Precious Metals Market Report

Tuesday 4 April, 2017

Fundamentals and News

U.S. Stocks Decline as Auto Sales Trail Estimates: Markets Wrap

(Bloomberg)

Stocks fell Monday after auto manufacturers reported worse-than-expected U.S. sales for March.

The S&P 500 Index was down 0.42 percent 2,351.58 at 1:51 p.m. in New York, while the Dow Jones Industrial Average fell 0.35 percent to 20,590.19. Auto retailers, auto manufacturers and auto parts and equipment makers were the three worst performing industry groups in the S&P 500. Ford Motor Co. dropped 2.63 percent, General Motors Co. declined 3.95 percent and Fiat Chrysler Automobiles NV lost 4.89 percent.

“Sales are under forecast and there were a lot of incentives during the month,” Michelle Krebs, an analyst with Autotrader.com, said in an interview. “Before long, we will see more production cuts.”

South Africa’s rand slumped for a sixth day after Standard & Poor’s cut the country’s currency rating to junk. Last week, finance Minister Pravin Gordhan was dismissed in a political shake-up. The currency plummeted 2.3 percent on the news.

As the second quarter gets going, political developments threaten to cloud the improving global economic outlook. This week, the Federal Reserve is scheduled to release the minutes of its previous meeting and the non-farm payrolls report is due. Earlier Monday, the Institute for Supply Management released data showing that factories continued to expand production at a robust pace in March.

“Bottom line, this is another sentiment indicator that is bullish on growth but again it just reflects the direction of change, not the degree,” Peter Boockvar, chief market analyst at the Lindsey Group, wrote in a note Monday.

Fed speakers include Dudley and Governor Daniel Tarullo. Minutes from the March meeting, which are scheduled to be released April 5, should put their recent public comments into perspective. Minutes are also due from the European Central Bank’s latest gathering.

India’s central bank also will probably hold rates firm. Inflation numbers are due from Thailand, South Korea and the Philippines.

The Nasdaq 100 Index fell 0.31 percent and the Russell 2000 Index was down 1.17 percent.

The Stoxx Europe 600 dropped 0.49 percent, after increasing 5.5 percent for the first three months of the year, the best quarter in two years.

The MSCI All Country World Index was down roughly 0.5 percent.

The Bloomberg Dollar Spot Index was up 0.1 percent.

Britain’s pound fell 0.59 percent to $1.2476 after the worse-than-expected manufacturing data, and the euro advanced 0.15 percent to $1.0669.

The ruble retreated 0.1 percent to 54.32 versus the dollar. About 10 people were killed and 20 injured in the subway blast, according to the Interfax news agency.

WTI crude was fell 0.61 percent to $50.29 a barrel. Crude stockpiles are starting to decline in a sign that the production cuts implemented this year are bringing the market to balance, according to OPEC’s Secretary-General Mohammad Barkindo.

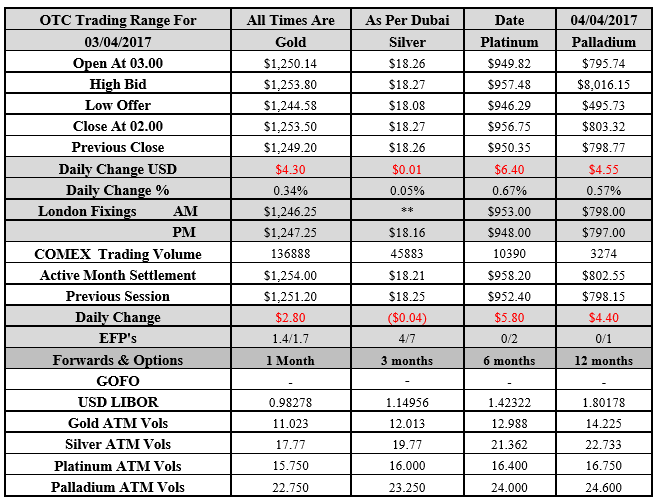

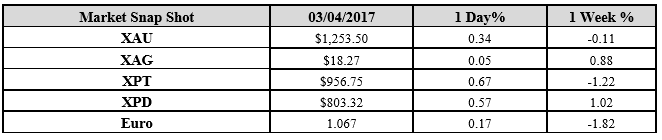

Gold gained 0.27 percent to $1,254.60 per ounce. The metal has alternated between gains and losses for the past six days.

(*source Bloomberg)

Data – Forthcoming Release

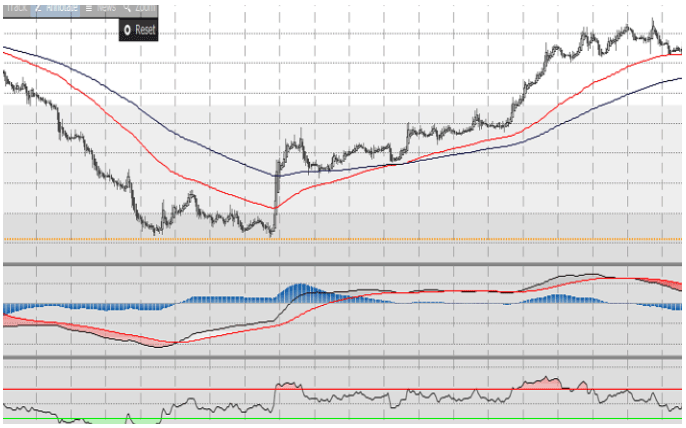

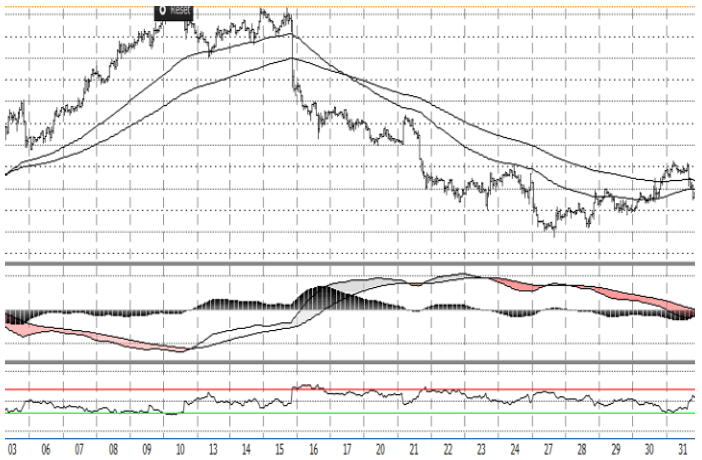

Technical Outlook and Commentary: Gold

Gold for Spot delivery was closed at $1253.5 an ounce; with gain of $4.30 or 0.34 percent at 1.00 a.m. Dubai time closing, from its previous close of $1249.2

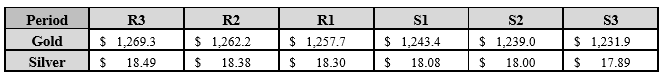

Spot Gold technically seems having resistance levels at 1257.7 and 1262.2 respectively, while the supports are seen at $1243.4 and 1239.0 respectively.

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $18.27 an ounce; with gain of $0.01 or 0.05 percent at 1.00 a.m. Dubai time closing, from its previous close of $18.26

The Fibonacci levels on chart are showing resistance at $18.30 and $18.38 while the supports are seen at $18.08 and $ 18.00 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply