Extrapolating current trends into the future leave many people unprepared for major societal shifts

Bullion.Directory syndicated content June 12, 2018

Bullion.Directory syndicated content June 12, 2018

By Elliott Wave International – Collated by Alison Macdonald

Commercial Editor at Bullion.Directory

The one thing you can count on in financial markets, and society at large, is change.

I was reminded of this when I read this May 18 New York Times’ headline and subheadline:

The Last Days of Time Inc.

… how the pre-eminent media organization of the 20th century ended up on the scrap heap.

Time Inc. has been purchased by the Meredith Corporation, which plans to spin off Time magazine, Sports Illustrated, Fortune and Money. All four magazines have suffered from declining ad revenue and declining circulation. There are other details, but the bottom line is that an established media empire, which had a long history of reporting on change, has now been swept up by change.

A generation ago, many observers would not have imagined that a company as iconic as Time Inc. would find itself “on the scrap heap.”

But linear trend extrapolation has always had its pitfalls, and on changes that have been on a much bigger scale than one media company, which brings to mind what the 2017 book, The Socionomic Theory of Finance, said:

(1) It is 1975. Project the future of China.

(2) It is 1963. Project the cost of medical care in the U.S.

(3) It is 100 A.D. Project the future of Roman civilization.

In 1975, the Communist party was entrenched in China. … Would anyone have imagined that China’s economic production, in just over a single generation, would rival that of the United States?

In 1963, medical care was cheap and accessible. … Would anyone have guessed that [today] pills would sell for $2, $20, $200 and even $1,000 apiece?

In 100 A.D., would you have predicted that the most powerful state in the world–the Roman Empire–would be reduced to rubble in a bit over three centuries? Few people of the day imagined that outcome.

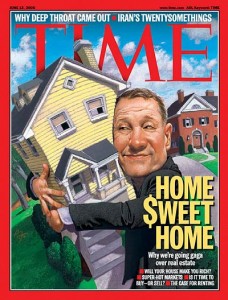

Let me add: It’s June 13, 2005 — what were many people projecting for home prices?

Let me add: It’s June 13, 2005 — what were many people projecting for home prices?

Well, here’s a Time magazine cover which published on that date.

If that cover was an indicator, most people expected home prices to keep rising.

But, we know what happened: Housing stocks topped that very year and the “subprime mortgage crisis” hit about two years later.

Eventually, home prices plummeted by more than 50% in some of the nation’s high-flying real estate markets.

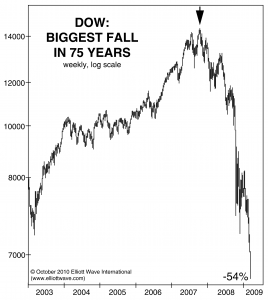

Moreover, the Dow topped in 2007 and then suffered its worst decline in 75 years:

Yes, this dramatic trend change in the Dow also took many observers by surprise.

The reason you should brace yourself for more big financial and economic changes is that EWI’s analysis suggests that the next financial change will again surprise the unprepared.

We just released this new, free report, 5 ‘Tells’ that the Markets Are About to Reverse, that reveals many false indicators – a.k.a. “head fakes” — investors see every day.

The report helps readers separate themselves from the herd and survive (and thrive) in volatile markets. Read the free report now.

This article was syndicated by Elliott Wave International and was originally published under the headline Why You Should Brace Yourself for Big Financial Changes. EWI is the world’s largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply