If you’re like most Americans, one of the biggest factors that affected how you chose to vote this past year was the economy, specifically your personal economy.

Bullion.Directory precious metals analysis 30 January, 2025

Bullion.Directory precious metals analysis 30 January, 2025

By Peter Reagan

Financial Market Strategist at Birch Gold Group

It was to remind everyone about what the campaign needed to focus on in that election.

And, as you’ll remember, they won that election.

Jumping back to our present day, most Americans felt a lot of pain every time that they went to the grocery store after four years of Bidenomics, and that was a primary driver of Donald Trump’s win of the White House again.

Obviously, most everyone wants the economy under Trump to do a complete turnaround and to actually feel prosperous again instead of having to hear more lectures about the greatest economic recovery in world history.

Especially when the typical American family feels the opposite.

We don’t need to be told when we’re doing great…

…we need to actually be able to provide for ourselves and our families.

And many people are (understandably) optimistic about the economy with Trump back in office. I hear you. So it’s worthwhile to ask an important question…

What can we expect the economy to be like in 2025?

The answer: Not as rosy as we’d like.

The fact of the matter is that four years of Bidenomics won’t be quick to rebound from, and Trump can’t simply snap his fingers and make it all go away.

I wish that he could, believe me.

The unfortunate news is that we’re looking at a bumpy ride this year as the Trump administration works to get the U.S. economy back on track to growth and prosperity. L.C. Leach III, for The Epoch Times, writes:

If 2024 was anxious, uneasy, apprehensive, or too often perturbing because of worker shortages, political unrest, and ongoing inflation, the new year might prove more stable and uplifting, if you can handle the continued bumpiness—that is the view of several national expert economists heading further into 2025.

Remember, though, that economists aren’t prophets. They don’t have a crystal ball.

What we do have is an understanding from history of how the type of economic policies that the last administration put into place tend to stick around longer than anyone (outside of D.C., at least) would like. Leach continues:

As in 2024, the biggest challenges at present and ahead are inflation, interest rates, labor productivity, profit margins, and the ongoing labor shortage.

“If trends in these metrics are not as constructive as we expect in our base case, it could inspire a recession that no one anticipates at present,” [investment strategist Jeff] Krumpelman said.

This is the legacy of bad economic policy that all of us are having to deal with going into 2025 and that will stick with us through this year and, very likely, beyond.

The standard answer in Washington to these problems has typically been for the Federal Reserve to cut interest rates as a way to jumpstart the economy, but…

Don’t bet on the Fed cutting interest rates.

That’s more bad news to those who buy into the whole top down approach to “managing” the economy.

The truth in this situation, though, is that the Fed isn’t likely to cut interest rates, at least not any time soon. Courtney Brown with Axios writes:

The outlook is cloudy, with inflation proving stubborn and the impact of President Trump’s immigration and trade policies uncertain.

It puts the Fed in a tricky position: Officials don’t want to be seen as commenting on White House decisions, but also are charged with guiding an economy that will be shaped by them.

The Fed wants to at least appear to be nonpartisan and to not be political.

Trump has revived familiar calls for the Fed to lower rates, but chair Jerome Powell will likely seek to emphasize the central bank’s attention to data as a driver of its decisions, rather than the president’s words.

In other words, the Fed will see how things are going before they make up their mind.

With Trump’s big policy changes in Washington, especially with how quickly they’ve already started to be implemented, the Fed isn’t sure how those changes will affect the economy, so they’ll most likely take a wait-and-see approach before making that decision.

Or to put it another way:

The impression will be that it may well require an extended time-out through June before the fog clears and the Fed has the visibility it needs to consider a further cut,” Evercore ISI’s Krishna Guha wrote in a note.

So, June at the earliest? Maybe. Maybe longer than that.

Why does the Fed’s decision matter to you?

There’s a reason every talking head on the financial news networks has an unhealthy obsession with the Federal Reserve. Why every release of FOMC meeting minutes gets endlessly interpreted and dissected.

Here’s a very brief explanation of the immensely important role the Fed plays in the economy.

First, the Federal Reserve controls the money supply. They can “print” new money – this is usually called “quantitative easing” or QE. (I’m sure a very smart public relations person came up with that term, which sounds so much more reasonable than “money-printing.”) The Fed can also shrink the money supply through “quantitative tightening” or QT.

Increasing the money supply lowers the purchasing power of the dollar. Decreasing the money supply boosts the dollar’s purchasing power. We usually see this indirectly, through changes in prices. When the money supply goes up, so do prices. Everything from the cost of a dozen eggs to the price of gold increases.

Since 1982, on average, the Fed has increased the supply of money by a little over 6% per year. That’s why everything always seems to get more expensive – because it really does!

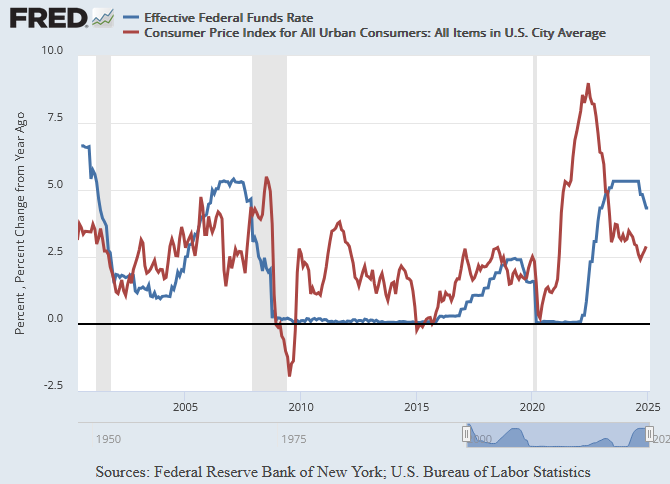

Second, the Fed controls the cost of credit by controlling interest rates. Higher interest rates make borrowing more expensive – and make saving more profitable. Conversely, lower interest rates make borrowing cheap and encourages spending over saving. Lower interest rates tend to drive prices higher, too – cheaper credit increases demand.

You can see how closely correlated the cost of credit (blue) and the cost of living (red) have been since the turn of the century:

With these two levers (and dozens of smaller, more complex mechanisms), the Federal Reserve’s decisions affect the prices of everything from a summer home to a tank of gas. All by determining how much money and credit is available.

Now that you understand this concept, I hope it’s becoming clear that it’s impossible to predict future prices. Since you have absolutely no control over the purchasing power of your dollars, you can’t know how it will change.

Not today, not next week – and certainly not five years from now.

Buckle up for the bumpy ride

This excerpt from a recent story capture today’s uncertainty pretty well:

A self-imposed Feb. 1 deadline by Donald Trump for a first round of tariffs on Canada, Mexico, and China looms in less than two days as economic observers and world leaders try to plan amid the uncertainty.

A series of comments in recent days from the president and his commerce secretary pick have offered little clarity, leaving many in wait-and-see mode.The uncertainty could already be weighing on business decisions, according to Charles Schwab’s Kevin Gordon, citing the effects of last weekend’s 10-hour trade war with Colombia that ended as quickly as it began.

“That nature of policy-making is what causes companies to maybe take a step back and halt their spending,” he said…

We simply have no control over the nation’s economic policies – what they are, whether they’ll be implemented and what consequences they’ll have.

We simply have no control over the Federal Reserve’s decisions about how much, and how rapidly, to devalue our dollars and destroy our purchasing power.

That’s frustrating! So let’s focus on what we can and should do instead.

I encourage you to prioritize putting your own finances in order. To build a solid foundation for your current and future prosperity. A foundation solid enough to shelter your savings from the consequences of current and future presidential administrations, Federal Reserve decisions and unforeseen black swan events.

I believe one of the best ways to do this is to diversify your savings with physical precious metals.

Can you think of any other inflation-resistant investments that can’t be defaulted on, hacked or inflated away?

You can learn more about the benefits of physical gold ownership here. And you can learn even more by requesting your free 2025 Precious Metals Information Kit.

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply