The ruble has crashed to all-time lows amid a 650 bps interest rate hike.

Bullion.Directory precious metals analysis 17 December, 2014

Bullion.Directory precious metals analysis 17 December, 2014

By Christopher Lemieux

Senior FX and Commodities Analyst at FX Analytics

The Russian central bank is under pressure as the ruble has hit an all-time high, reaching almost 80 rubles per dollar.

An emergency rate hike of 650 bps (6.5 percent) was issued in order to make the ruble more expensive to short and try to hinder increasing inflation, but that has not worked. The dollar-ruble currency pair has been so volatile, three large online brokerages halted all trades on the ruble.

The crashing ruble has caused panic domestically, as Russians frantically spend their weakening currency or exchanging them for dollars. Globally, the Russian crisis is bringing traders back to 1998 when Russia defaulted on debt, inflation reached 84 percent and interest rates on short-term debt obligations hit 150 percent.

The current collapse in the ruble was not phased by the interest rate hike from 10.5 to 17 percent.

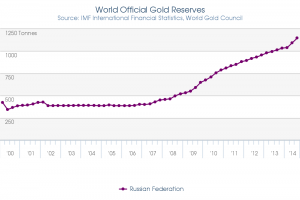

Some traders believe the Russian central bank will ultimately sell some of its gold reserves in an attempt to defend the ruble from falling further. According to the World Gold Council, Russia holds 1,149.78 tons of gold through the third quarter. Russia has also led central banks this year in gold accumulation, buying over 150 tons through November.

There was some talk that the drop in gold prices on Monday were do to the Russian central bank looking to sell. However, it is unknown whether the sale of gold reserves are actually going to happen.

Needless to say, gold bears are looking for this to drag gold lower. It is uncertain whether or not raising cash through the sale of gold would even stop the hemorrhaging in the ruble. It is not likely that selling their gold hoard would be in the central bank’s top choices.

The ruble has come down from the highs as trading remains limited. Currently at 65 rubles per dollar, the sale of gold by the Russian central is seen as a possibility if the rate remains at these levels over a prolonged period of time.

Gold prices have been subdued near $1,200 per toz, with this level acting as a bit of resistance even as global equities sell-off and the dollar retreating a bit. Support has remained within $1,187/93.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply