 on Weak US Fed Policy

Bullion.Directory precious metals analysis 29 January, 2020

Bullion.Directory precious metals analysis 29 January, 2020

By Adrian Ash

Head of Research at Bullion Vault

European stock markets extended their rally, and commodities led by copper and crude oil also rose again after plunging on news of the coronavirus outbreak in No.1 natural-resources importer, China.

Over the last month, betting on where Fed interest rates will stand at the end of 2020 has seen a strong rise in rate-cut expectations as betting on the Fed making no change has halved, according to data from the CME derivatives exchange.

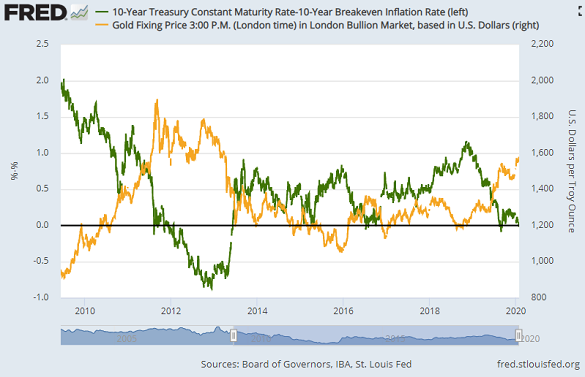

Ten-year US Treasury yields on Wednesday tested last week’s 3-month lows at 1.62% per annum, holding below both the current US Fed overnight rate of 1.75% and also the latest reading of US consumer-price inflation at 2.3%.

Adjusted for inflation expectations, the path of 10-year T-bond yields typically shows a strong negative correlation with Dollar gold prices.

alt=”Chart of real 10-year US Treasury yields vs. gold price. Source: St.Louis Fed” />

alt=”Chart of real 10-year US Treasury yields vs. gold price. Source: St.Louis Fed” />

“After posting its best annual performance since 2010 last year,” says a note from independent consultancy Metals Focus, “gold started 2020 on a strong note as well” thanks to the US-Iran conflict and then China’s coronavirus outbreak.

Both events threaten to “negatively impact global growth,” Metals Focus says, and “against this backdrop, risk assets have suffered and defensive instruments, such as gold and US Treasuries, have benefitted.

“Going forward, even if prevailing concerns fade, from a wider macroeconomic perspective, gold is likely to continue benefiting from supportive central bank policies,” the consultancy concludes, forecasting an annual average gold price of $1515 per ounce – a rise of 9% from last year’s daily average – with a peak of $1650 hit late in 2020.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply