2-3 Year Bull Market in Gold Bullion ‘to Start Late-2019’ on Dollar Decline, End of Fed Rate Hikes

Bullion.Directory precious metals analysis 18 December, 2018

Bullion.Directory precious metals analysis 18 December, 2018

By Adrian Ash

Head of Research at Bullion Vault

With the Fed’s 2-day meeting starting today, and with New York’s S&P500 index now 7.0% lower from this time last month, Asia and European equities lost another 1% on average by lunchtime in London.

The odds of 3 or more Fed hikes between now and this time in 2019 have dropped from 37.8% to just 10.3% according to speculative betting on CME interest-rate futures.

“A lot of investors are expecting that the Fed will defer interest rate hikes and may not look to raise them quickly,” Reuters quotes one Singapore gold bullion dealer.

“For much of 2018, investors tended to focus on other, higher-yielding asset classes [than gold],” says a note from specialist analysts Metals Focus, “but we do expect this position to gradually change, especially during the latter part of 2019…[as] a slowdown in the US economy will encourage the Fed to adopt a far more dovish stance towards its interest rate policy.”

Forecasting that “a bull market in gold [will] emerge from late 2019 onwards,” Metals Focus think that uptrend will then “remain in place for two to three years.”

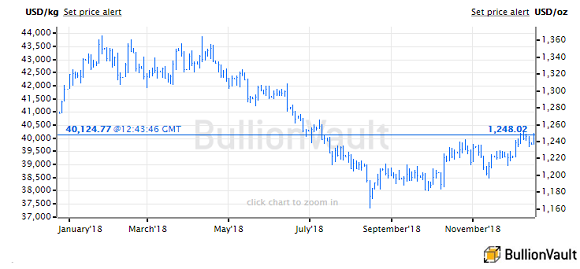

Investment and bullion bank J.P.Morgan also expects gold prices to remain “neutral” over the first half of 2019 between $1200 and $1250 an ounce but “in the final three months of the year gold will finally start to shine and make a push towards $1400.”

Again, J.P.Morgan points “expectations for a Fed pause” next year led by an economic slowdown. That in turn will lead real interest rates – adjusted by inflation – “to potentially begin to move lower, exciting gold prices.”

“We expect the US Dollar index [against a basket of other major currencies] to weaken by about 6.5% in 2019,” says Swiss bullion bank UBS’s Global Macro Strategy team, saying that its “overarching views” see non-US interest rates as being too low while the Dollar “is fundamentally expensive”.

With the Bank of England due to announce its latest rates policy Thursday, the British Pound meantime hit a 1-week high versus the Dollar and a 2-session high versus the Euro today, even as the UK Government met to discuss accelerating plans for a “No deal hard Brexit” next March.

That capped the price of wholesale gold bullion for UK investors beneath last week’s finish of £984 per ounce.

Euro gold prices also retreated to last Friday’s finish, erasing yesterday’s 0.5% gain after briefly rising above €1100 per ounce – a 6-month high for bullion when first reached last Tuesday.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply