GoldLONG

The combination of rhetoric on a Federal Reserve rate within the next two months and traders unwinding their historically high (5-year average) net-long positioning did not help price action.

However, as gold was selling off into the weekend, fund flows data showed that $454M was added into GLD (indicating that traders are willing to buy on the discount).

Risk assets received a boost on light volume during Monday’s trading session; but as North American traders come back online from the banking holiday, the sharp rise in futures could be seen as am opportunity to sell.

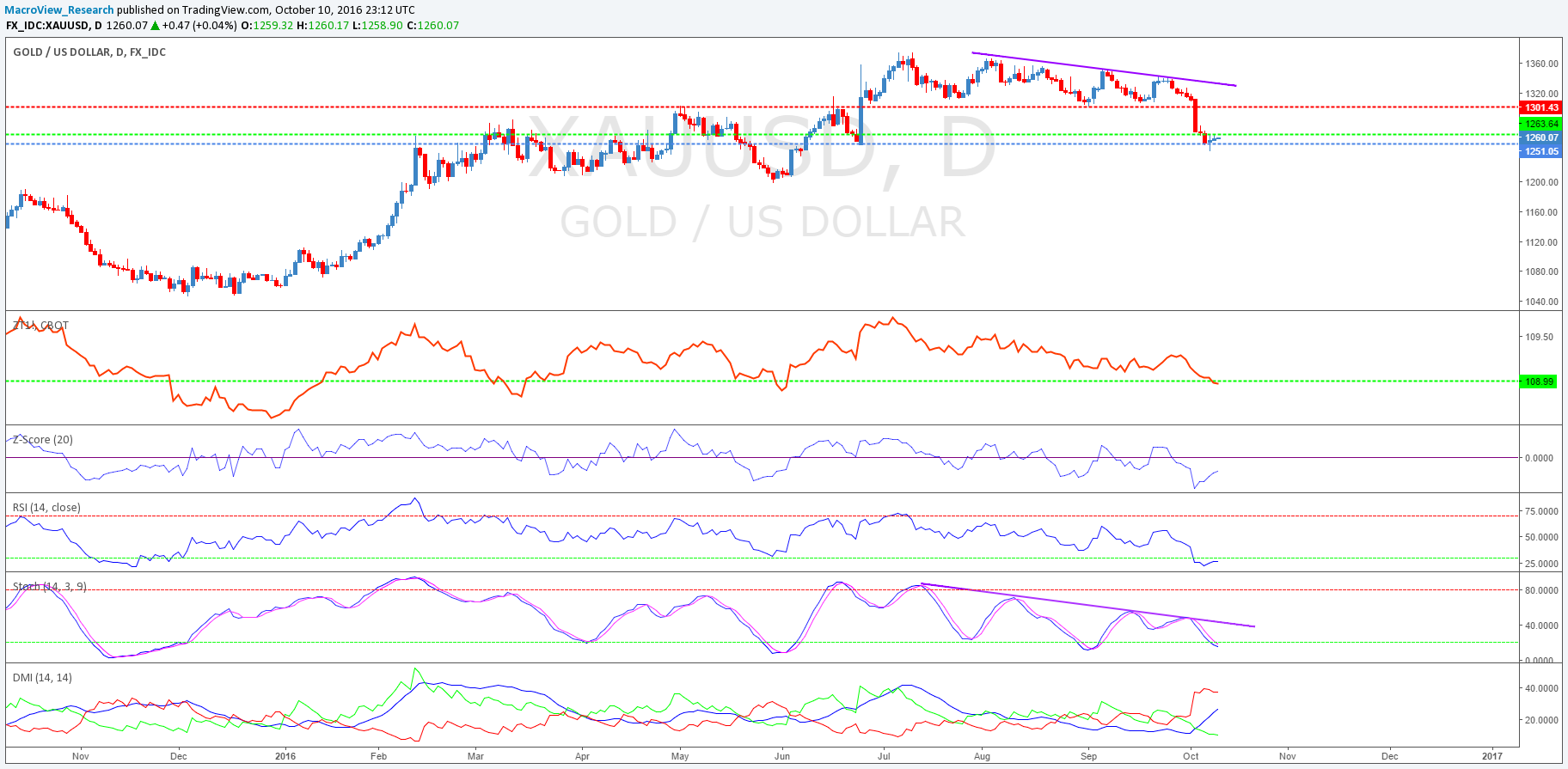

We expect gold to benefit and attempt $1,267-70 over the next few days. Both the RSI and z-score are moving in the right direction, and stochastics are suggesting a potential bullish cross which should aid in gold’s ascent.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply