Precious metals decline across the board on 16% housing start increase

Bullion.Directory precious metals analysis 19 August, 2014

Bullion.Directory precious metals analysis 19 August, 2014

By Christopher Lemieux

Senior FX and Commodities Analyst at FX Analytics

Precious metals declined across the board as US housing starts increased almost 16 percent, the highest jump in eight months.

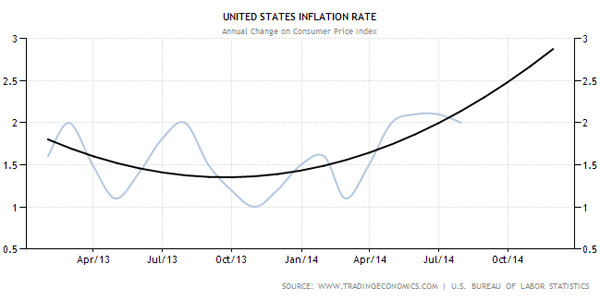

The consumer price index (CPI) increased .1 percent, but the limited inflation pressure left traders no reason to dump safe-haven assets.

July’s consumer price data increased at the slowest pace in five months, while gold futures teeter over-and-under $1,300 per toz.

Silver prices dipped over 1.25 percent, sending the price below $19.45 per toz.

“Today’s CPI number shows that inflation is not raising and you don’t need to hedge against inflation,” said Blake Robben, senior strategist at Archer Financial Services.

Keep in mind, inflation went from 1.1 percent in March to 2.1 percent in June this year.

Nevertheless, inflation has been at or above the Fed’s two percent target and forecasts show that inflation could begin to creep near three percent by the time the central bank is expected to end quantitative easing.

And take it from the Bank of Japan, uncontrolled monetary policy doesn’t go without its consequences.

Inflation can jump at a moment’s notice, and it is likely that Janet Yellen & Co. are unprepared to deal with any significant increase in inflation should the ever-increasing money supply enter circulation.

Nobody purchases medical insurance after they break their leg because they either cannot get it or it is too expensive. So, why would anyone purchase inflation insurance (precious metals) after inflation climbs higher?

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply