Gold is your monetary insurance policy.

Bullion.Directory precious metals analysis 24 December, 2014

By Christopher Lemieux

Senior FX and Commodities Analyst at FX Analytics

Gold has been used as money throughout history. Whether it was ancient Rome or Greece, gold was the foundation of trade. However, today’s trade is ruled by – literally, – worthless fiat paper currency. Central banks claim their fiat money is sound while tons of gold are held in their underground vaults.

Gold is often called a safe haven asset because its value increases during times of economic uncertainty, inflation and geopolitical tension.

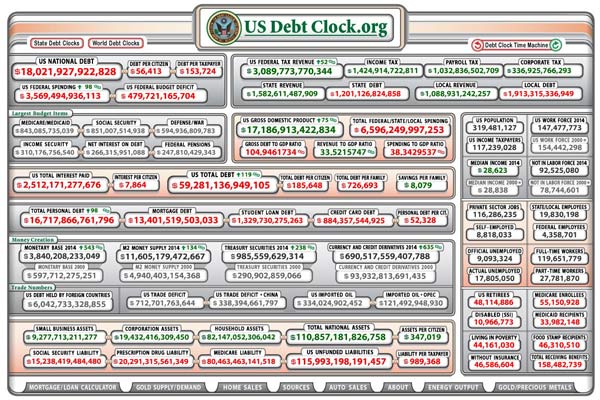

And this is true, but it also is seen as a hedge against central banking and their reckless policies of deficit spending. The US debt has ballooned to $18 trillion, while unfunded liabilities are approaching somewhere between $80-100 trillion.

The Federal Reserve has liabilities over $4.5 trillion and only $54 billion in capital. Both are insolvent, yet the world seems that everything will be peachy. But, it will not. Gold helps ward of default risk if the financial institution goes belly up.

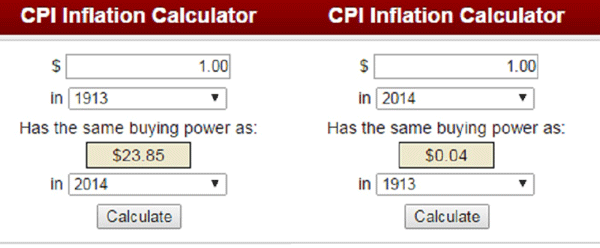

Even in today’s low inflation enviornment, the dollar’s (euro, pound, any paper currency) value has eroded. Gold helps to reserve its purchasing power. Here is something interesting as many pundits talk about a “strong dollar.”

In 1913 (keep in mind, this is the year the Fed was created), a dollar would have the purchasing power today of $23.85.

However, a dollar from today back in 1913 would have a mere $.04 purchasing power. Yes, that’s only four cents; and that’s just inflation.

I am often asked, “but, there is no inflation. Wouldn’t gold loose value in a deflationary period?”

On the surface, yes gold could loose its value in dollar or currency terms. During deflation, paper money gains value – but unfortunately for debtors, this is not good.

Does anyone ask why central banks want inflation so badly? It’s because of the asinine indebtedness of governments.

The Bank of Japan risked total monetary apocalypse to drive up inflation, and it’s causing havoc for their economy. The US government has meanwhile borrowed so much from future generations in order to live above its means, that it’s now stuck in a slow growth environment.

Inflation is needed to pay back (as if they ever could) their debts with cheaper, and cheaper money.

Screengrab from USdebtClock.org

Deflation also causes deleveraging from risky assets. Inflation expectations are continuing to decline as equity prices continue to rise, which is historically the opposite of what tends to happen. So, either inflation has to increase or stocks have to correct.

The divergence will continue to grow, and the snap back will be that much more painful.

Fear and euphoria are dominant forces, and fear is many multiples the size of euphoria. Bubbles go up very slowly as euphoria builds. The fear hits, and it comes down very sharply. When I started to look at that, I was sort of intellectually shocked. Contagion is the critical phenomenon which causes the thing to fall apart.

Alan Greenspan

Gold has other uses. For instance, gold has no credit risk.

We all keep are hard earned money at a local bank, probably even a bank that had to be bailed out during the last financial crisis. We deposit our money in the bank, and, in turn, the bank uses that money for loans and other means of earning capital.

We assume our money is safe, but depositors were awakened when they found out that banks routinely put depositors at risk by placing highly leveraged, risky derivative trades. The Cromibus spending bill that just passed put the US taxpayer on the hook for over $300 trillion in derivative trades. Essentially, this is a bail-in.

Over the last three years, precious metals investors almost revolted from the save haven metals due to the large correction from 2011-highs. Many of them figured prices would always go up, or it would be easy to buy in and sell out of precious metals holdings.

The problem lies with not understanding why someone holds gold.

It is an insurance policy. Pick one of your choice. Medical insurance is something people pay every month. Each month, the premium is paid regardless of whether you need to go to the doctor or ER because there is always that one event that those services will be called upon. Or, maybe it can be compared to life insurance.

Personally, I hold precious metals because I do not think my daughter’s future will be bright. The US has dug such a deep hole, my child (and probably her child) will be paying for it. When I am gone, I will rest easy knowing there will be a monetary foundation.

Look, nobody likes paying for an investment that only yields capital appreciation, more so when there is a lack of it. But, it’s necessary.

To look at physical metals as a “trade” is foolish. Gold and silver are not income generators.

If there is an issue with that, then one should not own it. Typically, there are large premiums buying (and then selling ) from a dealer, and not many retail investors can buy enough bullion to make it worthwhile trade. There are other instruments like stocks, fixed-income, or even paper gold that can be traded or invested in that generate a steady stream of capital.

The largest problem among retail goldies is that the purpose of gold is greatly misunderstood. If one does not understand the instrument in which they are investing, pain and suffering will follow. One would not invest in a leveraged ETF because they are not designed to do so because those are made for day-to-day trading, but one could invest in a quality stock that generates free cash flow and pays a healthy dividend.

When they realize the purpose of gold, then they will begin to appreciate it. As always, gold is only a piece of the puzzle and a well-diversified portfolio is the way to go.

Up next, we’ll look at an easy way to value gold and silver.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply