Gold Bullion Touches ‘Hurdle at $1356’ as Dollar Falls, Tokyo Equities Join Correlation Break

Bullion.Directory precious metals analysis 15 February, 2018

Bullion.Directory precious metals analysis 15 February, 2018

By Adrian Ash

Head of Research at Bullion Vault

The Dollar fell again, with the single currency Euro briefing touching $1.25, just shy of end-January’s 3-year high.

Snapping a typically strong inverse relationship with interest rates on US bonds, Dollar gold prices have now gained 4.5% since the start of 2018, even as 2-year Treasury yields have risen by a quarter of one percentage point to reach the highest level in nearly a decade.

Tokyo’s stock market also broke a typically strong inverse correlation on Thursday, rising sharply despite a fresh 14-month high in the Japanese Yen’s exchange-rate with the Dollar.

US stock markets opened higher, extending yesterday’s post-inflation data surge, but European equities cut their earlier gains for the day back to 0.7%.

“The Yen, which no-one is focusing on, makes me more nervous,” says the ever-gloomy Albert Edwards, strategist at French investment bank Societe Generale.

“Huge speculative Yen shorts have been accumulated at a technically important moment,” says Edwards.

“That makes it far more likely the Dollar will fall and the Yen quickly surge” now that a multi-year uptrend in the Dollar’s Yen value has been broken at the ¥107.9 level.

Priced in the Yen, the US Dollar fell Thursday beneath ¥106.4, down some 5.7% for 2018 so far.

Bets on US Fed interest rates rising 4 times or more to end 2018 at 2.25% or above have now swollen by one-third from this time last month, totalling over 6-in-10 of all speculative bets according to data from futures exchange the CME.

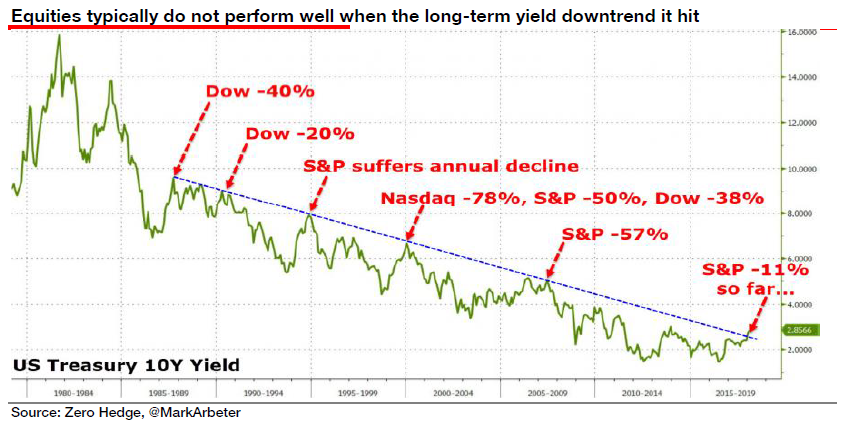

“Kissing this downtrend [in 10-year US bond yields] has typically been very bad news indeed for equity markets,” says Edwards at SocGen.

“Whatever the arguments are in favour of tax reform in the US (and there are many),” Edwards adds, blaming Donald Trump’s new budget for worsening the inflation scare and sell-off in bonds, “this is probably the singularly most irresponsible macro-stimulus seen in US history.

“To say it is ill-timed and ill-judged would be a massive understatement.”

With the US Dollar falling again Thursday, the price of gold touched 3-week highs at $1356 per ounce but slipped in terms of other currencies.

The UK gold price in Pounds per ounce retreated £5 from Wednesday’s spike to 1-month highs above £968.

Gold priced in Euro terms fell €5 from its highest since 25 January at €1090 per ounce.

Closing “sharply higher” on Wednesday, Dollar gold prices now face “new resistance at $1357.60, the September high,” says the latest technical analysis from bullion bank Scotia Mocatta‘s New York office.

“Gold has tested the overnight high of $1355 a couple of times,” says Swiss refiner MKS Pamp’s Asian trading note, “[but] volumes are pretty thin with [Shanghai] closed for Chinese New Year.

“On the topside, a break above yesterday’s New York high should see the metal testing the January [intraday] high at $1365.”

“[After] gold failed to confirm the [longstanding and potentially bullish] multi-year inverse Head and Shoulders [pattern] at $1356,” says a note from Albert Edwards’ technical analysis colleagues at SocGen, posted before Wednesday’s inflation-data spike, “it has started staging a recovery and has crossed above a descending trend.

“The next hurdle [still comes] at $1356.”

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply