Gold didn’t react to rising inflation in May as expected and sank. The reason? Strengthened expectations of steeper interest rate hikes by the Fed.

Bullion.Directory precious metals analysis 15 June, 2022

Bullion.Directory precious metals analysis 15 June, 2022

By Arkadiusz Sieroń, PhD

Lead Economist and Overview Editor at Sunshine Profits

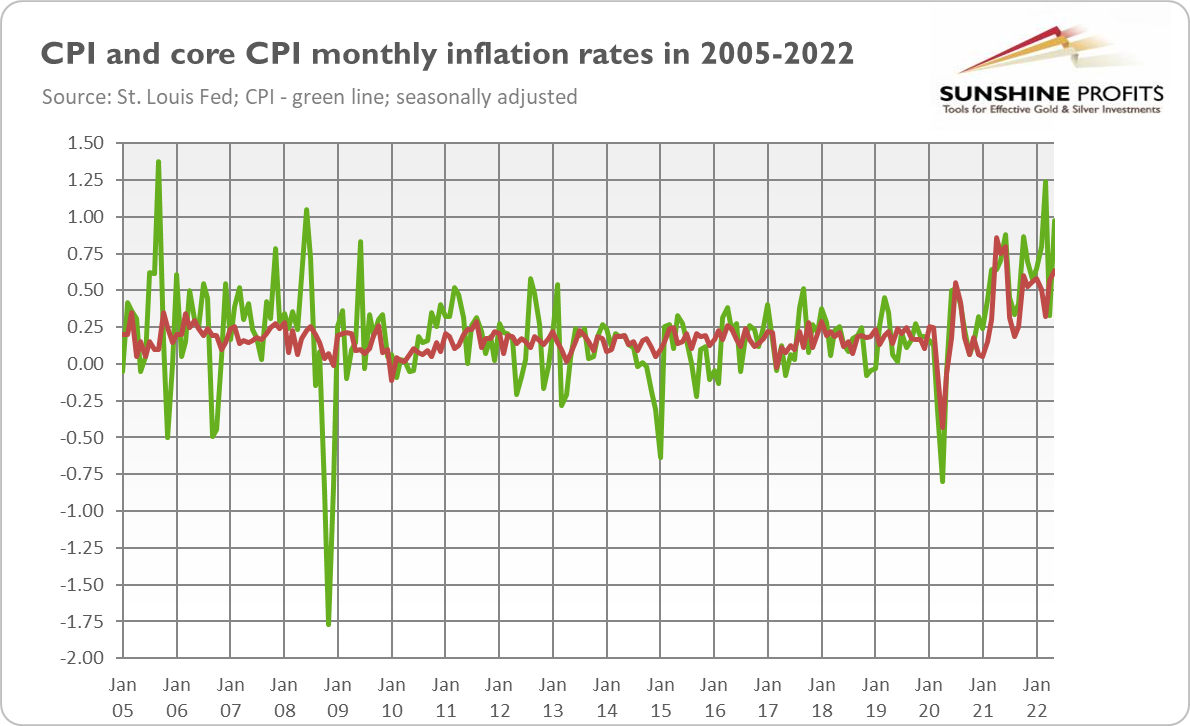

This is a huge increase, especially since we are talking here about changes from month to month.

The core CPI, which excludes energy and food prices, rose 0.6%, the same increase as in April. What is particularly disturbing is that almost all major components increased over the month, which clearly shows that inflation is broad-based. The monthly inflation rate in May was the highest since June 2008, the middle of the Great Recession.

However, the previous cases were rather temporary spikes, while now – as the chart below shows – we observe a clear upward trend.

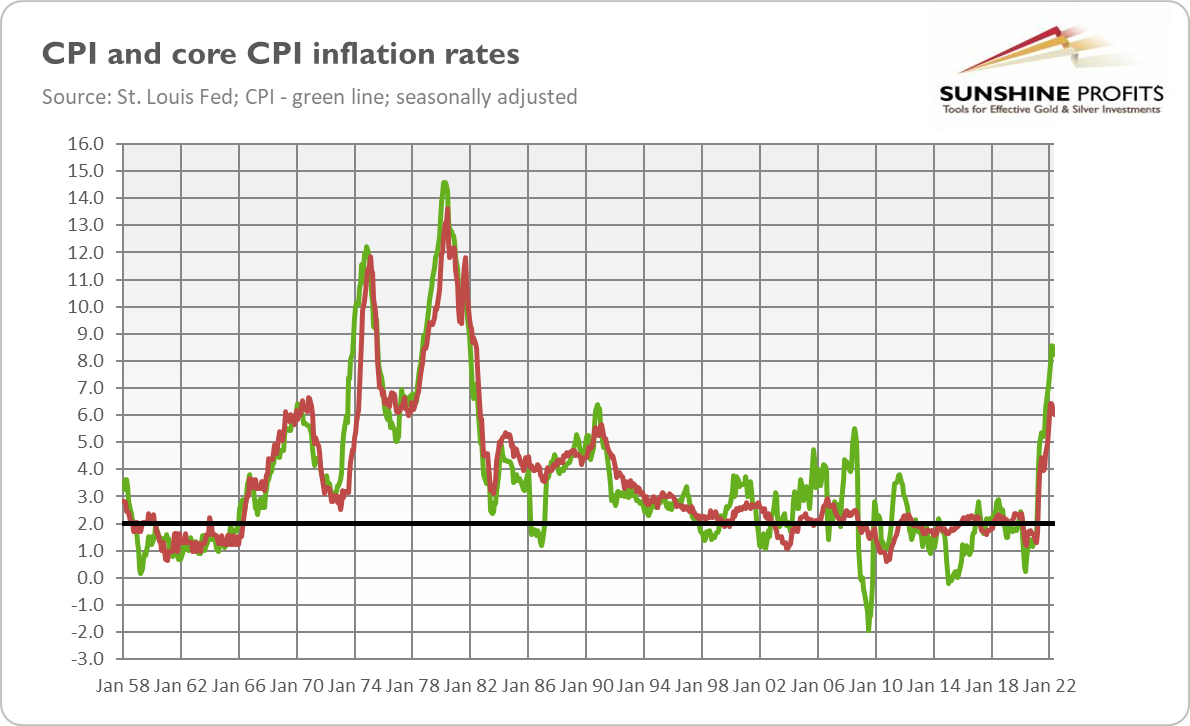

On an annual basis, the situation doesn’t look any better. The overall CPI inflation increased 8.6% for the 12 months ending May, the largest 12-month increase since the period ending December 1981, as the chart below shows.

However, it was then a period of disinflation, while inflation is still on the rise today.

Sure, there was a surge in oil and gas prices – the index for fuel oil soared 106.7%, which was the largest increase in the history of the series that began in 1935. But the core CPI rose 6%, which indicates that inflation is broad-based and cannot be simply explained by rising energy prices.

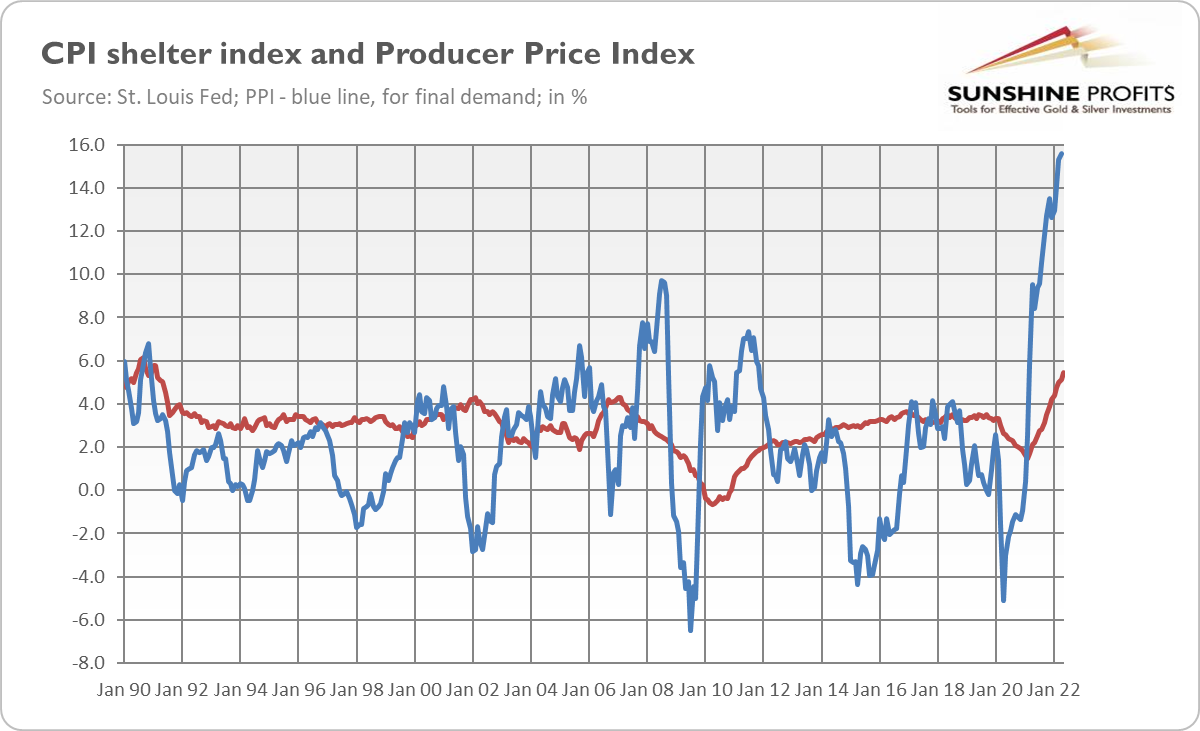

Indeed, inflation is accelerating, not just because gasoline is rising. Inflation is also spiking in services, where consumers spend most of their money. For example, the index for shelter rose in May to 5.45%, the largest rate since October 1990, as the chart below shows.

The Producer Price Index is also accelerating, which suggests that inflation may not be in the mood to peak yet.

Implications for Gold

What does it all mean for the gold market? Well, higher and more entrenched inflation should be supportive of the yellow metal. However, hot inflation numbers boosted market bets on steeper interest rate hikes from the Fed.

According to the FedWatch Tool, the odds of a 75-basis point hike at the FOMC meeting in June surged from merely 3.9% one week ago to 90.5%! Consequently, both bond yields and the US dollar have risen, pushing gold down.

As the chart below shows, the price of the yellow metal decreased from $1,853 last week to about $1,830.

However, the long-term outlook for gold is much better. All periods with such high inflation ended up in recession. You see, there are only two options. The first is that the Fed will stay behind the curve and won’t curb inflation, but then inflation will destabilize the economy on its own. The second is that the Fed will significantly tighten its monetary policy, but then it will probably overdo it and push the economy into recession.

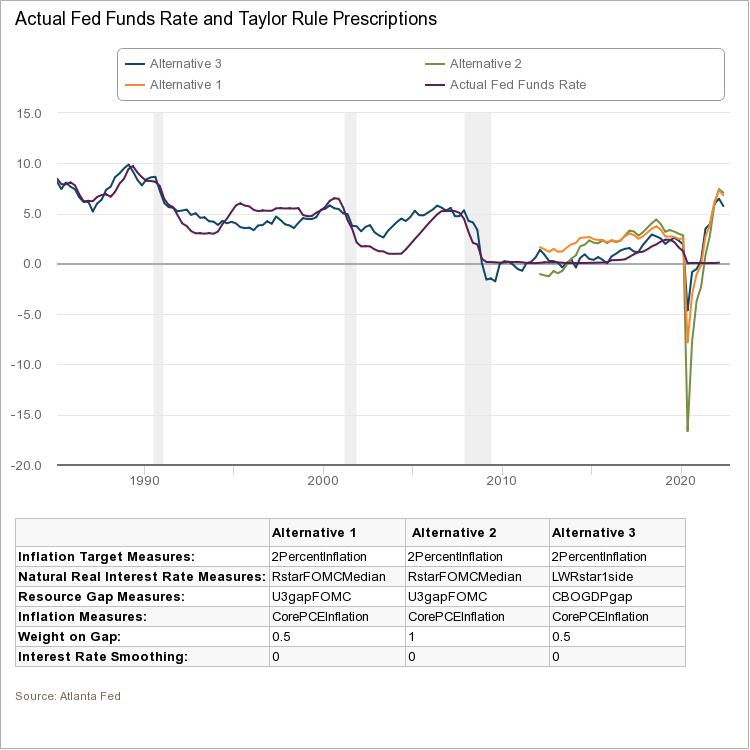

So far, monetary policy remains accommodative – at least in terms of what the Taylor rule suggests (see the chart below). Thus, if the Fed really wants to become restrictive, it would have to aggressively hike the federal funds rate, which could lead to stagflation.

Gold should shine during stagflation. However, as long as real interest rates are rising, gold may struggle. However, the yellow metal is still outperforming stocks (not to mention cryptocurrencies), and when the end of the easy money era deflates other asset classes even more, investors will likely to seek a safe haven in gold.

The orgy of excess liquidity and ultra low interest rates that began after the financial crisis of 2007-2008 is ending, which could wipe out a lot of value from the markets.

Surely, gold will also be liquidated, especially at the beginning of the next economic crisis, but it should ultimately emerge as the winner from the upcoming turmoil.

Arkadiusz Sieroń

Arkadiusz Sieroń – is a certified Investment Adviser, long-time precious metals market enthusiast, Ph.D. candidate and a free market advocate who believes in the power of peaceful and voluntary cooperation of people.

He is an economist and board member at the Polish Mises Institute think tank, a Laureate of the 6th International Vernon Smith Prize and the author of Sunshine Profits’ bi-weekly Fundamental Gold Report and monthly Gold Market Overview.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply