Gold Price Hits Mid-July Highs as China Stimulus ‘Fades Fast’ and ‘Spreadonomics’ Hit Italy

Bullion.Directory precious metals analysis 23 October, 2018

Bullion.Directory precious metals analysis 23 October, 2018

By Adrian Ash

Head of Research at Bullion Vault

Gold prices came within 40 cents of $1240 per ounce – adding 6.8% from August’s plunge to start-2017 levels – as geopolitical tensions rose with Turkey’s President Erdogan detailing what Ankara’s intelligence services claim is the “naked truth” about the Saudi murder in Istanbul of US-based journalist Jamal Khashoggi.

Silver yet again failed to follow gold higher, trading up to only 1-week highs at $14.80 per ounce as crude oil hit 1-month lows and other industrial commodities fell.

Shanghai’s CSI 300 index lost 2.7% and the Yuan dropped to new 21-month lows versus the Dollar even as Beijing followed the weekend’s raft of supportive measures and promises with new support for private debt and another $17 billion “liquidity injection” of short-term loans to commercial lenders.

“Nobody expected the policy effect to fade out so soon,” the South China Morning Post quotes one Hong Kong analyst.

“The last two weeks of steep correction indicate that the A-share market is in panic mode,” says brokerage CLSA in a note on China’s domestic Yuan-denominated equities.

The price of wholesale gold bullion bars rose faster still on Tuesday for non-US investors, gaining 1.3% for the week so far in Euro and Sterling terms as the EuroStoxx 600 index fell 1.1% and London’s FTSE-100 fell below the 7,000 mark – a new record high when first reached this March.

Wall Street futures put the S&P500 on track to open lower yet again, heading for its 14th loss in 17 sessions so far this October.

Alongside gold prices, developed-world government bond prices also rose, cutting the cost of borrowing for Western governments. But Asia, Africa, East Europe and Latin America bond prices fell, adding extra stress to emerging-market borrowers.

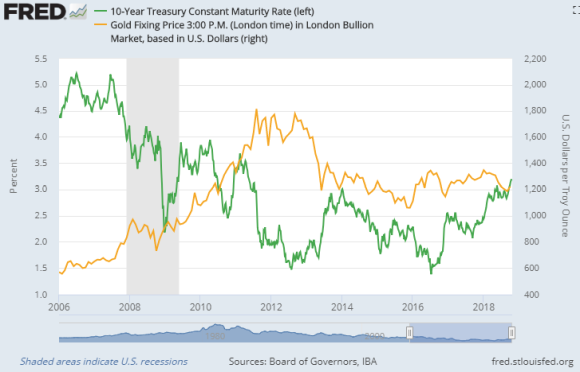

The flight into Treasuries drove the 10-year US bond yield down another 5 basis points to 3.15%, almost one-tenth of a percentage point below this month’s new 7-year highs.

Italy’s bond yields also eased back on Tuesday but not as fast as other Eurozone markets after Rome’s Council of Ministers approved the left-right coalition government’s 2019 budget plans, including the “Quota 100” early retirement scheme, requiring 38 years of state-pension contributions.

Life expectancy in Italy currently stands above 83 years old, and is forecast to keep rising.

Rome’s spread over German Bund yields today rose back above 300 basis points – the 5-year high reached last month – and the spread over Spain’s borrowing costs rose back near this month’s 20-year high.

“The ‘spreadonomics’ is unforgiving,” says Italian financial newspaper Il Sole 24 Ore, “and governments cannot free themselves from the judgment of investors.”

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply