The non-farm payrolls delivers the elixir risk assets needed. Good thing nobody looks past the headlines.

Bullion.Directory precious metals analysis 3 October, 2014

By Christopher Lemieux

Senior FX and Commodities Analyst at FX Analytics

Gold and silver have been taken behind the woodshed for a beating, as gold trades below $1,200 for the first time this year.

In what looked like a decent, respectable pullback in the equity bubble, the September’s non-farm payroll report pushes the S&P 500 over 19 points and growing. According to the Bureau of Labor Statistics (BLS), the United States added 248,000 jobs, well above the 216,000 general consensus.

However, wages post the first monthly decline since 2013, and the labor participation rate increased .1 percent to 62.7 – still a 38 year low.

Do not get me wrong, there are 248,000 more jobs in the US. The leading sector this month was in professional services, and that is what we need to see.

Unfortunately, nobody looks past the headline figure to see that low-skill, low-paying jobs still remain close to the top; and, these lower wage jobs continue to lead the jobs rally.

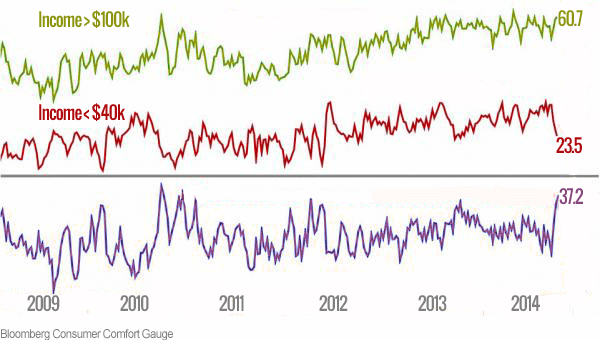

Stocks love this magic number, yet the Bloomberg consumer comfort index continues to plunge.

The divide between the haves and the have nots continues to widen. Someone earning six-figures would be comfortable, no doubt, but if these job additions are so spectacular, why is the middle class not benefiting?

Simple: they cannot afford to be comfortable because they are in the retail, education or leisure sectors that lead total job additions.

When wages go nowhere, people suffer. When the middle class suffers, the economy suffers.

No need to be doom-and-gloomy. I love when my economy is strong and healthy, but it is frail and manipulated.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply